The Mid-Week Brief: Labor Market Cracks as Small-Caps Stage Comeback

Soft jobs data cements December rate cut, triggering a rotation into small caps as tech earnings reveal a growing divide.

The narrative on Wall Street shifted dramatically this week. What began as a post-holiday hangover on Monday has evolved into a full-blown “bad news is good news” rally by Thursday morning. The catalyst? A stunning contraction in private sector jobs that has all but locked in a Federal Reserve rate cut for next week.

Investors are now aggressively rotating capital. While the AI trade remains alive, the real action has shifted to interest-rate-sensitive sectors like small caps and biotechnology, betting that a cooling economy will force the Fed’s hand. Here is your essential breakdown of the trading so far this week.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Market Drivers

ADP Shock (The Smoking Gun): The biggest story of the week dropped Wednesday morning. The ADP National Employment Report showed private payrolls contracted by 32,000 in November, missing the consensus forecast for a +40,000 gain. This is the clearest signal yet that high rates are biting the labor market.

- Fed Rate Cut Odds: Following the ADP miss, traders effectively went all in on a December cut. The implied probability of a 25-basis-point reduction at the December 10 FOMC meeting spiked to nearly 90%, according to the CME FedWatch tool.

- Services vs. Manufacturing: We are looking at a two-speed economy.

- Manufacturing: Remains in recession (ISM PMI: 48.2).

- Services: surprisingly resilient (ISM PMI: 54.1), keeping the “soft landing” hope alive despite job losses.

- The “Hassett” Factor: Rumors swirled early in the week that President Trump is eyeing Kevin Hassett as the next Fed Chair nominee (post-2026), adding a layer of long-term dovish speculation to the mix.

Major Market Indices

The Dow Jones Industrial Average has outperformed this week, buoyed by a resurgence in industrial giants, while the Nasdaq has faced headwinds from software volatility.

| Index | Symbol | Level | Weekly Trend | Key Driver |

| Dow Jones Industrial Average | DJI | 47,882.90 | Bullish | Surging Industrials & Financials. |

| S&P 500 | SPX | 6,849.72 | Neutral/Up | Held back by mixed tech earnings. |

| Nasdaq Composite | IXIC | 23,454.09 | Mixed | Dragged down by software (Snowflake/Pure Storage). |

| Russell 2000 Index | RUT | 2,512.14 | Breakout | +1.9% surge Wed on rate cut bets. |

Market Movers

Individual stock selection was critical this week as earnings created massive winners and catastrophic losers.

Top Gainers

| Company | Price | Change (Week) | Catalyst |

| iRobot (NASDAQ: IRBT) | $3.39 | +118% | Speculative Rally: Surge driven by reports the White House may issue an executive order supporting the US robotics industry. |

| Microchip Technology (NASDAQ: MCHP) | $63.61 | +12.2% | Raised guidance; signaled the bottom of the industrial chip inventory cycle. |

| Boeing (NYSE: BA) | $202.50 | +10.1% | CFO issued bullish 2026 cash flow forecast; production ramping. |

| Marvell (NASDAQ: MRVL) | $100.20 | +7.9% | AI earnings beat + acquisition of Celestial AI to boost optical tech. |

| Salesforce (NYSE: CRM) | $238.72 | +1.7% | Q3 earnings beat; “Agentforce” AI platform gaining traction. |

Data as of market close on December 3, 2025.

Top Decliners

| Company | Price | Change (Week) | Catalyst |

| Pure Storage (NYSE: PSTG) | $68.85 | -27.3% | Punished for margin guidance and fears that AI storage revenue is materializing slower than hyped. |

| Torrid Holdings (NYSE: CURV) | $1.15 | -15.0% | Missed Q3 earnings estimates; sales fell 10.8% due to assortment missteps. |

| Snowflake (NYSE: SNOW) | $259.68 | -7.5% | Although beating revenue, guidance disappointed investors looking for faster AI monetization. |

| Coinbase (NASDAQ: COIN) | $276.92 | -6.0% | Dragged down early in the week by Monday’s sharp crypto leverage flush before recovering slightly. |

| Moderna (NYSE: MRNA) | $43.12 | -7.0% | Reports that the FDA may adopt stricter vaccine approval processes weighed on the biotech sector. |

Data as of market close on December 3, 2025.

Magnificent Seven

The Magnificent Seven stocks showed mixed performance this week. Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL) shares jumped, while Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOGL) shares slid. Meta Platforms (NASDAQ: META), Amazon (NASDAQ: AMZN), and Nvidia (NASDAQ: NVDA) have all generated positive, but smaller, returns so far this week.

Magnificent Seven Performance (Week-to-Date):

- Tesla (TSLA): +4.53%

- Apple (AAPL): +2.50%

- Nvidia (NVDA): +0.35%

- Amazon (AMZN): +0.39%

- Meta Platforms (META): +0.62%

- Alphabet (GOOGL): -0.76%

- Microsoft (MSFT): -2.03%

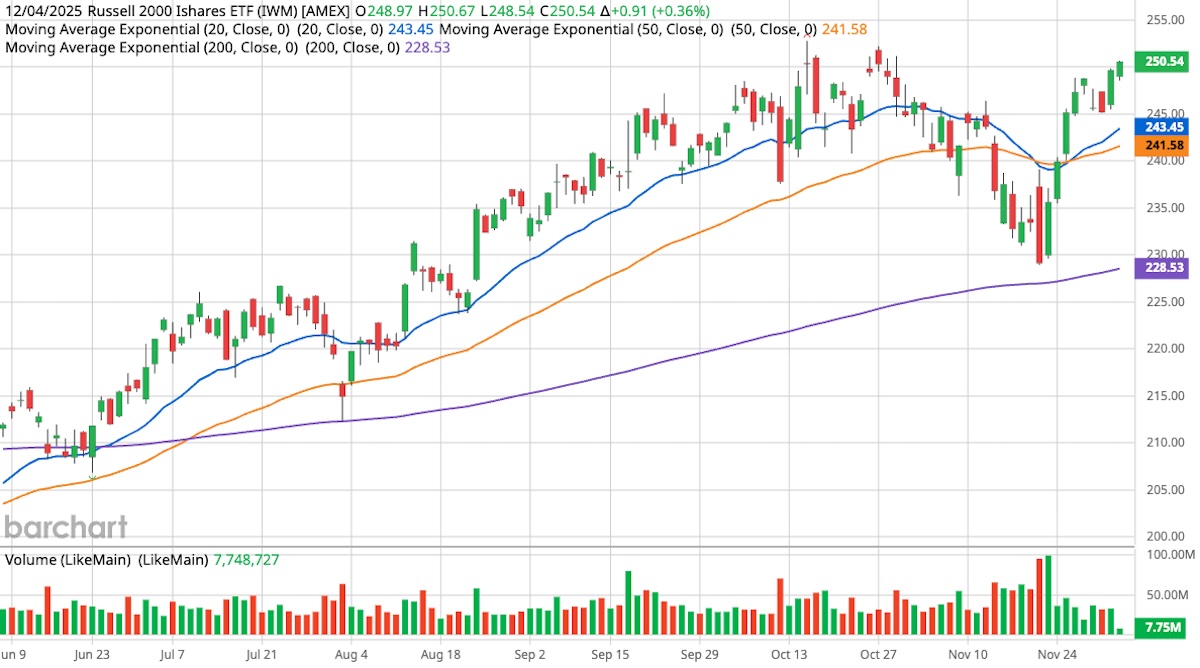

Small and Microcap Market

The “Rotation Trade” is in full swing. Small caps are arguably the biggest beneficiaries of the incoming rate cuts, as they carry more floating-rate debt than their large-cap peers.

- Russell 2000 Index (RUT): The index staged a massive breakout on Wednesday, surging 1.9% to close at 2,512.14. It is now outperforming the S&P 500 for the week.

- Russell Microcap Index (RUMIC): Also joined the rally, tracking 2.95% higher as risk appetite returns to the most speculative corners of the market.

Also Read: Small Digital Health Stock Charts Bold Path to $250 Million Revenue by 2030

Corporate Earnings

This week was a critical test for the “AI Trade” beyond Nvidia. Here are the stocks that reported this week and the specific figures investors are scrutinizing:

Salesforce (CRM): BULLISH

- EPS: Salesforce reported $3.25 (Adj) vs. $2.86 estimated.

- Revenue: $10.3B vs. $10.27B estimated.

- Takeaway: The company raised full-year guidance. Management successfully convinced Wall Street that their new “Agentforce” AI platform is gaining traction, alleviating fears that AI would disrupt their seat-based pricing model.

Marvell Technology (MRVL): BULLISH

- EPS: MT reported $0.76 (Adj) vs. $0.75 estimated.

- Revenue: $2.075B (Record) vs. $2.06B estimated; up 37% YoY.

- Data Center Revenue: $1.52B, up 38% YoY.

- Takeaway: Marvell confirmed that data center demand is expanding beyond just Nvidia GPUs to the custom silicon (ASICs) and optical interconnects that Marvell dominates.

Pure Storage (PSTG): BEARISH

- EPS: PS reported $0.58 (Adj) (Met estimates); GAAP Income $0.16 vs $0.23 exp.

- Revenue: $964.5M vs. $955M estimated.

- Takeaway: Despite a “beat” on revenue, the stock crashed ~27%. Investors punished a miss on GAAP profitability and expressed concern that the company isn’t capturing immediate AI revenue as fast as hyped hardware peers.

Dollar General (DG): MIXED / VOLATILE

- EPS: Dollar General (NYSE: DG) reported $1.28 vs. $0.92 estimated.

- Revenue: $10.65B vs. $10.96B estimated.

- Takeaway: A solid profit beat was overshadowed by a revenue miss. Management commentary confirmed the low-income consumer is “financially constrained,” focusing spending only on low-margin essentials like food rather than discretionary goods.

Companies Scheduled to Report Next Week (Dec 8 – 12):

- Broadcom (NASDAQ: AVGO): The next major AI hardware test.

- Oracle (NYSE: ORCL): Cloud infrastructure growth watch.

- GameStop (NYSE: GME): Expect meme-stock volatility.

- Adobe (NASDAQ: ADBE): Critical update on AI monetization in creative tools.

Market Sentiment

Fear is creeping back into the market, but structurally, investors are still buying dips.

- Fear & Greed Index: 31 (Fear). Down from “Extreme Greed” last month. Investors are cautious about valuations.

- CBOE Volatility Index (CBOE: VIX): 16.07. Elevated but stable. Not signaling panic, just alertness.

- Put/Call Ratio: The ratio is up this week for equities and market indices, indicating a shift towards more bearish sentiment among stock and index option traders.

Cryptocurrencies

Crypto experienced a violent “leverage flush” on Monday, dumping over 5% in hours, but bulls stepped back in by mid-week to defend key support levels.

| Asset | Price | Weekly Trend | Note |

| Bitcoin (BTCUSD) | $93,425 | Recovering | Rebounded from Monday lows; ETF inflows providing a floor. |

| Ethereum (ETHUSD) | $3,194 | Bullish | Showing strength relative to BTC mid-week. |

| Solana (SOLUSD) | $143.56 | Stable | Holding support; network activity remains high. |

| XRP (XRPUSD) | $2.17 | Bearish | Seeing profit-taking after massive November run. |

| Dogecoin (DOGEUSD) | $0.150 | Flat | Cooling off after speculative frenzy. |

Commodities

Metals Gold continues to act as the ultimate hedge against fiscal uncertainty and lower rates. Copper is signaling global industrial demand despite the weak US manufacturing PMI.

- Gold (XAUUSD): $4,207.36 (+0.1%). Holding firm above $4,200.

- Silver (XAGUSD): $33.50. Consolidating recent gains.

- Copper (XCUUSD): $5.30 (+2.3%). Hitting new record highs on supply concerns.

Energy Oil markets are responding to geopolitical tension (Ukraine-Russia pipeline attacks) and potential supply disruptions.

- West Texas Intermediate (WTI): $59.37 (+0.7%). Bouncing off the $58 support level.

- Brent Crude Oil (BZ): $63.10. Remains rangebound.

Forex

The Dollar is softening as rate cut bets solidify, breathing life into foreign currencies.

- U.S. Dollar Index (DXY): 99.30. Trading at one-month lows.

- EUR/USD: $1.0520. Strengthening as the ECB signals a potentially slower cutting pace than the Fed.

- USD/JPY: $155.14. The Yen weakened slightly, but volatility is high ahead of the Bank of Japan’s meeting later this month.

- USD/CAD: $1.3950. The Loonie is flat, largely ignored by traders focusing on the Euro and Yen.

The Bottom Line

We are currently in a “bad news is good news” regime. The ADP jobs miss was the green light the market needed to price in lower rates, sparking a rotation into small caps and bonds. However, the crash in stocks like iRobot and Pure Storage proves that quality matters—weak balance sheets are being punished mercilessly.

What to Watch Next: All eyes are on Friday’s Non-Farm Payrolls (NFP) report. If the BLS confirms the weakness seen in the ADP data, expect the “Santa Claus Rally” to broaden out further. If the data comes in hot, expect a sharp reversal in yields and stocks.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.