Wealthy VC’s 18-Month Winner Recap: Our Biggest Market Calls That Soared

From the 21st-century space race to the AI revolution, nuclear energy breakthroughs, and a 10,000% biotech bonanza, these are the picks that defied expectations and delivered massive returns for our readers.

At Wealthy VC, we don’t just watch the ticker tape; we anticipate where the next wave of momentum will strike. Over the last 18 months, our team identified and alerted subscribers to some of the most explosive opportunities in the market before the mainstream media caught on. We looked for the inflection points, where narrative, fundamentals, and insider action collide to create the perfect storm for share price appreciation.

This recap highlights our most successful calls. These companies didn’t just inch higher; they erupted. From a Chinese biotech firm that shattered records to the satellite innovators connecting the unconnected, here is how our top picks performed.

1. Regencell Bioscience (RGC)

$0.79 → $83.60 (+10,482.28%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $0.79 (03/20/25) | $83.60 (06/16/25) | 2 Months | +10,482.28% |

Regencell Bioscience (NASDAQ: RGC) became the defining phenomenon of 2025. This Hong Kong-based biotech company, focused on Traditional Chinese Medicine (TCM) for neurocognitive disorders like ADHD and autism, defied every conventional valuation model.

We alerted investors to RGC at $0.79, identifying a unique setup driven by a tightly controlled float and aggressive insider maneuvering. As the company executed a massive 38-for-1 stock split and insiders tightened their grip on the outstanding shares, the stock went parabolic. Volatility traders flocked to the name, fueling a squeeze that sent shares skyrocketing over 10,000% in just two months. While the company reported zero revenue, the sheer force of market mechanics and speculative fervor turned Regencell into the year’s most lucrative trade for those who entered early.

2. AST SpaceMobile (ASTS)

$6.17 → $102.79 (+1,565.96%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $6.17 (05/29/24) | $102.79 (10/16/25) | 1.5 Years | +1,565.96% |

We saw the potential for AST SpaceMobile (NASDAQ: ASTS) to disrupt global telecommunications long before the market priced it in. The thesis was simple: dead zones are a relic of the past. ASTS promised to connect standard smartphones directly to satellites, bypassing the need for expensive ground infrastructure.

Our alert at $6.17 proved timely. As the company launched its “BlueBird” satellites and secured game-changing contracts with AT&T (NYSE: T), Verizon (NYSE: VZ), and the U.S. government, Wall Street woke up to the reality of the technology. The successful deployment of their largest commercial communications array validated the tech, causing the stock to soar past $100. Investors who held on through the development phase captured a staggering 1,500% return as AST SpaceMobile cemented its status as a leader in space-based connectivity.

3. Oklo (OKLO)

$12.82 → $193.84 (+1,412.01%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $12.82 (10/16/24) | $193.84 (10/15/25) | 1 Year | +1,412.01% |

The AI revolution requires massive amounts of power, and we identified Oklo (NYSE: OKLO) as the premier solution. This advanced fission company designs portable nuclear microreactors that provide clean, reliable energy to data centers and industrial sites.

We highlighted Oklo just as the energy demands of hyperscalers began to dominate financial headlines. The company capitalized on this trend perfectly, breaking ground on its first Aurora powerhouse in Idaho and signing supply agreements with major players like Diamondback Energy. As feasibility studies for gigawatt-scale power generation surfaced, the market re-rated Oklo from a speculative play to a critical infrastructure provider. The result was a 1,412% surge in exactly one year.

4. MicroAlgo (MLGO)

$137.10 → $972.00 (+608.97%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $137.10 (02/28/25) | $972.00 (04/01/25) | 1 Month | +608.97% |

MicroAlgo (NASDAQ: MLGO) represented a classic momentum play in the central processing algorithm sector. We caught this stock right before a massive liquidity event triggered a frenzy.

The company, backed by WiMi Hologram Cloud, executed a series of strategic moves, including a reverse stock split that tightened supply. When news broke of their surging revenue and expanded algorithm portfolio, the stock went vertical. In just over four weeks, MLGO vaulted from $137.10 to a breathtaking $972.00. This trade highlighted the power of technical setups meeting sector hype, delivering over 600% gains in a single month.

5. SunPower (SPWR)

$0.59 → $3.37 (+471.86%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $0.59 (05/14/24) | $3.37 (09/25/24) | 4.5 Months | +471.86% |

We spotted a turnaround opportunity in SunPower (NASDAQ: SPWR) when sentiment hit rock bottom. With shares trading at mere pennies, the market priced the company for bankruptcy. We saw a different picture: a legacy brand ripe for restructuring.

The company pivoted aggressively, shifting focus from manufacturing to high-margin downstream services and acquiring Sunder Energy to boost its sales network. By Q3 2025, SunPower shocked analysts by posting record operating profits, proving the turnaround was real. Investors who bought the fear at $0.59 watched their position expand nearly fivefold as the company regained its footing and its swagger.

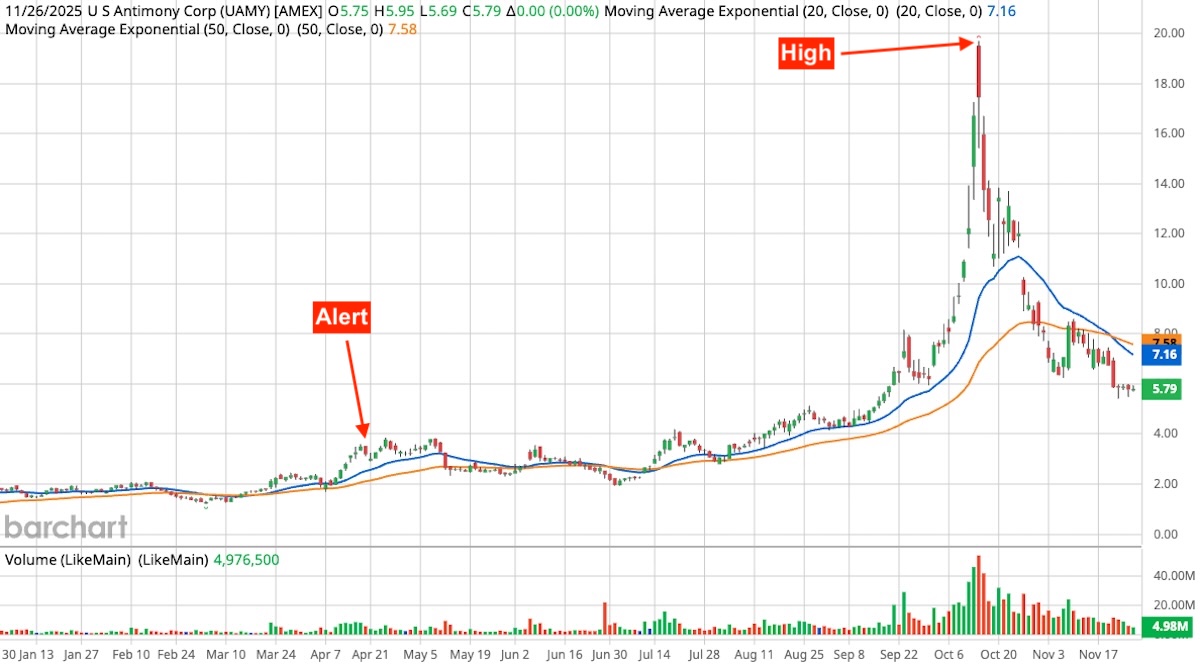

6. United States Antimony Corporation (UAMY)

$3.51 → $19.71 (+461.54%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $3.51 (04/17/25) | $19.71 (10/14/25) | 6 Months | +461.54% |

Geopolitics creates opportunities, and United States Antimony Corporation (NYSE Arca: UAMY) became the primary beneficiary of supply chain tensions. Antimony is a critical mineral for military munitions and high-tech hardware, and China controls the vast majority of global supply.

When China announced export restrictions, domestic sources became invaluable overnight. We alerted subscribers just as this narrative began to unfold. UAMY subsequently secured a massive $245 million contract with the Defense Logistics Agency and ramped up its Montana refinery capabilities. The market rushed to secure exposure to the only significant U.S. supplier, driving the stock up 461% in six months.

7. Planet Labs (PL)

$3.23 → $16.78 (+419.51%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $3.23 (11/14/24) | $16.78 (10/08/25) | 11 Months | +419.51% |

Data is the new oil, and Planet Labs (NYSE: PL) owns the pipeline. We identified Planet Labs as a sleeping giant in the geospatial intelligence sector. Their ability to image the entire Earth daily provides invaluable data for defense, agriculture, and finance.

The catalyst for the breakout was the company’s shift toward AI-enabled analytics and the securing of lucrative eight-figure defense contracts. As Planet Labs launched its next-generation Pelican satellites and demonstrated a clear path to profitability, institutional money poured in. The stock climbed steadily from our alert price of $3.23 to nearly $17, rewarding patience with substantial returns.

8. Uxin Ltd. (UXIN)

$1.61 → $7.84 (+386.96%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $1.61 (09/23/24) | $7.84 (09/30/24) | 1 Week | +386.96% |

Sometimes, the gains come fast. Uxin Ltd. (NASDAQ: UXIN), a leader in China’s used car e-commerce market, delivered a lightning-round win for our subscribers.

We flagged the stock as it transitioned to its new “superstore” inventory model. The market reacted violently to the upside as Uxin announced it had hit positive EBITDA milestones and saw a surge in transaction volumes. In a mere seven days, the stock ripped from $1.61 to $7.84, offering a near 400% return for traders nimble enough to catch the move.

9. NANO Nuclear Energy (NNE)

$13.12→ $60.87 (+363.95%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $13.12 (06/20/24) | $60.87 (10/15/25) | 1.5 Years | +363.95% |

Nano Nuclear Energy (NASDAQ: NNE) fits perfectly into our thesis on the decentralized future of power. As the first portable nuclear microreactor company listed in the U.S., NNE offered unique exposure to advanced energy tech.

We alerted this stock early in its public life. The company executed flawlessly, advancing its ZEUS and KRONOS reactor designs and initiating feasibility studies for massive 1GW power projects. The rebranding of its Canadian operations and strategic hires bolstered confidence, driving a steady and powerful uptrend that delivered 363% gains over an 18-month hold.

10. Solidion Technology (STI)

$7.49 → $33.99 (+353.81%)

| Alert | High | Time Held | Potential Gain |

|---|---|---|---|

| $7.49 (09/03/25) | $33.99 (10/14/25) | 1.5 Months | +353.81% |

Solidion Technology (NASDAQ: STI) combined two of the hottest market themes: EV battery innovation and cryptocurrency. While their core business focuses on high-capacity silicon anode materials, their strategic decision to allocate corporate treasury funds to Bitcoin (BTCUSD) caught the market’s imagination.

We alerted the stock at $7.49, sensing a breakout. The company regained Nasdaq compliance and won prestigious R&D awards, but the dual narrative of battery tech breakthroughs and crypto exposure ignited the rally. The stock surged to nearly $34 in just six weeks, proving that unconventional treasury strategies can act as powerful catalysts.

The Best of the Rest

While the top ten grabbed the headlines, our momentum system generated winners across the board. From crypto-mining infrastructure to silver exploration, here are the remaining top performers from our 18-month recap.

| Company | Alert | High | Time Held | Potential Gain |

|---|---|---|---|---|

| Bakkt Holdings (NYSE: BKKT) | $11.31 (11/18/24) | $49.79 (10/02/25) | 11.5 Months | +340.23% |

| Charlie’s Holdings (OTCQB: CHUC) | $0.09 (05/30/24) | $0.38 (09/22/25) | 1 Year | +322.22% |

| Insmed (NASDAQ: INSM) | $49.65 (05/28/24) | $208.72 (11/24/25) | 1.5 Years | +320.38% |

| Coeur Mining (NYSE: CDE) | $5.71 (06/12/24) | $23.61 (10/16/25) | 1.5 Years | +313.49% |

| Neonode (NASDAQ: NEON) | $7.45 (09/12/24) | $29.90 (07/23/25) | 11 Months | +301.34% |

| MP Materials (NYSE: MP) | $25.07 (03/06/25) | $100.25 (10/14/25) | 7.5 Months | +299.88% |

| Digital Turbine (NASDAQ: APPS) | $2.09 (08/08/24) | $8.28 (11/05/25) | 1 Year | +296.17% |

| NuScale Power (NYSE: SMR) | $14.92 (10/16/24) | $57.42 (10/16/25) | 1 Year | +284.85% |

| Rocket Lab (NASDAQ: RKLB) | $19.43 (11/14/24) | $73.97 (10/15/25) | 11 Months | +280.70% |

| Core Scientific (NASDAQ: CORZ) | $6.25 (06/04/24) | $23.63 (11/03/25) | 1.5 Years | +278.08% |

| Arm Holdings (NASDAQ: ARM) | $56.10 (09/12/23) | $188.75 (07/09/24) | 10 Months | +236.45% |

| Affirm Holdings (NASDAQ: AFRM) | $31.00 (06/24/24) | $100.00 (08/29/25) | 1 Year | +222.58% |

| Vizsla Silver (NYSE: VZLA) | $1.66 (06/18/24) | $5.07 (10/16/25) | 1.5 Years | +205.42% |

| Sangamo Therapeutics (NASDAQ: SGMO) | $1.05 (08/06/24) | $3.18 (11/08/24) | 3 Months | +202.86% |

| Faraday Copper (TSX: FDY) | $0.78 (06/11/24) | $2.34 (10/29/25) | 1.5 Years | +200.00% |

| Porch Group (NASDAQ: PRCH) | $6.63 (03/04/25) | $19.44 (09/22/25) | 7 Months | +193.21% |

| Arbe Robotics (NASDAQ: ARBE) | $1.02 (04/02/25) | $2.88 (10/08/25) | 6 Months | +182.35% |

| Tharimmune (NASDAQ: THAR) | $3.59 (08/20/25) | $9.08 (08/25/25) | 1 Week | +152.92% |

| Zepp Health (NYSE: ZEPP) | $24.88 (08/06/25) | $61.85 (10/09/25) | 2 Months | +148.59% |

| POET Technologies (NASDAQ: POET) | $4.01 (11/23/24) | $9.41 (10/09/25) | 1 Year | +134.66% |

The Bottom Line

These results validate the Wealthy VC approach: aggressive research, early identification of catalysts, and the conviction to act when the data aligns. Whether it was the meteoric rise of Regencell Bioscience or the steady industrial dominance of AST SpaceMobile, our subscribers had the information they needed to capture significant value. As the market evolves, we remain focused on finding the next generation of winners. The next big opportunity is out there, and we intend to find it first.

Read Next: Space Stocks Rocket Higher on Reports of SpaceX’s Massive $1.5 Trillion Planned IPO

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.