This Company’s Hydrogen at the Pump Technology is Set to Make it the Tesla of Commercial Transportation

The century-long era of the internal combustion engine and the fossil fuels that fuel them is coming to an end. Regardless of whether one prescribes to man-made climate change, one need only look at China’s major cities to see the undeniable effect that emissions from fossil fuel combustion have on air quality. While most developed countries in the Western world do not have air pollution on par with China, numerous studies have shown that fossil fuels are still having negative health effects and even directly contributing to millions of deaths. Clearly, a change is needed.

Addressing the need for green energy is a core part of President Joe Biden’s recently announced $2 trillion infrastructure plan, but most of the attention (and money) has been focused on battery electric vehicles (BEV) as a way to combat the burning of fossil fuels. While BEV’s do eliminate the emissions from the tailpipe of individual cars, the electricity needed to power them needs to be generated somewhere. This creates a problem, as electricity is generated primarily by fossil fuels, especially overseas.

While the use of renewables, such as wind and solar power, is replacing fossil fuels, it will be some years yet before coal, and other fossil fuels are removed from the electric grid completely. In the interim, there is an opportunity for companies with competing technologies to offer their own solutions to the need for clean energy.

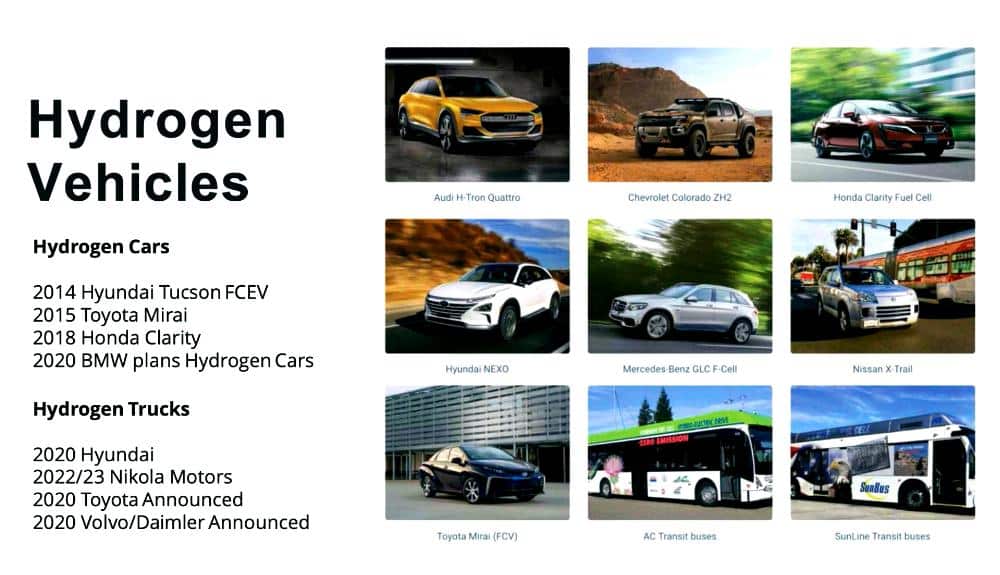

One of those technologies is hydrogen power. Hydrogen power replaces traditional fuels such as gasoline and diesel with refined hydrogen, which can be used to generate electricity and power a motor without the emissions associated with burning fossil fuels. This emerging tech is being introduced to more and more passenger vehicles.

Companies like BMW, Ford, Honda, Hyundai, Mercedes, Toyota and Volvo have either already released hydrogen-powered cars or are planning a release in the near future. Many of these vehicles come with generous fuel credits to incentivize buyers. The Toyota Mirai, for instance, comes with six years or $15,000 in hydrogen fuel credits.

And then there are large vehicles like buses, trucks, trains and even ships. Since larger vehicles typically refuel at centralized locations, they are particularly suitable for hydrogen power; there is less infrastructure to build out and lower associated costs. These vehicles are also some of the worst polluters globally, so there is an increased urgency to get them away from fossil fuels.

If hydrogen power catches on and becomes the new standard, there is substantial opportunity for companies looking to build out hydrogen-fueling infrastructure. Clean Power Capital (NEO: MOVE) (OTC: MOTNF) (FRA: 2K6A) is an investment firm focused on companies that are bringing to market disruptive technologies in the green energy industry. Their majority-owned subsidiary, PowerTap Hydrogen, is looking to break into the hydrogen fuel industry in a big way. PowerTap has the ambitious business plan and experienced management team that will be needed to reach their lofty goals.

The goal at PowerTap is a simple one: become the dominant player in hydrogen fueling stations in the U.S. While the end goal is simple, getting there is anything but that. First, the company needed to develop a competitive product, both in terms of costs, convenience and how “green” the product is.

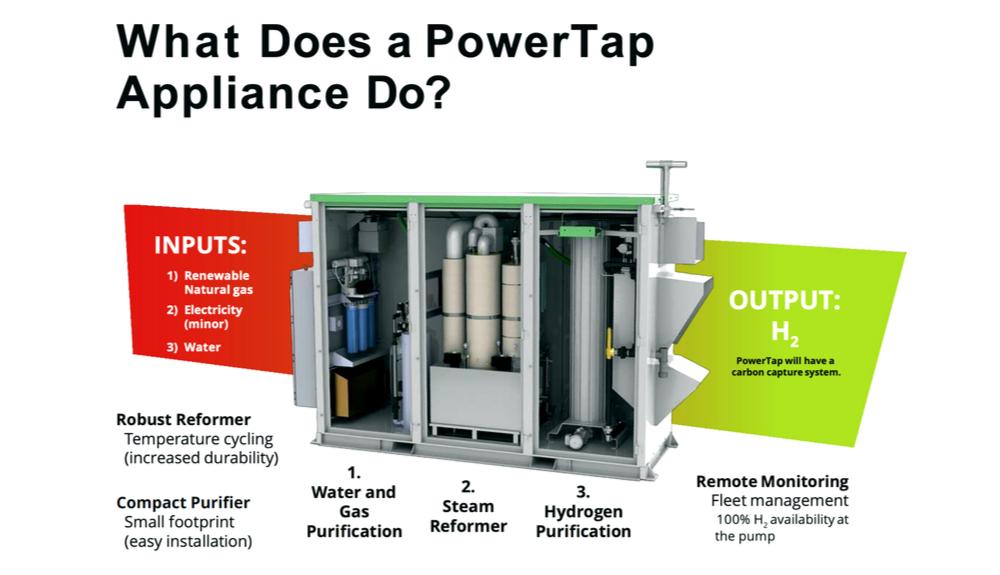

While most of their competitors have to transport refined hydrogen from the processing plant to the refuelling station, PowerTap’s patent-protected solution is the PTG-50, an onsite, compact steam-methane reforming (SMR) hydrogen refuelling station. The PTG-50 requires only water and natural gas as inputs and will capture 100% of emissions.

Highlights:

- Smallest onsite blue hydrogen station @ 960 square feet

- Produces 2,750 pounds of refined hydrogen per day

- Replaces compressed gas with liquid storage, increasing safety

- Fire suppression system uses SMR byproduct (CO2)

- Life cycle of 40,000 hours

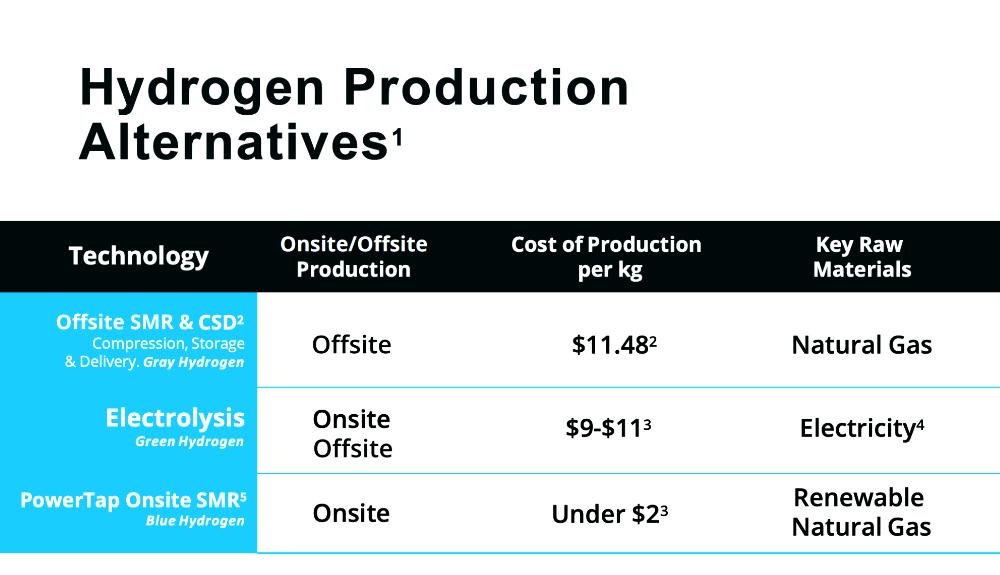

The station produces so-called “blue” hydrogen, derived from renewable natural gas. Blue hydrogen sits in the middle of black hydrogen (SMR using non-renewable natural gas) and green hydrogen (electrolysis) in terms of how “green” it is while costing 80% less than those alternatives.

Rather than building entirely new facilities from the ground up, management has decided to partner with existing gas stations to add hydrogen fueling. This will save PowerTap a significant amount of time and money compared to going at it alone. To this end, the company is partnering with the Andretti Group to install the fueling stations at existing Andretti Group gas stations and truck stops across California.

Management also plans to raise funds via clean energy programs, both at the federal and state level. For instance, California, which is the primary focus of the company, offers significant carbon credits for developing hydrogen infrastructure. Management believes these funds will cover upwards of 70% of the costs needed to build out their initial network of fueling stations. This will eliminate most of the need for management to dilute shareholders to remain afloat until the refuelling stations begin generating revenue.

Raghu Kilambi – CEO & CFO: Mr. Kilambi is an extremely successful entrepreneur who focuses on entering newly emerging industries. He’s been involved with growing multiple startups into publicly traded companies with market caps in the billions and specializes in public offerings, M&A and internal business development. Raghu graduated with Great Distinction from McGill University with degrees in commerce and public accounting and was formerly a Canadian Chartered Accountant. His ability to raise money for projects should prove invaluable for a company that will need to spend many millions to build out its refuelling station network.

Kelly Owen – COO: Kelly is a 25 year veteran of setting up IT systems for logistics and warehouse operations. He’s previously worked as a senior executive with Discount Tires and International Transportation Services, as well as served as a consultant to Nestle Corporation to implement their nationwide distribution system.

Salim Rahemtulla – President: Mr. Rahemtulla graduated from USC with an undergraduate degree in Economics and an MBA and is a 30-year veteran of the real estate development industry. He’s been involved with over $2 billion in both residential and commercial real estate development, including affordable housing projects in Los Angeles and military facilities aboard a Navy base. This strong history of real estate development makes him the perfect fit at PowerTap, where building out refueling stations is the prime focus of the company.

Cody Bateman – Technology Advisor: The so-called brains behind the operation, Cody is the subject matter expert in using liquid hydrogen as a fuel. He has an Electrical Engineering degree from Texas A&M, as well as an MBA from Duke University. His company, Cryotek LLC, has been in the oil and gas industry for over 30 years and has worked on R&D with 11 different countries, including the U.S. Mr. Bateman began to realize the potential of hydrogen fuel while working on cryogenic testing under NASA at the Kennedy Space Center. He and his team developed the onsite hydrogen fueling stations that PowerTap plans to roll out.

Michael Andretti – Advisory Board: The son of racing legend Mario Andretti, as well as a hall of fame driver himself, Michael Andretti heads up the Andretti Group, an investment firm primarily focused on gas stations with convenience stores/restaurants and fueling infrastructure/logistics. Since retiring from professional racing in 2003, Mr. Andretti has built the Andretti Group to over 100 gas stations, as well as a variety of fleet fuel and maintenance operations, across California, Oregon and Washington.

George Steinbrenner IV – Advisory Board: Nephew to the Chairman and Managing Partner of the New York Yankees, George decided to turn away from baseball to focus on another sport: racing. He’s the youngest owner of an IndyCar Series racing team, Steinbrenner Racing. An advocate of clean energy, Mr. Steinbrenner has been working with IndyCar to bring green technologies to the sport, both in the cars and at the tracks themselves. His advocacy will give hydrogen a voice in IndyCar, as well as the wider car racing community.

Dave Rogers – Advisory Board: Mr. Rogers is a veteran of the energy industry. He’s the Founder and CEO of Amp Energy, which focuses on renewable energy production and battery storage. Amp Energy has built out over 1.8 GW of renewable energy infrastructure and has a further 2 GW under development across 10 countries worldwide. Before starting Amp Energy, Dave worked at Front Street Capital, where he was head of carbon markets, where he oversaw the trading of carbon credits, both publicly and privately. His extensive experience with rolling out energy infrastructure and capitalizing on the resulting carbon credits will prove crucial to PowerTap’s strategy of tapping into government funding.

The main sources of competition for PowerTap are hydrogen fuel companies and other clean energy companies (BEV’s primarily). PowerTap’s management believes their company offers key advantages over each of the competitors, whether it be refuelling time, costs or how “green” the underlying technology is.

Tesla: Perhaps no company on Earth has captured the public’s attention over the last few years as Tesla (NASDAQ: TSLA). Run by the eccentric (understatement?) Elon Musk, the automaker’s bread and butter, is the rechargeable battery. By combining cutting-edge battery technology, world-class safety and revolutionary self-driving tech, Tesla has become the most valuable car company on Earth. If PowerTap had to name its single greatest competitor, it would have to be Tesla.

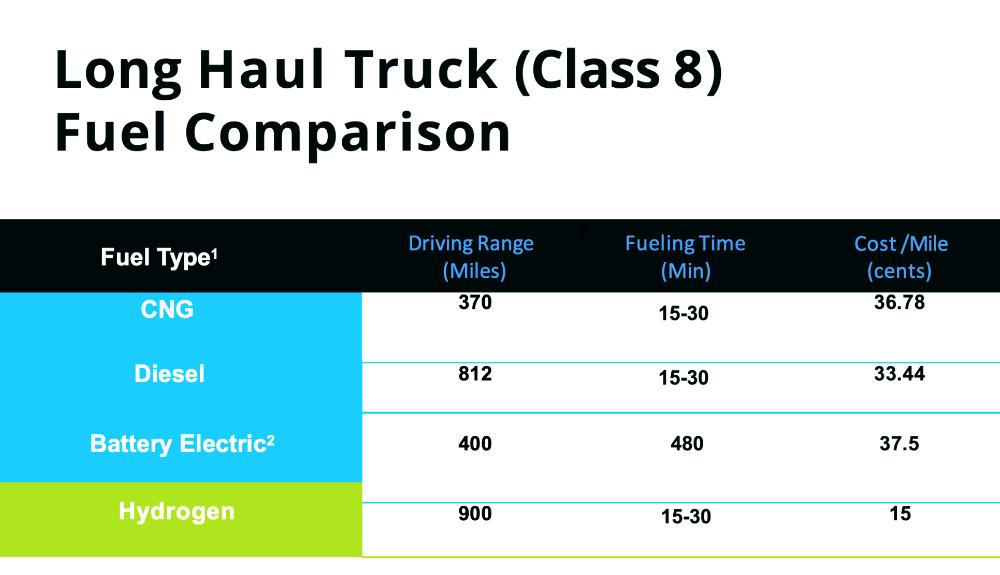

While it will be tough (see: impossible) to stop the proliferation of BEV’s altogether, PowerTap’s management believes they have a major advantage over Tesla in long-haul trucking. Basically, the battery needed to power a fully-loaded truck over long distances is very heavy, cutting down on both range and load sizes; the time needed to charge such a battery might also prove prohibitive to widespread use. Hydrogen-powered trucks would combine the clean energy of BEVs like Tesla with the range and refueling time of a diesel. Finally, management expects that hydrogen power will save operators over 50% per mile driven compared to other types of fuel.

Nikola: The most famous name in the hydrogen industry, Nikola Corporation (NASDAQ: NKLA) is a producer of class 8 trucks powered by hydrogen. Nikola’s business plan is somewhat unique: included with the purchase of one of their trucks is a supply of hydrogen from the network of refuelling stations that Nikola plans to roll out.

Much like PowerTap, Nikola’s stations produce hydrogen onsite, albeit in a significantly larger footprint. Unlike PowerTap, Nikola uses electrolysis to create refined hydrogen. This process has the advantage of only requiring water and electricity, thus being “greener” than PowerTap’s SMR method. PowerTap’s PTG-50 captures all waste products, however, so the difference in emissions is minimal. Electrolysis is also known to be more expensive than SMR, given the vast electricity requirements.

While Nikola will have a future due to their trucks and name recognition, their future in refuelling stations will depend on them keeping their costs down and lowering the footprint needed for their station. In the short term, PowerTap has them beat by a wide margin on both fronts.

Fuel Cell Energy: Perhaps the most ambitious player in the industry is Fuel Cell Energy (NASDAQ: FCEL) (FRA: FEY2). Not only do they intend to get in on the vehicle refueling game, they wish to bring the green benefits of hydrogen power to use in powering our businesses and homes. Their systems are catered to individual projects, in addition to the general electric grid; a data center or apartment complex, for instance, would install a system onsite to generate their electrical needs, while a local energy company might install a system to support (or replace) their fossil-fuel burning facilities.

Fuel Cell’s plans for refuelling hydrogen vehicles involve creating a synergistic relationship with local wastewater treatment plants. Basically, the wastewater plant would provide the water and natural gas for the Fuel Cell’s system while receiving heat and electricity in return. Such an arrangement would produce hydrogen in quantities well above what is produced by a single PowerTap station, but the hydrogen must then be transported and stored to individual gas stations. So while Fuel Cell’s cost of production is likely lower than PowerTap, those savings are likely lost on distribution costs, especially when supplying more out-of-the-way stations.

Such an arrangement bears the most resemblance to the way we currently produce and distribute fuel, but would oil companies use such an arrangement if they could produce gasoline at the gas stations? The huge costs to ship and store fuel doesn’t make it seem likely.

The global energy industry is experiencing great upheaval. Fossil fuels are being phased out all over the world, replaced by solar panels, wind farms, battery storage and, perhaps most revolutionary, liquid hydrogen-powered cars. Their unique blend of zero emissions, convenience and cost-effectiveness make hydrogen-powered vehicles viable alternatives to BEV’s. And those vehicles are going to need to refuel.

PowerTap Hydrogen is an under-the-radar name in the industry that is rolling out the world’s largest hydrogen fueling network. And it costs them very little to do so. Their Andretti Group partnership is providing the real estate and logistics network, while green energy grants are providing the bulk of the costs to get the refueling stations installed and operational.

If hydrogen essentially replaces diesel as the fuel of choice for trucks and other large vehicles while also capturing a portion of the passenger vehicle market, look for PowerTap to quickly roll out their industry-leading fueling stations nationwide. The potential is there for PowerTap to become the next Chevron (NYSE: CVX) or Shell (NYSE: RDS), depending on how the hydrogen vs BEV (and SMR vs electrolysis) race plays out.

Investors looking to throw their lot in with PowerTap should understand that it is a subsidiary of Clean Power Capital. As such, further research would need to be done on the parent company, as well as PowerTap’s competitors, prior to making any investment decisions.

Clean Power Capital recently applied to get uplisted to the NASDAQ exchange, which would grant it access to the largest pool of investors in the world. Once the uplisting is complete, the company should catch the attention of the younger investor demographic, who are eager to invest with their conscience by seeking out clean energy companies.

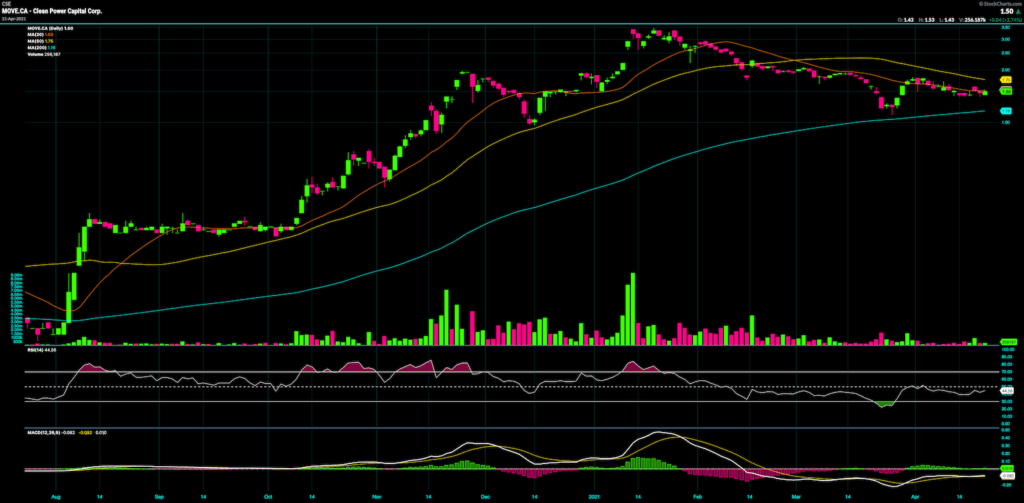

Clean Power Capital (NEO: MOVE) Technical Stock Chart

Learn more about Clean Power Capital: Website | IR Website | Investor Deck | MOVE Chart

- ???????? Canada | NEO: MOVE

United States | OTC: MOTNF

Germany | FRA: 2K6A

Follow WVC on Social Media: Facebook | Instagram | Twitter | LinkedIn

Clean Power Capital is a paid client of Wealthy VC.

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.