Rising Fintech Star XTM Offers Solution to Business’s Most Complex and Time-Consuming Issues

Staffing and Payroll Are Among the Most Complex and Time-Consuming Parts of a Business’s Operations, Making the Technology and Products Offered By Rising Fintech Star XTM Inc. (CSE: PAID) (OTCQB: XTMIF) (FSE: 7XT), a Very Hot Commodity

The complexity of scheduling a transient workforce and being able to adapt on the fly when staffing doesn’t fall into line as planned is challenging and can have a negative reputational and financial impact. Conversely, from the employee perspective, it has become increasingly important to them to work for an employer who offers them access to their earnings on demand. Both processes, scheduling and earned wage access, are high priorities for businesses looking to attract and inspire a new generation of workers.

XTM Inc. (CSE: PAID) (OTCQB: XTMIF) (FSE: 7XT), founded in cloud banking for the transient workforce three years ago, has set out to refine earned wage access and staff management along with a host of other business functions with Today Pay and Timely it’s scheduling and staff call-out product.

The industries where EWA is an attractive form of payment include service staff, general laborers, and temporary or part-time staff. Waiting for a two-week pay cycle to complete does not meet the needs of this workforce, many of whom studies show do not even have nominal funds on hand to manage a personal emergency.

Wages for the service industry traditionally include gratuities, often paid out as the industry calls them in ‘due-backs, using cash. With most patrons paying with credit or debit cards, due-backs have become necessary as there is increasingly less cash in the hospitality ecosystem. Therefore, access to funds at the end of a shift can be complicated for an operator looking to pay out their staff.

The core feature of Today Pay is that employees’ earnings, including tips, bonuses, etc., are available to them on demand. The platform is either integrated with a Point of Sale, Payroll or administered by the operator through a portal. It automates the disbursement of tip calculation and eligible earnings draw, ensuring staff are inspired to work more and with greater satisfaction with instant gratification. Today Pay is integrated into the leading POS platforms, including Square, Lightspeed and Clover, so that companies can convert customer payments to employee wages in real-time.

Staff Management: Problem in Need of a Solution

Significantly adjacent to paying on demand is managing time and attendance, scheduling, and shift callouts. Timely is part of the Today product suite for staff management. Timely automates scheduling, callouts, and staff incentives with gamification, all with the goal of inspiring workers to work more happily. Employees receive a detailed listing about the job being posted, including hours and pay, and have the option in-app to accept or decline. XTM uses its app to “call out” if they are unable to fill the shift.

Today Wellness connects financial wellness to overall health. With an interactive and personalized budgeting and savings tool combined with virtual health care, Today Health creates a sticky user experience and benefits not typically available to many of Today’s targeted users, including many in the service industry.

Finally, there’s Today Financial, which provides cloud banking services. Users will be able to access their funds even faster thanks to the seamless integration between their wages and their bank. In addition to a debit card, the platform offers popular features like cash-back rewards and purchase protection.

XTM Executive Team

CEO – Marilyn Schaffer:

Marilyn Schaffer is a serial entrepreneur, and through her PR practice, she built her own reputation by advancing the businesses and reputations of others. She founded NEO Communications in the late 1990s, which was quickly acquired by Omnicom (NYSE: OMC). Post-acquisition, Marilyn was appointed Vice President, Global Technology Practice. In her 20s, Marilyn and her team won the confidence and business of a number of mid-size and large brands, including Bell Canada, Bell Mobility, Rogers, Tangerine, Canada Post and AT&T. Following her tenure with NEO Communications, Marilyn left and went on to launch XTM Inc. in 2006.

XTM launched as a full-service digital advertising and marketing agency. The company had many significant successes and grew to become a contender in the space, winning awards for its work, including the First Nations, Mississauga of the New Credit’s representation at the PanAm Games in 2015. This was a multi-million dollar account, and media spend executed within four months from start to completion.

In March 2018, Marilyn’s company, XTM Inc., acquired the assets of Zoompass, placing the company squarely into the Fintech payment space. Since the acquisition, XTM became public ( CSE: PAID), has launched in Miami, and Toronto is seen as a fintech innovator in the neo-banking space. XTM is a global card issuer and real-time payment specialist providing technology to businesses to automate and expedite worker payouts and eliminate cash. XTM integrates businesses into a payment ecosystem that is coupled with a free mobile app and a Visa or Mastercard debit card with free banking features. XTM drives enterprise value and creates a positive user experience.

CFO – Paul Dowdall:

Throughout his two-decade career working in finance, Paul has worked with a variety of private and public companies, from CPG firms to financial services. His areas of expertise include recapitalizing companies by freeing up cash flow and reducing costs, organizational restructuring to control costs and establishing compensation plans that align employees and shareholders.

CTO – Chad Arthur:

Chief Technology Officer Chad Arthur has eight years of experience developing digital solutions for the public relations and fintech segments. His past roles include Lead Mobile Developer and Technical Product Manager, pointing to his strong knowledge of app development. This experience has served him well as he’s built out the Today Pay platform and continues to build on and refine the product.

XTM Growth & Performance

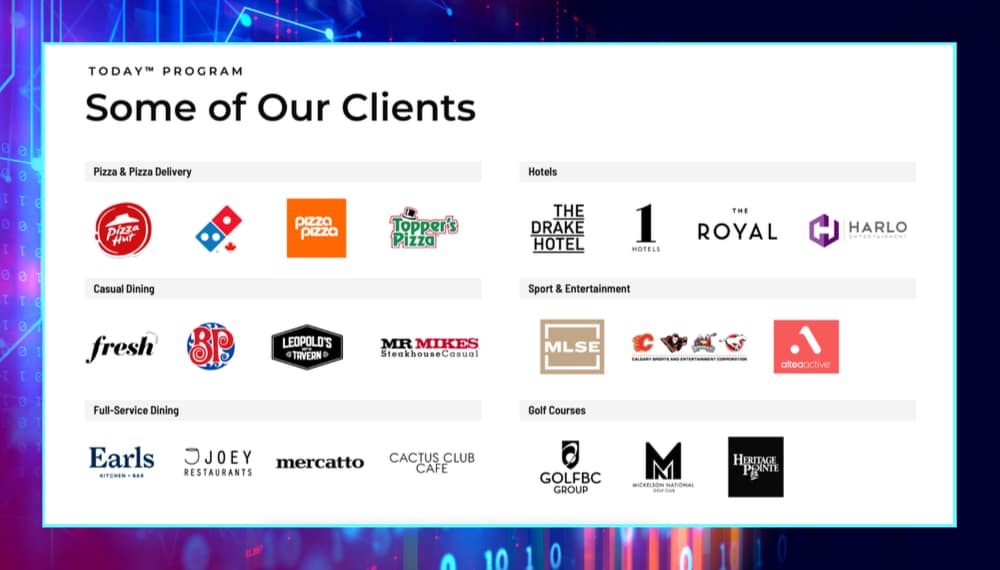

Today Pay started its pilot program in 2020 with nearly 12,000 users across 620 different hospitality establishments. By 2021, the number of users had grown to 41,000 across 1,300 businesses, thanks to organic growth in the hospitality industry, as well as an entrance into the beauty market.

2022 saw a focus on golf courses, hotels and delivery services, resulting in the user base rising to 67,000 at 2,000 establishments. In 2023, Today Pay is being utilized by many major companies, including Denny’s, Pizza Hut and Aramark.

XTM plans to continue to grow its existing markets, as well as enter multiple new markets. By the end of 2024, the company plans on operating in the following segments: quick-service restaurants, full-service restaurants, golf courses, beauty salons, staffing agencies and healthcare providers.

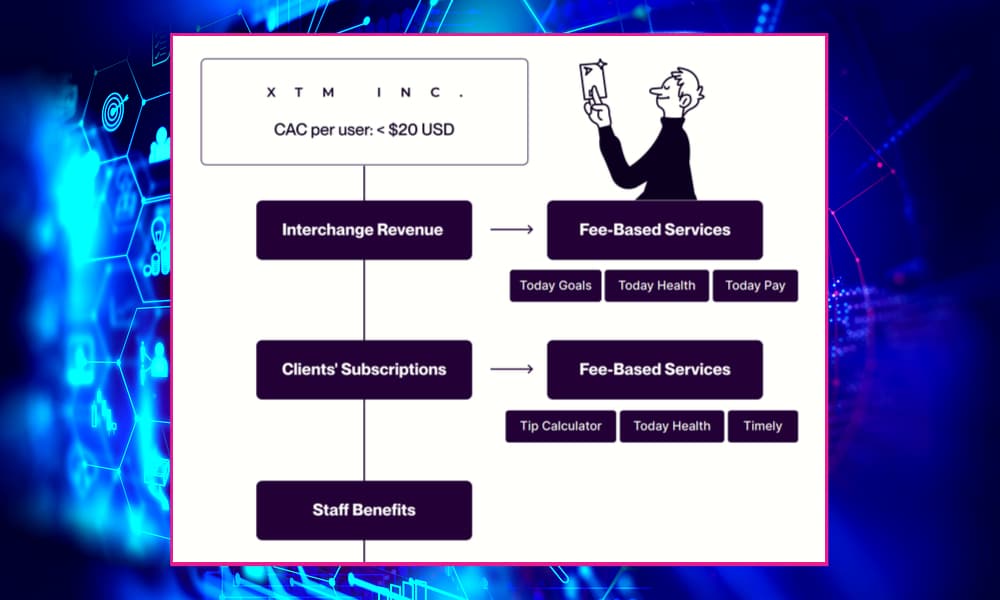

The company has multiple revenue streams coming in from the Today Pay platform. In addition to the revenue generated by subscribing to the platform itself, there are various fee-based services available for users.

XTM Valuation

With the beating the markets have taken over the last year, the need to invest in companies with solid fundamentals at attractive valuations has increased. XTM Inc. is one such company. The company’s core product has been built out and refined, meaning most of the R&D costs are in the rearview mirror. Meanwhile, they have been growing their user base at a rapid clip and introducing ancillary revenue streams like Today Goals and Today Health.

While the company is currently unprofitable, it is in heavy growth mode. Over time, the recurring revenue from the established customer base will eclipse the costs to grow said customer base. The company estimates that once it reaches 500,000 users, profits should begin to rapidly outpace expenses.

With a market cap under $30 million, there is plenty of room for growth, considering just how large the addressable market is. Once XTM tips the scale on profitability, its valuation metrics will show how undervalued the company is relative to its peers.

A bonus to the company’s attractive valuation is that it has a relatively high portion of shares (12%) owned by insiders. Insider ownership of this level typically results in greater returns for investors, as insiders’ interests are aligned with shareholders.

In Summary

The trend toward a primarily digital future seems inevitable at this point. Both employers and employees need to adapt to how these changes will affect the workplace. Today Pay provides them with a comprehensive tool to handle many of the most challenging and time-consuming processes associated with employee relations.

XTM Inc. (CSE: PAID) (OTCQB: XTMIF) (FSE: 7XT) has done a great job marketing Today Pay and growing its business, with plans in place to grow the company’s revenue for years to come. XTM’s strong management team and solid business plan should pave the way for future profitability, with margins and revenue improving with further growth. For investors that believe in the plan and have the patience to watch it play out, XTM offers them one of the more attractive options among microcap companies.

Learn more about XTM: Website | Investor Deck | PAID Chart

Follow XTM on Social Media: Facebook | Instagram | Twitter | LinkedIn

Join the Discussion in the Wealthy VC Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

XTM Inc. (CSE: PAID) is a paid client of Wealthy VC.

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.