5 Fintech Stocks To Capitalize On A Cashless Society

In the not-too-distant future, cash transactions will become something of a novelty, having been supplanted by various forms of digital payments. Investors looking to capitalize on this inevitable outcome have a number of options for companies to invest in. Below are 5 fintech companies that stand out from the crowd and deserve investor attention.

XTM Inc.

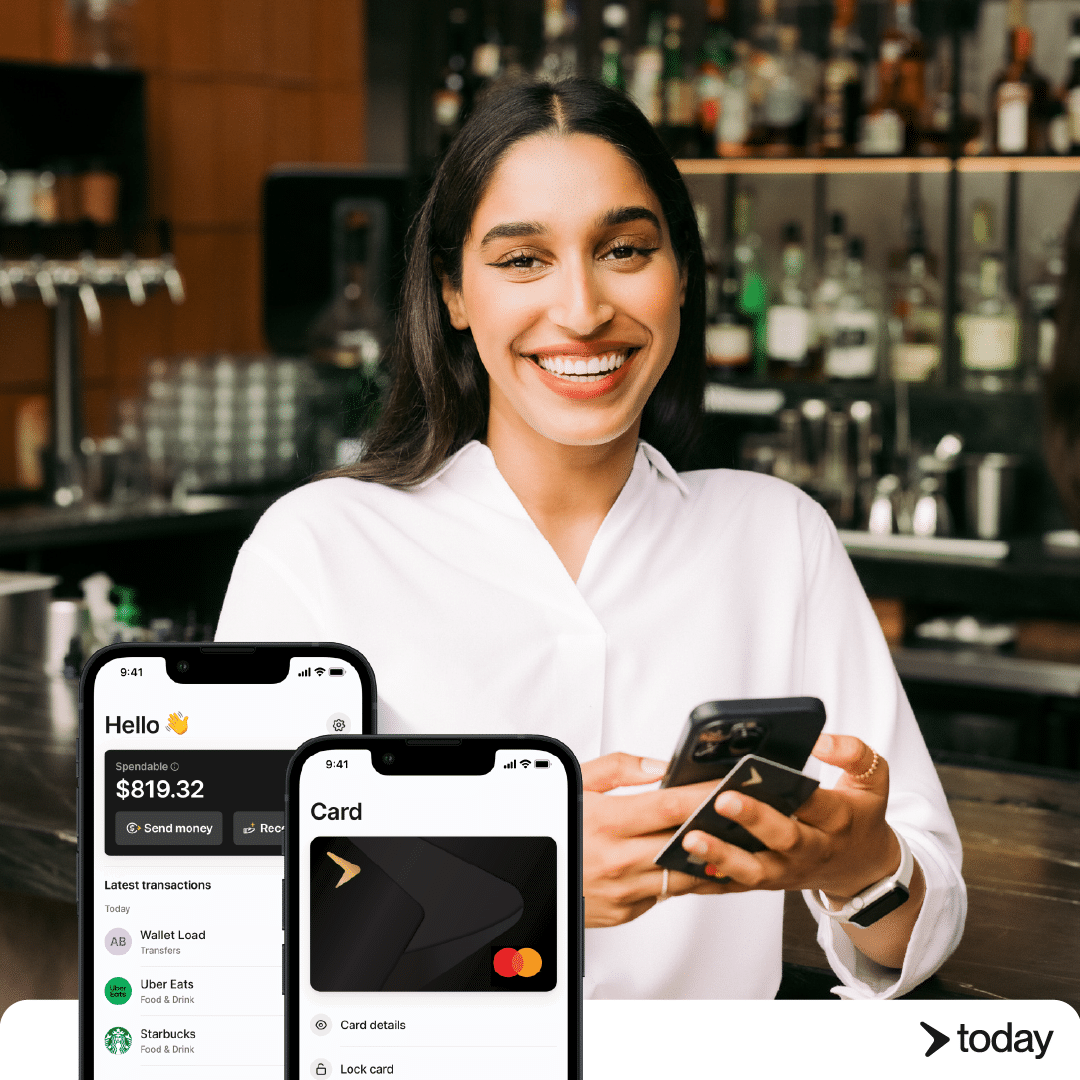

The top company on our list, XTM Inc., is also the smallest. Their business is similar to that of Payfare Inc. in that both companies are seeking to use digital payments to expand EWA. While PayFare is heavily focused on gig workers and other so-called “1099 employees”, XTM is focusing on the service industry, whose employees are more likely to be paid in cash and expect to take home their wages each day.

Where XTM sets itself apart is the breadth of the company’s platform, Today Pay. In addition to digital payments and online banking, Today Pay hosts a number of other features for employer/employee coordination, including scheduling, callouts and last-minute shift fulfillment.

Also included in Today Pay are a number of functions (collectively called Today Wellness) aimed at boosting employee morale, such as virtual healthcare and financial planning tools. The final vertical of the platform is Today Financial, which is the cloud banking division that allows employees to instantaneously access their funds via a supplied debit card.

The combination of XTM’s small size and ambitious goals mean it has the most upside to any company on this list. Given their focus on the service industry, investors shouldn’t be surprised when their local restaurants begin to use Today Pay to manage their employees.

XTM Inc. last traded at $0.16, up +45.5% YTD.

Jack Henry & Associates

Founded in 1976 and publicly traded since 1985, Jack Henry & Associates is by far the oldest company on this list. They’ve been innovating financial technology and processes throughout their existence. Today, they have an extensive array of financial products available to customers, including digital banking (including a commercial division), digital payments, IT services and customer relationship management.

The company’s maturity and solid business fundamentals are especially attractive to value investors, as is their annual dividend raise that has gone on for over a decade. Faced with uncertain economic times ahead, the least risky stock on the list could weather the storm the best.

Jack Henry & Associates last traded at $152.01, down -13.7% YTD.

PayPal Holdings Inc.

The largest and most well-known company on the list is PayPal Holdings Inc, the undisputed king of digital payments and 143rd on the Fortune 500 list of largest U.S. companies by revenue. Founded in 1998, PayPal has emerged as the global leader in both peer-to-peer payments, as well digital payments between customers and companies.

Like many tech companies over the last few years, PayPal was overly ambitious in growing its workforce and is now being forced to trim its workforce via layoffs (~7% of the workforce). While unfortunate for the laid-off workers, the cost savings will improve operating margins and, thus, the bottom line. Whether these layoffs lead to a significant impact on revenue growth is still to be determined, but any impact should be minimal relative to the cost savings.

PayPal last traded at $73.68, down -1.21% YTD.

Payfare

One of the greatest benefits of digital payments is the ability to transfer money instantaneously. This is necessary for the spread of Earned Wage Access (EWA), or the idea that employees should have access to their wages as soon as they are earned as opposed to waiting for payday.

Payfare is bringing EWA to employees and contractors via their digital payment platform. The platform allows employers to pay their employees as soon as the work is completed, giving employees instant access to their funds. The platform also includes a fully built-out online banking division, which includes debit cards and cash-back rewards.

Payfare Inc. last traded at $6.50, up +45.09% YTD.

Formerly called Square Inc., Block Inc. is primarily known for its credit card processing services, which have been revolutionary for small business owners. Square, their phone or table-based point-of-sale system, is much cheaper than traditional point-of-sale systems, as well as being mobile and more user-friendly.

Since its founding in 2009, the company has acquired a number of other firms and increased its offerings beyond point-of-sale systems. These additions led the executives to rename the evolved company to Block Inc. Today, in addition to its legacy Square division, Block Inc. is also in the business of buy-now-pay-later (Afterpay), web hosting (Weebly) and music streaming (Tidal).

Block Inc. last traded at $74.50, up +15.3% YTD.

Follow Wealthy V.C. on Social Media: Facebook | Instagram | Twitter | LinkedIn | GETTR

????Join the Discussion in the Wealthy V.C. Investor Group

????Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

Risk Disclaimer: XTM Inc. is a paid client of Wealthy VC.

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.