SpaceX, xAI Reportedly in Merger Talks Ahead of Pending Trillion Dollar IPO

The proposed combination aims to integrate orbital infrastructure with artificial intelligence as competitors Alphabet and Meta ramp up space-based research.

Elon Musk’s SpaceX and artificial intelligence startup xAI are engaged in discussions to merge their operations, a move that would consolidate the billionaire’s aerospace and AI interests ahead of a highly anticipated initial public offering. The potential transaction, first reported by Reuters, would involve an exchange of xAI shares for SpaceX equity. While specific terms remain undisclosed, the deal would bring SpaceX’s Falcon rockets and Starlink satellite constellation under the same corporate umbrella as the X social media platform and the Grok AI chatbot.

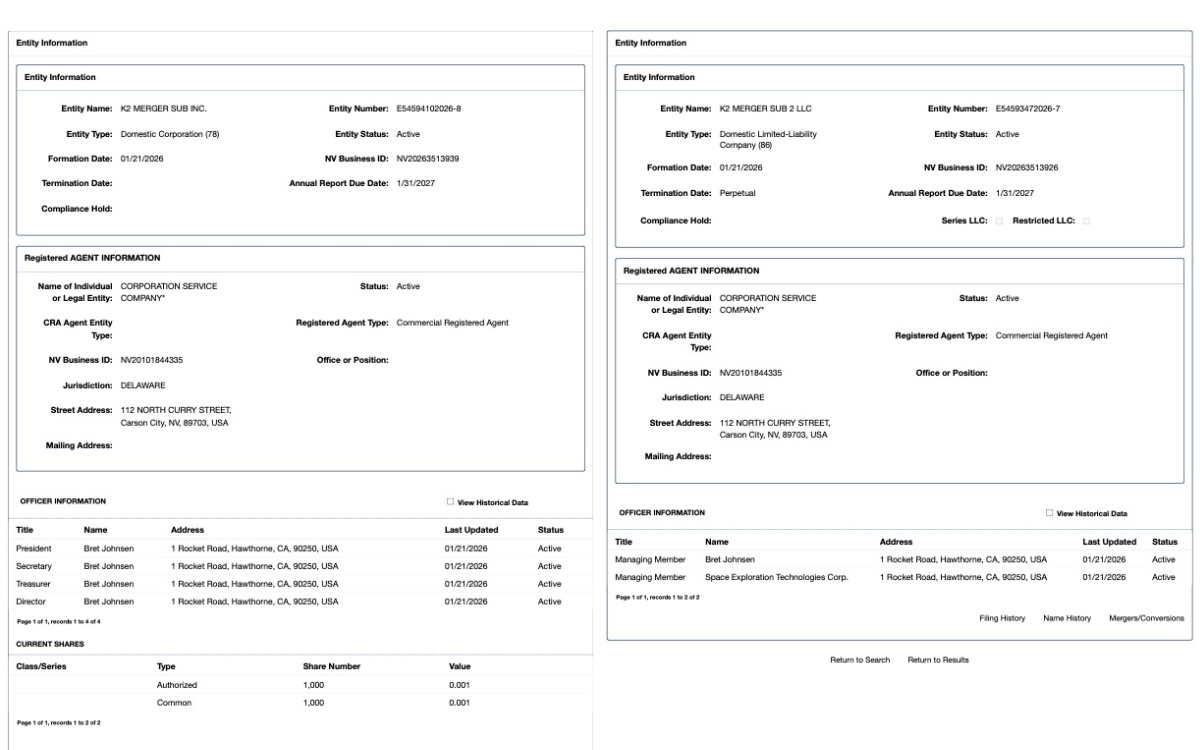

Documents filed in Nevada on January 21 reveal the creation of two new entities, K2 Merger Sub Inc. and K2 Merger Sub 2 LLC. These filings list SpaceX Chief Financial Officer Bret Johnsen as a managing member. Under the proposed structure, some xAI executives may be offered the option to receive cash instead of SpaceX stock, though no final agreement has been signed. The news comes as Musk continues to oversee a portfolio that also includes Tesla (NASDAQ: TSLA), Neuralink, and The Boring Co.

Integrating Intelligence and Infrastructure

A primary driver for the tie-up appears to be Musk’s ambition to move high-capacity computing into orbit. Speaking at the World Economic Forum in Davos, Switzerland, last week, Musk suggested that space could eventually offer the most cost-effective environment for AI processing.

In an interview with BlackRock (NYSE: BLK) CEO Larry Fink, Musk stated:

“It’s a no brainer for building Solar-Powered AI Data Centers in space because, as you mentioned, it’s also very cold in space. If you’re in the shadow, then it’s very cold, just three degrees Kelvin. So you just have solar panels facing the sun and then a radiator that’s pointed away from the sun, so it has no sun incidence, and then it’s just cooling. It’s a very efficient cooling system. So, net effect is that the lowest cost place to put AI will be space, and that’ll be true within two years, maybe three at the latest.”

By utilizing solar power and the vacuum of space for cooling, orbital data centers could potentially reduce the overhead associated with terrestrial supercomputers like xAI’s “Colossus” facility in Tennessee. This strategic shift places SpaceX in direct competition with other technology giants exploring similar frontiers. Alphabet (NASDAQ: GOOGL) is currently researching orbital data centers through its Project Suncatcher initiative, while Meta Platforms (NASDAQ: META) remains a primary competitor in the race to develop advanced generative models.

Building these systems in orbit involves significant technical risks. Analysts have questioned whether the potential energy savings justify the costs of hardening hardware for the radiation and thermal extremes of space. However, the merger would allow xAI to leverage SpaceX’s launch frequency to iterate on hardware faster than competitors who must rely on third-party launch providers.

Source: Forbes Breaking News YouTube

Defense Implications and Market Impact

The combination of xAI’s software capabilities with SpaceX’s Starlink and Starshield units could strengthen the company’s position in securing U.S. defense contracts. The Pentagon is currently implementing an “AI acceleration strategy” intended to speed up military planning and decision-making. xAI already holds a contract worth up to $200 million to provide Grok products to military networks.

Caleb Henry, director of research at Quilty Analytics, noted that the Pentagon’s push into AI-enabled systems makes vertical integration with satellite infrastructure a significant strategic advantage. Such a move could streamline the deployment of intelligence-gathering tools that rely on real-time data processing in orbit.

The market reaction to the report has been immediate for associated entities. Shares of EchoStar (NASDAQ: SATS), which holds a stake in SpaceX, fell 10.5% as investors assessed how the merger and subsequent IPO structure might impact existing equity positions. Concurrently, Tesla recently disclosed that it agreed to invest approximately $2 billion in xAI, further intertwining the financial health of Musk’s various enterprises.

Valuation and Path to Public Markets

SpaceX was most recently valued at approximately $800 billion in a secondary share sale. Reports from the Financial Times indicate that the company is considering a June 2026 IPO with a target valuation of $1.5 trillion. A merger with xAI, which was valued at $230 billion following a recent $20 billion Series E funding round, would likely assist in reaching that trillion-dollar threshold.

The proposed deal follows a pattern of internal consolidation within Musk’s business empire. In 2025, Musk folded the X social media platform into xAI via a share swap. This followed his 2016 use of Tesla stock to acquire SolarCity. While SpaceX has traditionally remained private to focus on long-term goals, the success of the Starlink satellite-internet service has reportedly shifted the company’s strategy toward a public listing.

Read Next: What Michael Burry’s GameStop Bet Signals About the Company’s Future

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.