‘Big Short’ Investor’s $1 Billion Bet Against These 2 AI Giants Sends Tech Sector Plunging

Michael Burry’s bearish wagers on Nvidia and Palantir trigger a market-wide rout, fueling fears that the AI boom is a bubble on the verge of popping.

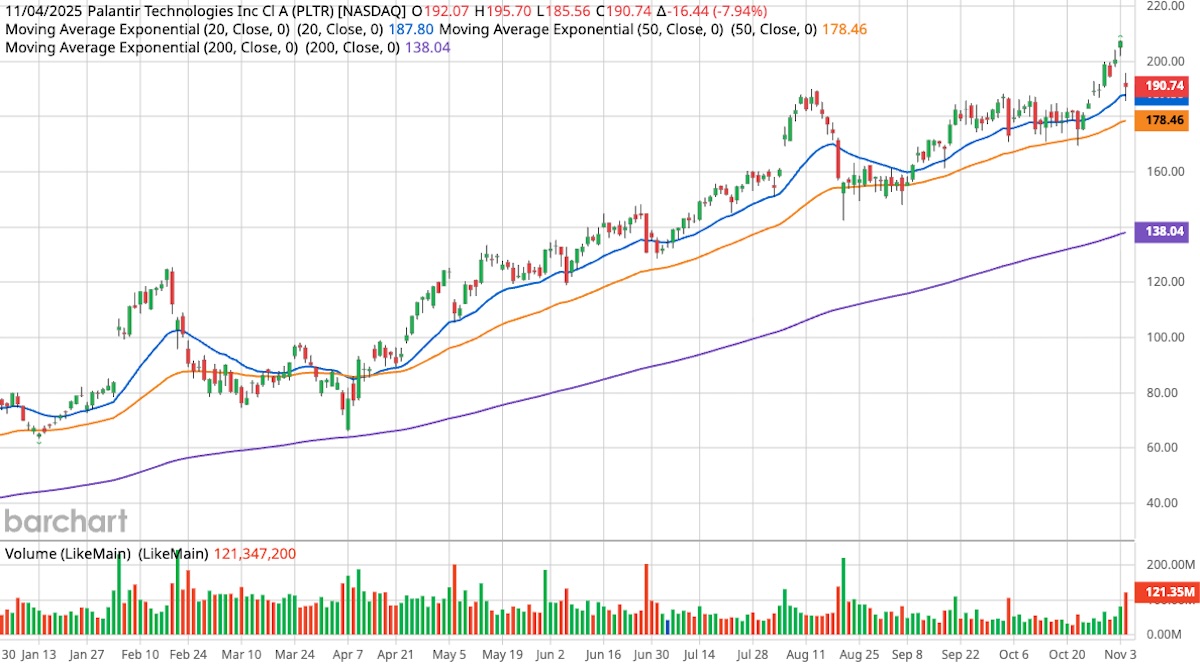

Michael Burry, the enigmatic investor immortalized in the film The Big Short for predicting the 2008 financial crisis, just dropped a $1.1 billion anvil on the high-flying artificial intelligence sector. His firm, Scion Asset Management, revealed massive “put” contracts, bets that a stock’s price will fall, against AI darlings Nvidia (NASDAQ: NVDA) and Palantir (NASDAQ: PLTR). The move, disclosed in a mandatory 13F filing, immediately sent shockwaves through Wall Street. The revelation triggered a broad-based tech rout that erased hundreds of billions in value and forced investors to confront the question they have been whispering for months: Is the AI boom an echo of the dotcom bubble?

BREAKING: Michael Burry just filed a portfolio update.

He entered massive options positions betting against Nvidia and Palantir.

He bought call options betting on Halliburton and Pfizer.

Full portfolio up on Quiver. pic.twitter.com/gImnU9dYYL

— Quiver Quantitative (@QuiverQuant) November 3, 2025

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Burry, who operates under the X handle Cassandra Unchained, a nod to the Greek mythological figure who issued true prophecies that no one believed, has been telegraphing his concerns. He recently returned to the social media platform to post charts comparing the current tech capital expenditure to the bubble of 1999-2000. He also highlighted the slowing growth in cloud computing. Now, he has put his money where his mouth is. Scion’s filings show a staggering $912 million short position against Palantir and an additional $187 million bet against Nvidia. For investors who watched Burry’s 2005 wager against the housing market turn his fund’s value up by 489%, this new billion-dollar bet is impossible to ignore.

These aren’t the charts you are looking for.

You can go about your business. pic.twitter.com/ICldNUp2OI— Cassandra Unchained (@michaeljburry) November 3, 2025

The Market Carnage

The fallout was swift and brutal. The tech-heavy Nasdaq Composite (IXIC), which has been carried aloft by AI hype all year, led the losses, plunging 2%. The benchmark S&P 500 (SPX) fell 1.2% as the pessimism spread. Even the Dow Jones Industrial Average (DJI), which includes fewer high-growth tech names, dipped 0.5%. The Russell 2000 Index (RUT), tracking smaller companies, tumbled 1.4%, signaling a clear risk-off sentiment.

Nvidia, the undisputed poster child of the AI revolution, saw its shares drop nearly 4%, wiping out $200 billion from its staggering market cap. Palantir, the target of Burry’s larger bet, cratered by as much as 8.5%. The pain spread rapidly, dragging down the entire Magnificent Seven and other related tech stocks. Advanced Micro Devices (NASDAQ: AMD) and Super Micro Computer (NASDAQ: SMCI), both key players in the AI hardware space, also slid.

The contagion did not stop at equities. Bitcoin (BTCUSD), a barometer for investor risk appetite, plunged more than 7% to fall below $100,000 for the first time since June. Even traditional safe havens stumbled; Gold (XAUUSD) dipped 1.6% as a strengthening dollar added to the pressure. The sell-off was indiscriminate, hitting strong earners like Uber (NYSE: UBER) and Spotify (NYSE: SPOT), both of which slid despite posting solid results, proving that fundamentals mattered little in the face of pure market panic.

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

“Bat-sh*t Crazy”

Not everyone, however, is running for the exits. Palantir’s CEO, Alex Karp, did not mince words when responding to Burry’s massive short position. He branded the decision “bat-sh*t crazy,” particularly since Palantir’s shares tumbled despite the company beating Wall Street’s earnings and revenue expectations.

Karp fired back at the bearish thesis, telling CNBC:

“Those two companies he’s shorting are the ones making all the money, which is super weird.”

Karp’s defense highlights the central tension in the market. The bears, like Burry, see sky-high valuations completely disconnected from reality, fueled by hype. The bulls, like Karp, point to explosive earnings and a genuine technological revolution. An analysis from JPMorgan Chase (NYSE: JPM) Asset Management recently found that AI-related stocks have accounted for a staggering 75% of the S&P 500’s returns since ChatGPT launched, a level of concentration that exceeds the dotcom bubble. The question is whether those companies, like Nvidia and Palantir, can actually “make all the money” fast enough to justify their trillion-dollar-plus valuations.

Source: CNBC Television YouTube

Wall Street Joins the Chorus of Caution

While Burry’s bet was the catalyst, he is no longer a lone voice in the wilderness. Top bankers from Goldman Sachs (NYSE: GS) and Morgan Stanley (NYSE: MS) are now publicly warning clients to brace for a pullback.

At a recent financial summit, Morgan Stanley CEO Ted Pick suggested a correction would be healthy, stating:

“We should welcome the possibility that there would be drawdowns, 10% to 15%, that are not driven by some sort of macro cliff effect.”

David Solomon, CEO of Goldman Sachs, echoed that sentiment, warning that much of the capital being poured into AI “will turn out to not deliver returns.” This skepticism is seeping in just as other market pillars look shaky. Tesla (NASDAQ: TSLA) shares fell over 5% after Norway’s massive sovereign wealth fund, a major stakeholder, announced it would vote against Elon Musk’s $1 trillion pay package. Meanwhile, a record-long government shutdown in Washington continues to delay key economic data, leaving investors flying blind.

This is not the first time Burry has taken a high-profile swing and missed. In 2021, his fund disclosed a significant short position against Tesla, only to watch the stock more than double in the following six months. Conversely, he also knows how to win, doubling down on a bullish position in Estée Lauder (NYSE: EL) earlier this year before the stock rallied 40%. Burry’s legacy is one of being a contrarian, but his timing is not infallible. The entire tech sector is now holding its breath, waiting to see if Cassandra’s $1.1 billion prophecy is just another premature call or if the AI bubble has finally, truly, begun to pop.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.