Markets Rebound Sharply as Deal to End Government Shutdown Nears

Tech stocks, led by AI leaders, snap a brutal losing streak after a key Senate vote signals a breakthrough in Washington's 41-day impasse.

Wall Street breathed a massive sigh of relief Monday, posting a ferocious rally that clawed back nearly all of last week’s painful losses. The catalyst? Signs of life from Washington. Investors piled back into risk assets, energized by weekend dealmaking that finally points toward an end to the record-breaking 41-day U.S. government shutdown.

The buying spree was broad, but technology stocks clearly led the charge. The tech-heavy Nasdaq Composite (IXIC) surged 2.27%, finishing the day at 23,527.17. The benchmark S&P 500 (SPX) climbed 1.54% to settle at 6,832.43, while the Dow Jones Industrial Average (DJI) posted a solid gain of 381.53 points, or 0.81%, to close at 47,368.63. The market’s fear gauge, the CBOE Volatility Index (CBOE: VIX), fell over 7%, signaling a sharp reduction in investor anxiety.

This sudden reversal of fortune came after a weekend of intense negotiations in the nation’s capital. The prolonged shutdown has clouded the economic picture, weighing heavily on consumer confidence and, most critically for Wall Street, delaying the release of key economic data.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

A Breakthrough on the Hill

The gridlock in Washington finally broke late Sunday night. The Senate advanced a crucial procedural measure, clearing the 60-vote threshold to move forward on a new funding bill. The 60-40 vote materialized after eight senators in the Democratic caucus broke with party leadership to support the agreement, a significant bipartisan step.

This new deal, which House Speaker Mike Johnson has urged members to return to Washington to vote on, would reopen the government into January. It also reverses some of the recent mass federal layoffs and includes future protections for government workers.

However, the compromise does not include an immediate extension of Affordable Care Act subsidies, which had been a major sticking point for Democrats. Instead, the agreement reportedly includes a promise for a standalone vote on the subsidies in December. While this defers the fight, it provided just enough political cover for markets to celebrate the immediate positive: the government is on track to reopen.

Video Source: NBC News YouTube

A Welcome Reversal

Monday’s rally felt particularly strong given the bleak performance last week. Investors had grown increasingly worried about the shutdown’s economic drag, compounded by persistent fears over elevated valuations in the artificial intelligence sector. The Nasdaq shed roughly 3% last week, marking its worst weekly performance since the tariff-driven sell-offs back in April. Both the S&P 500 and the Dow lost more than 1% in the same period.

Tim Holland, chief investment officer at Orion, cited investors’ anxiety toward the shutdown, valuations, and a possible AI bubble as key drivers of the recent downbeat sentiment. Noting that the deal in Washington removes one major piece of uncertainty, Holland told CNBC:

“It’s been a bumpy November for risk assets. The concerns last week were reasonable, but I think we’ve at least taken one of those three concerns out of the picture, and I think that’s a big deal.”

The shutdown has tangible economic consequences. Consumer sentiment, as measured by the University of Michigan’s survey, recently plunged to its lowest level in more than three years. Furthermore, federal agencies have halted the release of crucial reports, including the consumer price index (CPI) and producer price index (PPI), that were scheduled for this week. This data blackout leaves both the Federal Reserve and Wall Street flying blind.

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

Big Tech Finds Its Footing

With the shutdown risk fading, investors eagerly scooped up the very names they had punished last week. The AI bull market leaders, Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO), led the impressive gains. Nvidia shares surged nearly 6%, a move bolstered by bullish analyst comments from Citi, which lifted its price target on the chip leader to $220 from $210, noting robust demand. Broadcom bounced 2.6%, snapping a two-day losing streak.

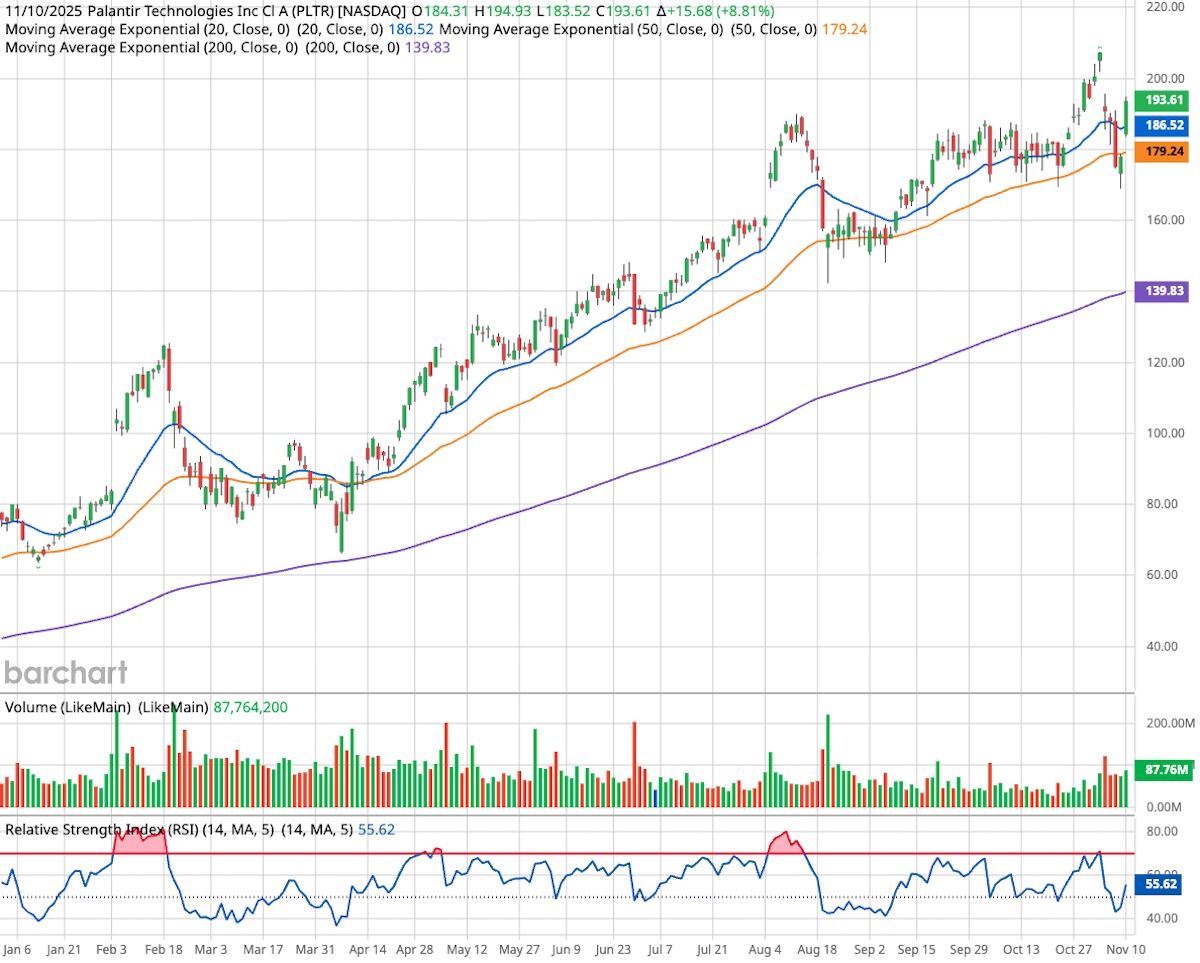

Another AI darling, Palantir (NASDAQ: PLTR), rebounding sharply after last week’s plunge that followed Michael Burry’s $1 billion short bet, was one of the S&P 500’s top performers, soaring nearly 9%. As a major government contractor, Palantir’s fortunes are closely tied to a functioning Washington, and investors cheered the prospect of federal contracts moving forward.

The rebound was also evident in the tech titans. Microsoft (NASDAQ: MSFT) shares rose 1.9%, a significant move that snapped an eight-day losing streak, its longest daily slide since 2011. Other big tech names followed suit, with Alphabet (NASDAQ: GOOGL) rising over 3%, while Tesla (NASDAQ: TSLA) raced 3.7% higher.

This risk-on appetite extended beyond equities, with the crypto market getting a dual boost. Bitcoin (BTCUSD), which had dipped below $101,500 over the weekend, caught a strong bid. The leading cryptocurrency climbed throughout the day, trading as high as $107,244.69, as optimism from the shutdown deal and fresh speculation from President Trump’s “tariff dividend” announcement flooded the market.

Also Read: Trump’s ‘Tariff Dividend’ Announcement Ignites Crypto Market

All Eyes on Earnings

While the political news dominated the session, the earnings season presses on. The market’s reaction to reports this week will provide a clearer health check on corporations.

CoreWeave (NASDAQ: CRWV), another top AI name and key Nvidia partner, provided a perfect example of the market’s nervous undertones. After closing up slightly during today’s trading session, the company reported quarterly results after the bell. Despite beating revenue estimates amid surging AI compute demand, the stock tumbled nearly 7% in extended trading, as investors apparently wanted an even larger beat.

Investors will now turn their attention to a handful of other key reports. The entertainment sector is in focus, with results due from Disney (NYSE: DIS) and Paramount Skydance (NASDAQ: PSKY). The market will also parse data from high-growth tech and space companies, including the nuclear innovator Oklo (NYSE: OKLO) and the launch provider Rocket Lab (NASDAQ: RKLB). Their performance will help determine if Monday’s rally has the legs to become a sustainable year-end trend.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.