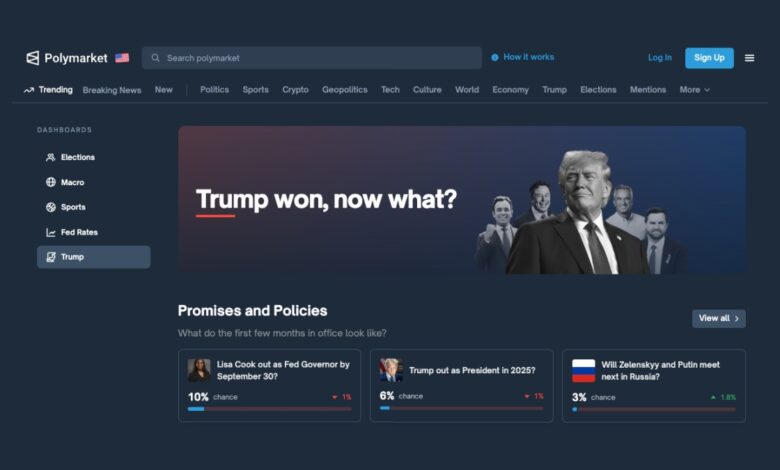

Trump Jr.-Backed Polymarket Set for U.S. Market Return

Prediction platform clears regulatory hurdles, eyes growth alongside Wall Street giants DraftKings and Flutter Entertainment’s FanDuel.

Polymarket, the blockchain-based prediction platform once forced to block American users, has secured the long-awaited green light to reenter the U.S. market. The move follows a no-action letter from the Commodity Futures Trading Commission (CFTC), which effectively clears the regulatory roadblocks that had kept the company sidelined for years.

Also Read: Why This Tiny Wearable Tech Stock Looks Poised for a Massive Breakout

CEO Shayne Coplan celebrated the breakthrough in a post on X, writing, “Polymarket has been given the green light to go live in the USA by the @CFTC. Credit to the Commission and Staff for their impressive work. This process has been accomplished in record timing.”

Polymarket has been given the green light to go live in the USA by the @CFTC.

Credit to the Commission and Staff for their impressive work. This process has been accomplished in record timing.

Stay tuned https://t.co/NVziTixpqO

— Shayne Coplan 🦅 (@shayne_coplan) September 3, 2025

The announcement caps off a whirlwind summer for the company, which included a $112 million acquisition of derivatives exchange QCEX, a fully licensed CFTC clearinghouse. That deal, combined with the regulator’s relief on event contract reporting requirements, provides Polymarket with a compliant pathway back into the world’s largest financial market.

Regulatory Winds Shift in Trump Era

The timing of Polymarket’s return is notable. Under the Trump administration, federal agencies have softened their stance toward crypto-related platforms, dropping several investigations that began under former SEC chair Gary Gensler. The CFTC and Justice Department closed probes into Polymarket earlier this year without issuing charges, clearing the final legal hurdles to its relaunch.

Donald Trump Jr.’s involvement adds another layer of political and financial firepower. Through his venture capital firm 1789 Capital, Trump Jr. has invested tens of millions into the platform and joined its advisory board. The firm, co-founded by Omeed Malik, a former Bank of America (NYSE: BAC) executive and major Trump donor, brands itself as an “anti-ESG” investor funding ventures aligned with “American exceptionalism.”

In a statement, Trump Jr. said, “Polymarket cuts through media spin and so-called ‘expert’ opinion by letting people bet on what they actually believe will happen in the world.”

Read Now: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

Betting Meets Wall Street

Polymarket’s return coincides with surging interest in prediction markets as alternatives to traditional polling and financial speculation tools. From Federal Reserve decisions to presidential elections, event contracts have exploded in popularity, with trading volumes topping billions of dollars.

The platform already boasts over $8 billion in wagers processed, putting it in the same conversation as established gambling leaders like DraftKings (NASDAQ: DKNG) and Flutter Entertainment (NYSE: FLUT), which owns FanDuel and Betfair. While DraftKings and Flutter dominate the sports betting arena, Polymarket aims to capture a broader market where outcomes of politics, economics, and global events become tradable assets.

Some on Wall Street see prediction markets as more than a novelty. Analysts argue they harness collective intelligence in ways that could eventually rival traditional equities or derivatives trading. Bank of America, which has been expanding its research on alternative data and unconventional asset classes, may see platforms like Polymarket as part of the evolving landscape in event-driven speculation.

Challenges Ahead

Despite the momentum, risks remain. Critics argue that prediction markets amount to little more than digital casinos, encouraging gambling on sensitive topics like elections and court rulings. Even within the CFTC, dissenting voices have called for clearer guardrails before widespread adoption.

Outgoing Democratic commissioner Kristin Johnson warned:

As of today, we have too few guardrails and too little visibility into the prediction market landscape. Because the target audience for these contracts is retail customers and some market participants seem to be marching down a path to offer leveraged, margined prediction market contacts to retail investors, there is an urgent need for the Commission to express in a clear voice our expectations related to these contracts.

Still, the opportunity is undeniable. With regulatory clearance, new funding, and Trump-era allies in its corner, Polymarket enters the U.S. market with a blend of political backing, venture capital muscle, and timing that could reshape both finance and betting.

For DraftKings and Flutter, the competition now extends beyond touchdowns and point spreads to the outcome of Fed policy meetings and presidential races. For Wall Street institutions like Bank of America, the rise of platforms such as Polymarket signals a new frontier in trading, where probability, politics, and profit intersect.

As the platform prepares to flip the switch for U.S. users, one question remains: Will prediction markets become the next multi-billion-dollar asset class, or will regulators and critics succeed in boxing them back in?

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: This Small Wearable Tech Stock Just Joined Wall Street’s Crypto Treasury Movement

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.