5-Minute Deep Dive: Why This Medical Company’s Disruptive Technology Combined With Its Equity Line and Bitcoin Treasury Could Be a Game Changer

Profusa’s disruptive Lumee oxygen sensor technology, combined with a bold $100 million equity line and Bitcoin treasury move, is capturing investor attention in both biotech and crypto-themed capital markets.

Why Profusa Stands Out in Small-Cap Investing

Profusa (NASDAQ: PFSA) is a biotech company that is developing tissue‑integrating biosensors for continuous monitoring of body chemistry. The company’s core technology, the Lumee™ Oxygen Platform, addresses high-need medical conditions, including peripheral artery disease, chronic wounds, and surgical recovery. Profusa also researches and develops the Lumee Glucose Platform to monitor glucose levels in interstitial fluid.

Profusa is carving out a rare and distinctive niche. This 14-year-old company is backed by over $100 million from top-tier venture investors, which includes ~$30 million from the Defense Advanced Research Projects Agency (DARPA), and armed with 85 worldwide patents, yet it operates with just 14 employees, keeping the cash burn in check.

Furthermore, Profusa is building a hybrid growth story that merges its breakthrough health monitoring technology with strategic exposure to Bitcoin (BTCUSD) and other digital assets. This unusual mix offers investors two distinct upside drivers: biotech-driven valuation growth and potential gains from crypto markets.

From Biotech to Bitcoin: Why PFSA’s Hybrid Strategy Could Redefine Growth

A key catalyst is the regulatory gap; for instance, in countries like the UK and Japan, crypto ETFs are either banned or heavily taxed, and many institutional investors globally are also barred from holding crypto or ETFs directly. In Japan, crypto gains can be taxed up to 55% versus 20% for stocks; in Brazil, 17.5% versus 15% — making listed treasury companies more tax-efficient than holding crypto outright. As of August 5, 2025, 154 public companies have raised or committed $98.4 billion to buy crypto, compared to just $33.6 billion by 10 companies before this year.

Profusa’s move taps into the same broader market trend, where companies fill this gap by providing a regulated, exchange-traded exposure to Bitcoin. Globally, crypto ETFs, including the BlackRock (NYSE: BLK) owned iShares Bitcoin Trust ETF (NASDAQ: IBIT), along with the Fidelity Wise Origin Bitcoin Fund (CBOE: FBTC), and Invesco Galaxy Bitcoin ETF (CBOE: BTCO), have already attracted over $100 billion, but these structural restrictions leave billions in capital searching for indirect vehicles.

Investors are paying hefty premiums for crypto-focused companies and often value them well above the market value of the Bitcoin they hold. With this combination of biotech innovation and Bitcoin exposure, Profusa positions itself to capture both sector-specific growth and global demand for indirect digital asset access.

With a $145 million post-money valuation (now trading around $25 million) and a dual-pronged strategy rarely seen in small-cap biotech, Profusa represents a unique bet on both the future of real-time health monitoring and the broader digital asset economy.

Also Read: Why This Tiny Wearable Tech Stock Looks Poised for a Massive Breakout

1. Winning Team & Sector

The Lumee™ Oxygen Platform: A First-of-Its-Kind Technology

Profusa’s core technology, the Lumee™ Oxygen Platform, addresses high-need medical conditions like peripheral artery disease, chronic wounds, and surgical recovery. This biotech strategy is a first-of-its-kind, continuous body chemistry monitoring device—smaller, less expensive, less intrusive, more accurate, and more functional than anything currently available.

The technology has already received EU approval. Distributors are in place, and the first manufacturing run is set for delivery in just 6–9 months. The U.S. and other global markets are also expected to follow by leveraging data from the European rollout.

This technology aims to upend the $7.5 billion continuous glucose monitoring (CGM) market, which is currently dominated by three major pharma players—making Profusa both a potential disruptor and an acquisition target. But the opportunity doesn’t stop there. By enabling post-surgical and continuous monitoring for peripheral artery disease and critical limb ischemia, Profusa is positioned to create an entirely new segment—one that could reach $20 billion and impact over 20 million people worldwide.

Why Profusa’s World-Class Talent Can Punch Above Its Weight

Profusa is led by a management team with deep biotech expertise, including multiple PhDs, with deep biotech, medical device, and government expertise.

- Ben Hwang, Ph.D. (Johns Hopkins; ex-McKinsey; former President, Asia Pacific at Life Technologies/Thermo Fisher) brings decades of global life sciences leadership.

- Fred Knechtel (B.Eng., Stony Brook; MBA, Hofstra) has over 20 years of experience as CFO in the life sciences sector, including DiamiR Biosciences, Interpace, and GENEWIZ.

- Peter O’Rourke, former Acting Secretary of Veterans Affairs under President Trump, has experience overseeing one of the largest hospital networks in the world. This adds high-level government, healthcare, and defense experience.

Together, they combine scientific credibility, commercialization expertise, and strategic access to major healthcare networks.

Grade: B

2. Competitive Advantage & Sector Position

Against competitors such as Know Labs (NYSE American: KNW), Nektar Therapeutics (NASDAQ: NKTR), Lantern Pharma (NASDAQ: LTRN), Tempest Therapeutics (NASDAQ: TPST), Vuzix (NASDAQ: VUZI), and Ekso Bionics (NASDAQ: EKSO), Profusa’s combination of product innovation, diversified market catalysts, and investor sentiment momentum stands out.

Know Labs (KNW): Innovative non-invasive glucose monitoring tech, but early in commercialization and regulatory approval processes. PFSA’s biosensor platform covers a broader health monitoring spectrum and has potential for faster adoption across multiple use cases.

Nektar Therapeutics (NKTR): Large molecule drug development with a history of high-profile trial failures. PFSA avoids the binary risks of single-drug pipelines by focusing on a platform technology adaptable across health monitoring markets.

Lantern Pharma (LTRN): AI-driven oncology drug development is promising but highly niche. PFSA’s tech addresses both chronic condition management and preventative health, vastly expanding the potential total addressable market.

Tempest Therapeutics (TEM): Oncology-focused with near-term catalysts tied solely to trial data. PFSA, by contrast, has biotech milestones plus external macro drivers via Bitcoin.

Vuzix (VUZI): AR hardware company with potential in enterprise and healthcare settings, but facing intense tech competition. PFSA doesn’t compete with big tech directly, allowing for clearer market positioning.

Ekso Bionics (EKSO): Strong in assistive robotics, but the commercialization pace is slow and dependent on institutional purchasing. PFSA targets both consumer and institutional markets simultaneously.

What emerges from this head-to-head is that PFSA’s competitive moat isn’t just technological, it’s strategic. Its dual-sector exposure means it can attract capital from biotech-focused funds, tech/innovation investors, and crypto-market speculators. In small-cap land, where liquidity and investor mindshare drive valuation spikes, this breadth of appeal is a serious advantage.

Grade: A

3. Technical & Fundamental Strength

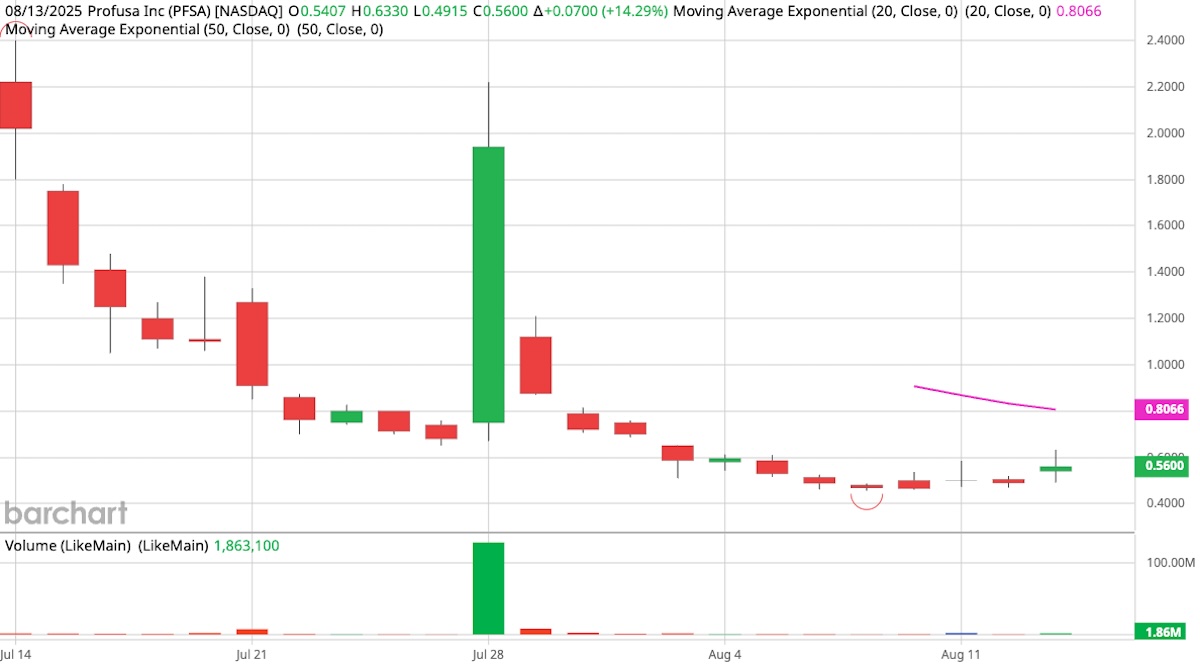

The daily chart for Profusa (NASDAQ: PFSA) is beginning to show early signs of recovery following a sharp decline from its July highs. The stock has now entered a consolidation phase, building a base in the $0.48–$0.60 range. Furthermore, the 14.29% gain in the latest session, closing at $0.56, is a constructive sign that buyers are stepping in, and if it breaks resistance at $0.60, it could run back to $2.00

Volume patterns also add a positive element to the outlook; recent sessions have shown an uptick and suggest growing interest from market participants. Importantly, the stock has held above its recent lows, showing resilience despite broader market volatility. With sellers appearing to lose control and buyers slowly regaining confidence, PFSA’s technical setup now leans toward a constructive scenario.

Fundamentals

Profusa’s technology has applications ranging from chronic disease management to advanced wellness tracking, putting it in the sweet spot of both regulated medical device markets and consumer health ecosystems.

Profusa maintains a lean operating model, with a focus on leveraging strategic partnerships rather than overextending on costly, fully in-house R&D pipelines, avoiding costly in-house R&D seen in NKTR (trial failures, cash burn), KNW (slow commercialization, heavy capital raises), LTRN/TEM/EKSO (narrow revenue, low reinvestment), and VUZI (hardware margin pressures).

Moreover, PFSA’s financial positioning is further differentiated by its crypto strategy, which functions as both a hedge against inflationary pressures and a potential asymmetric upside driver. In a high-liquidity event, such as a major crypto bull run, PFSA can unlock capital without diluting shareholders, a strategic advantage none of its peers share.

Grade: A

4. Clean Capital Structure

With approximately 30 million shares outstanding on a pro forma basis for the combined company, PFSA maintains a relatively low float compared to many small-cap biotech peers. This type of share structure can often amplify price movements when buying interest increases, creating favorable conditions for rapid upside.

In the case of PFSA, upcoming product rollouts, regulatory milestones, and strategic partnerships could serve as those triggers. Similar dynamics have propelled gains in other innovation-driven names, such as Ekso Bionics, and PFSA appears well-positioned to replicate that kind of performance if market sentiment aligns with its growth trajectory.

While the full post-merger financials have not yet been released, management has indicated that the combined balance sheet will reflect a significantly improved capital position, with much of the current debt load expected to be reduced or eliminated. This cleaner structure could further enhance investor confidence and attract institutional interest.

Grade: A

AI-Powered Investment Report Card

| Element | Grade |

| Winning Team & Sector | B |

| Competitive Advantage & Sector Position | A |

| Technical and Fundamental Strength | A |

| Clean Capital Structure | A |

| Overall Grade | A |

Final Verdict

Profusa’s biosensor platform taps into one of the fastest-growing segments of healthcare, whereas its Bitcoin and digital asset holdings offer an entirely separate macro-driven upside trigger. This two-pronged positioning gives PFSA flexibility and resilience. If biotech sentiment cools, crypto can heat up. If crypto stalls, regulatory and commercialization milestones in its biosensor technology can sustain momentum. Its peers, from KNW to EKSO, simply do not have this diversification. In the small-cap space, where asymmetric returns often hinge on timing and narrative, PFSA’s story offers compelling reasons for investors to win.

Read Now: Here’s Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Wealthy VC and its employees are not Registered Investment Advisors, Broker-Dealers or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Wealthy VC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled through their website, news releases, and corporate filings, or is available from public sources and Wealthy VC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Our website and newsletter are for entertainment purposes only. This website is NOT a source of unbiased information. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment.

Release of Liability: Through the use of this email and/or website advertisement, by viewing or using it, you agree to hold Wealthy VC, its operators, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Wealthy VC-sponsored advertisements do not purport to provide an analysis of any company’s financial position, operations or prospects and this is not to be construed as a recommendation by Wealthy VC or an offer or solicitation to buy or sell any security.

None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Wealthy VC strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below. Profusa, Inc. (NASDAQ: PFSA) has compensated wealthyvc.com’s parent company, 1000358139 Ontario Limited, USD $568,000 by wire transfer. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D and all reports published on SEDAR if the company featured is Canadian. Wealthy VC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors with a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results. Past Performance is based on the security’s previous day’s closing price and the high of-day price during our promotional coverage.

In preparing this publication, Wealthy VC has relied upon information supplied by various public sources and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this email and website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this email and website are believed to be reliable, however, Wealthy VC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Wealthy VC is not responsible for any claims made by the companies advertised herein, nor is Wealthy VC responsible for any other promotional firm, its program or its structure.