Here’s What to Expect From Wednesday’s Fed Rate Decision

Investors price in a quarter-point drop, but all eyes are on the tone of Jerome Powell’s messaging, which could make or break the year-end party.

Wall Street finds itself in a precarious position this Wednesday. The Federal Reserve has entered the final hours of its two-day policy meeting, and the tension is palpable across every asset class, from blue-chip stocks to digital currencies. While the consensus overwhelmingly points to a rate reduction, traders are looking past the headline number and focusing intently on the nuance of the delivery. The central bank faces a complex economic backdrop involving stubborn inflation, political pressure, and a labor market that sends conflicting signals by the day.

Tuesday’s trading session offered a preview of this anxiety. The benchmark S&P 500 (SPX) drifted just below the flatline, losing 0.09%, while the tech-heavy Nasdaq Composite (IXIC) managed a slight gain of 0.1%. The Dow Jones Industrial Average (DJI) suffered the most significant blow, shedding 0.4%, but this decline stemmed largely from specific corporate headwinds rather than macro fears. Beneath the surface of these major indices, the Russell 2000 Index (RUT) surged to an intraday all-time high of 2,541.77, signaling that small-cap investors are betting the house on lower borrowing costs.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

The Logic of a Hawkish Cut

Market participants currently assign roughly 90% odds to a quarter-point rate cut. This move would lower the federal funds rate to a range of 3.5% to 3.75%. However, Wall Street analysts have coined a specific term for this potential maneuver: the “hawkish cut.” This scenario involves the Fed lowering rates to support the labor market while simultaneously signaling that the easing cycle might pause in January to ensure inflation does not reignite.

Recent data complicates the Fed’s path. Inflation remains sticky at 2.8%, well above the central bank’s 2% target. Meanwhile, the Bureau of Labor Statistics released a JOLTS report on Tuesday that confused expectations; job openings unexpectedly ticked higher, yet layoffs also jumped. This mixed bag forces Chair Jerome Powell to walk a tightrope. He must offer relief to borrowers without spooking inflation hawks.

Bill English, a former Fed director and current Yale professor, accurately summarized the prevailing sentiment regarding the committee’s strategy.

Regarding the probable tone of Wednesday’s announcement, English noted:

“The likeliest outcome is a kind of hawkish cut where they cut, but the statement and the press conference suggesting that they may be done cutting for now.”

Investors will scrutinize the updated “dot plot,” which reveals individual officials’ rate expectations for the coming years. With political winds shifting and economic adviser Kevin Hassett emerging as a favorite for the next Fed chair, the long-term trajectory of monetary policy remains shrouded in uncertainty.

Precious Metals and Commodities Surge

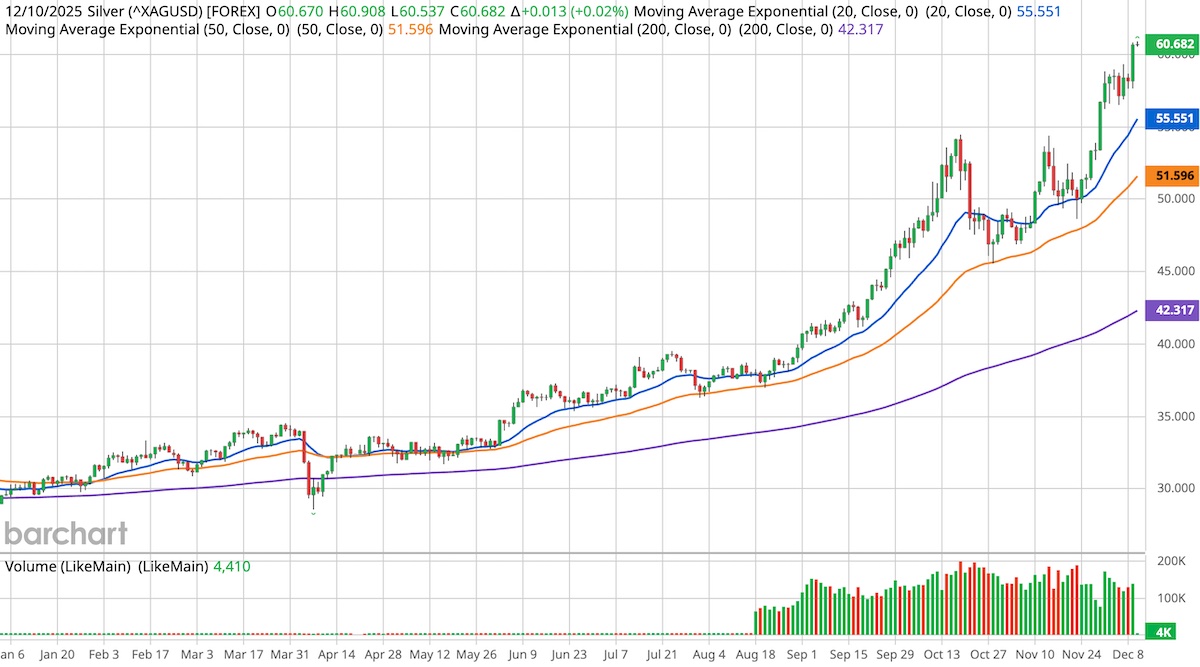

While equities tread water, the commodities market is screaming with optimism. Gold (XAUUSD) climbed on Tuesday, continuing its march toward elevated valuations, but Silver (XAGUSD) stole the show. The grey metal continued breaking records, surging past the $60 per ounce milestone to hit an all-time high of $61.29.

This rally stems from a perfect storm of catalysts. Supply constraints, robust industrial demand from the solar and AI sectors, and the anticipation of cheaper money have all fueled the buying spree. Unlike stocks, which rely on corporate earnings, precious metals respond solely to currency debasement and supply deficits.

Maria Smirnova, senior portfolio manager at Sprott Asset Management, highlighted the fundamental drivers pushing prices higher.

“Metals are volatile by nature, but unless we fix the deficit, silver only has one way to go, and that is up,” Smirnova stated, emphasizing the structural supply issues supporting the rally.

The divergence between the metals market and the broader economy is stark. While traditional investors worry about a “wait-and-see” Fed, commodity traders are aggressively positioning for a future defined by resource scarcity and persistent industrial need.

Also Read: Small Digital Health Stock Charts Bold Path to $250 Million Revenue by 2030

Corporate Earnings and Market Movers

Tuesday proved that even with the Fed looming, corporate fundamentals still dictate daily price action. CVS (NYSE: CVS) emerged as a standout winner, jumping as much as 5% after issuing a profit outlook that exceeded analyst estimates. Conversely, the banking sector faced headwinds. JPMorgan Chase (NYSE: JPM) shares tumbled over 4%, dragging the Dow lower, after an executive warned that expenses would climb significantly in 2026 due to credit card competition and AI spending.

The technology sector also saw renewed friction regarding international trade. Nvidia (NASDAQ: NVDA) shares dipped slightly following news that the U.S. government would allow shipments of H200 AI chips to China, albeit with heavy tariffs and restrictions. This geopolitical tug-of-war continues to create volatility for semiconductor stocks. Investors are now turning their attention to upcoming earnings reports from Oracle (NYSE: ORCL) and Broadcom (NASDAQ: AVGO) to gauge whether infrastructure spending on artificial intelligence remains robust.

In the retail space, volatility reigned. AutoZone (NYSE: AZO) plunged over 7% after missing quarterly estimates, while Campbell’s (NASDAQ: CPB) fell more than 5% as it struggles to balance price hikes with consumer demand. Wall Street awaits further data from Costco (NASDAQ: COST) and Lululemon (NASDAQ: LULU) later this week to better understand the health of the American consumer.

Meanwhile, the media landscape witnessed intensified drama. Netflix (NASDAQ: NFLX) and Warner Bros. Discovery (NASDAQ: WBD) remain locked in a competitive battle for dominance, with Warner shares rising on M&A speculation involving other industry players.

The Crypto Disconnect

Perhaps the most puzzling trend leading up to the Fed decision is the behavior of the cryptocurrency market. Bitcoin (BTCUSD) hovered near $94,000 on Tuesday, struggling to reclaim the psychological $100,000 level. Despite Strategy (NASDAQ: MSTR) continuing its aggressive acquisition of Bitcoin, the token has decoupled from the equity market’s recent success.

Usually, risk assets like crypto rally in tandem with the Nasdaq when rates fall. However, the fear of a “hawkish” message from Powell has dampened speculative fervor. Traders worry that if the Fed signals a pause in rate cuts for 2026, liquidity could dry up, leaving digital assets vulnerable.

Nic Puckrin, a Coin Bureau investment analyst, expressed caution regarding the immediate future of the crypto rally.

Puckrin warned:

“If Powell does indeed deliver a hawkish speech, the likelihood of a Santa rally for Bitcoin diminishes.”

As Wednesday afternoon approaches, the financial world stands at a crossroads. A rate cut appears certain, but the accompanying narrative will determine the market’s direction through the end of the year. Whether Powell chooses to soothe concerns or assert dominance over inflation will decide if the Santa Claus rally comes to town or if investors face a cold winter.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.