Fed’s Top Inflation Gauge Continued Cooling in October, Signalling Interest Rate Cuts Could Be Near (VIDEO)

Last Updated: 20.3.2024 21:09

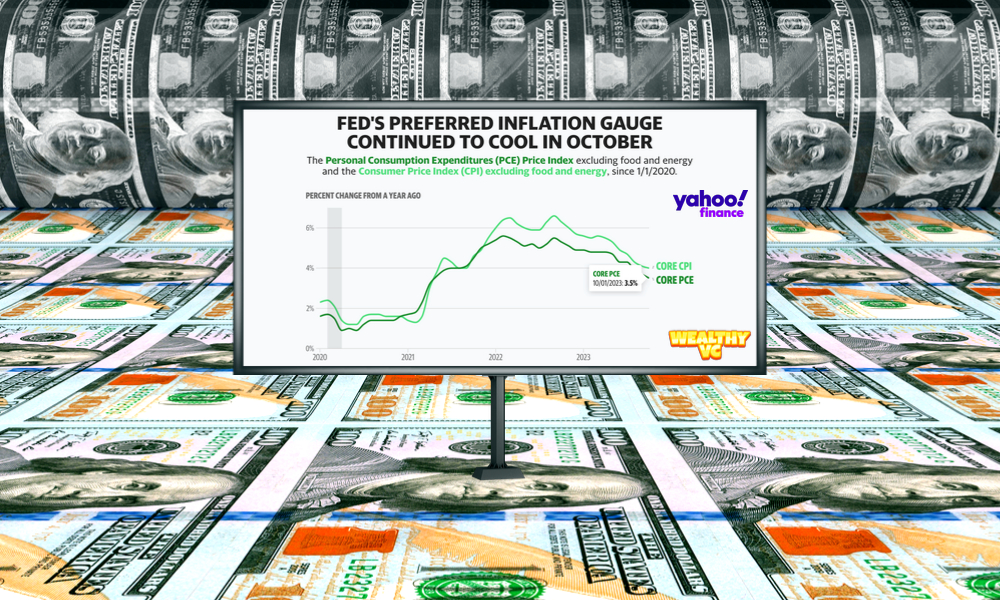

The Core Personal Consumption Expenditures (PCE) Index, the Federal Reserve’s Favourite Inflation Guage Continued its Cooling Trend in October, With Core PCE Reaching its Lowest Level Since May 2021

The end of interest rate hikes and the beginning of rate cuts could be closer than ever following the release of the latest inflation data today.

The Personal Consumption Expenditures (PCE) Index, the U.S. Federal Reserve’s top inflation gauge, increased by less than 0.1% in October and 3% year-over-year, down from 3.4% in September.

Core PCE, which excludes volatile food and energy prices, rose 0.2% month-over-month in October, down from 0.3% in September. Year-over-year, Core PCE increased 3.5%, down from 3.7% in the previous month.

The October PCE figures aligned with analyst expectations, with the reading on Core PCE reaching its lowest level since May 2021.

Source: CNBC Television

Also Read: October Inflation Report Sparks Market Rally on Hopes of Brighter Days to Come (VIDEO)

In a research note today, EY senior economist Lydia Boussour commented on the latest inflation data and the likely direction of the Fed, writing:

With the latest inflation data signalling that the Fed’s rate hike campaign is almost certainly over and that rate cuts could begin as soon as the end of Q2 2024, markets reacted positively with the Dow Jones Industrial Average (DJI) and S&P 500 (SPX) rising +1.47% and +0.38%, respectively. The NASDAQ Composite (IXIC) failed to close the day in the green slipping -0.23%.

Read More:

3 AI ETFs to Beat the Market in 2023 (VIDEO)

ELEVAI Labs Closes $6 Million NASDAQ IPO

5 Ultra High-Yield ETFs You’ve Probably Never Heard Of, With Yields as High as 32.35%

Follow Wealthy VC on Socials: Threads | Facebook | Instagram | Twitter | LinkedIn | GETTR | Tumblr

Join the Discussion in the Wealthy VC Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

Disclaimer: Wealthy VC does not hold a long or short position in any of the stocks or ETFs mentioned in this article.