VIDEO: Here’s Why the Yield Curve is Predicting That Interest Rates Have Already Peaked and the Stock Market Has Bottomed

According to Yardeni Research’s president and founder, Ed Yardeni, the yield curve’s inversion is indicating that long-term interest rates have peaked and the Federal Reserve’s tightening policy is likely approaching its limit. Yardeni also predicts that the inversion of the yield curve could signal that the stock market has bottomed.

In a note published Sunday, Yardeni wrote:

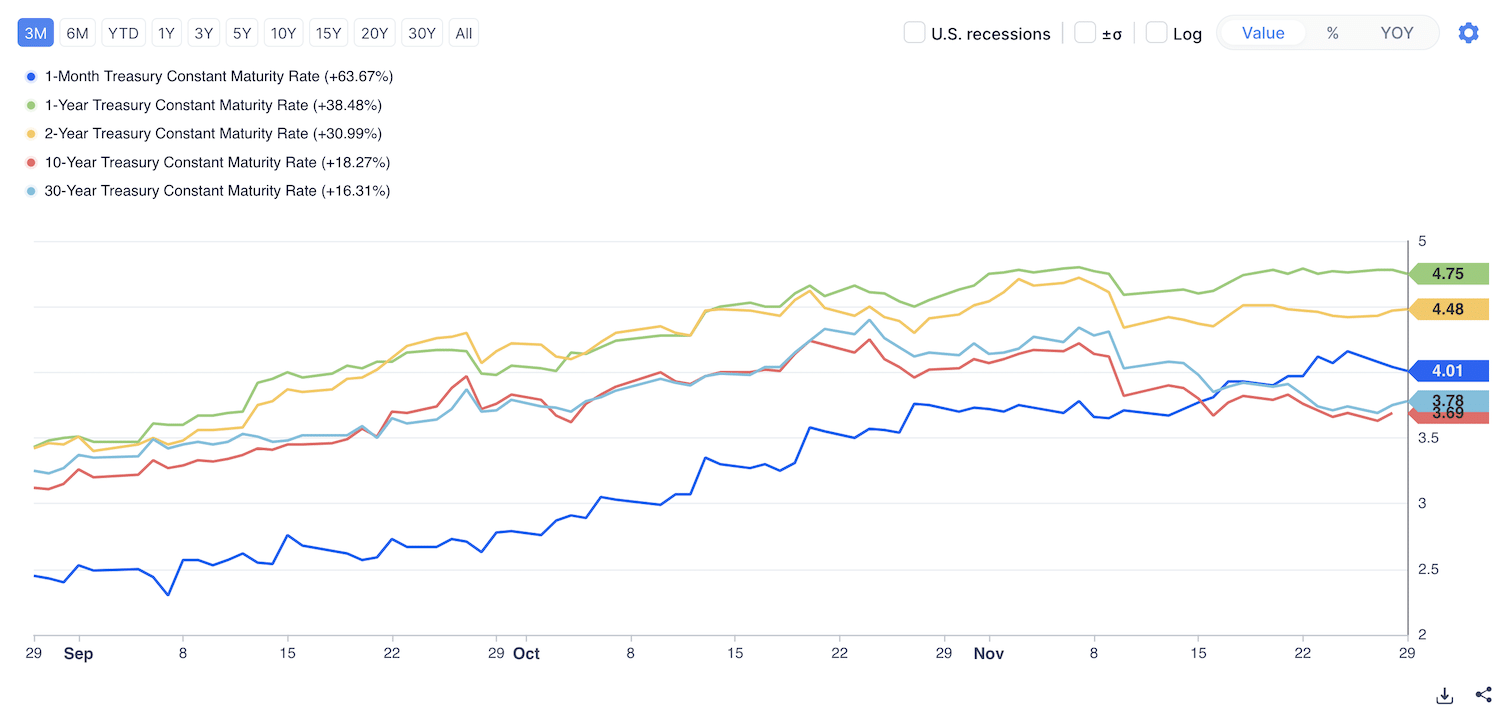

Current U.S. Treasury Yield Curve

* Data as of November 29, 2022

- 1-Month Yield: 4.001%

- 1-Year Yield: 4.745%

- 2-Year Yield: 4.477%

- 10-Year Yield: 3.752%

- 30-Year Yield: 3.796%

Chart Source: GuruFocus.com

Chart Source: GuruFocus.com

Read More:

Follow Wealthy VC on Social Media: Facebook | Instagram | Twitter | LinkedIn | GETTR | Tumblr

????Join the Discussion in the Wealthy VC Investor Group

????Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

Disclaimer: Wealthy VC does not hold a long or short position in any of the stocks mentioned in this article.