VIDEO: Here’s Why the Yield Curve is Predicting That Interest Rates Have Already Peaked and the Stock Market Has Bottomed

Ed Yardeni, President of Yardeni Research and Brian Levitt, Invesco’s Global Market Strategist, Joined CNBC’s ‘Squawk on the Street’ This Morning to Talk About the Recent Inversion of the Yield Curve and What it Means for Interest Rates, Inflation and the Stock Market

According to Yardeni Research’s president and founder, Ed Yardeni, the yield curve’s inversion is indicating that long-term interest rates have peaked and the Federal Reserve’s tightening policy is likely approaching its limit. Yardeni also predicts that the inversion of the yield curve could signal that the stock market has bottomed.

In a note published Sunday, Yardeni wrote:

“Yield-curve inversions actually predict that the Fed’s monetary policy is getting too tight, which could trigger a financial crisis that could quickly morph into a credit crunch, causing a recession. The Fed should be done tightening early next year, as anticipated by the inversion of the yield curve since this past summer.”

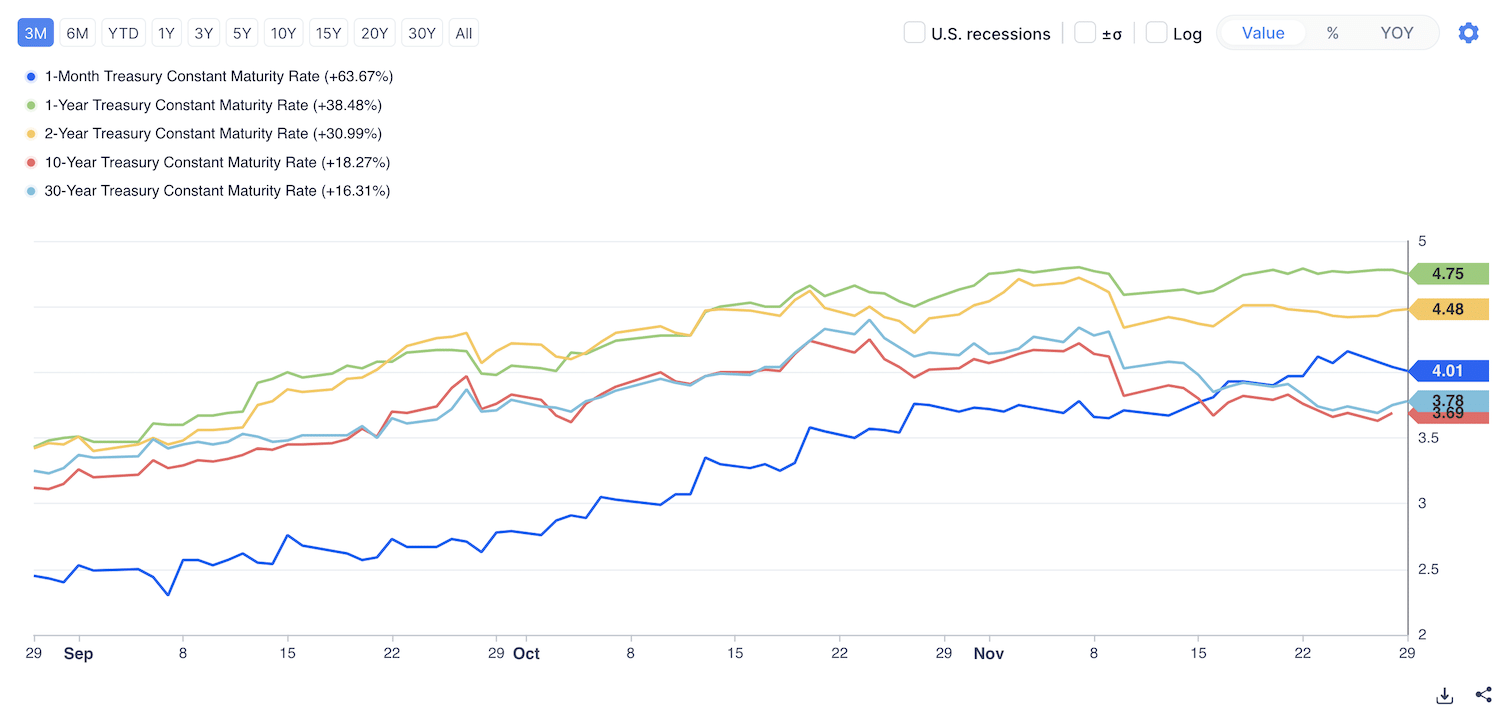

Current U.S. Treasury Yield Curve

* Data as of November 29, 2022

- 1-Month Yield: 4.001%

- 1-Year Yield: 4.745%

- 2-Year Yield: 4.477%

- 10-Year Yield: 3.752%

- 30-Year Yield: 3.796%

Chart Source: GuruFocus.com

Chart Source: GuruFocus.com