The Winners and Losers of Big Tech’s Earnings Season (VIDEO)

Big Tech Officially Kicked Off Earnings Season Last Week, With Alphabet, Apple, Amazon, Meta and Microsoft Reporting Their Financial Results

Last Updated: [wpdts-custom start=”post-modified” format=”j.n.Y G:i”]

Who were the winners and losers of last week’s big tech earnings season? Let’s take a look at the summary of each company’s results to find out.

Well, folks, another big tech earnings season is in the books.

With Alphabet (NASDAQ: GOOGL), Apple (NASDAQ: AAPL), Amazon (NASDAQ; AMZN), Meta Platforms (NASDAQ: META) and Microsoft (NASDAQ: MSFT) all reporting their quarterly financial results last week, let’s dig into the numbers and find out the winners and losers of the latest big tech earnings season.

Fiscal Year 2023 Fourth Quarter Financial Results

Q4 Key Numbers:

- Revenue: $40.1 billion, up 24.7%

- Beat the street’s expectation of $38.9 billion

- Net Income: $14 billion, up 201% year-over-year

- Beat the street’s expectation of $12.89 billion

- Earnings Per Share (EPS): $5.33, up 203% year-over-year.

- Beat the street’s expectation of $4.90.

- Announced first-ever quarterly dividend, of $0.50 per share.

Comments from Meta founder and CEO Mark Zuckerberg:

- Earnings Conference Call: Webcast | PowerPoint | Transcript

- META Official Earnings Press Release

Shares of Meta Platforms last traded at $459.41, down -3.28% on the day. YTD, META stock is up +32.67%. All-time, META is up +1,101.70%.

Learn more about Meta: Website | Investor Deck | META Chart

Fiscal Year 2023 Fourth Quarter Financial Results

Q4 Key Numbers:

- Revenue: $170 billion, up 14% year-over-year

- Beat the street’s expectation of $166.2 billion

- Net Income: $10.6 billion

- Beat the street’s expectation of $8.59 billion

- Earnings Per Share (EPS): $1, up 3,233% year-over-year

- Beat the street’s expectation of $0.80

Comments from Amazon CEO Andy Jassy:

- Earnings Conference Call: Webcast | PowerPoint

- AMZN Official Press Release

Shares of Amazon last traded at $170.31, down -0.87% on the day. YTD, AMZN stock is up +13.59%. All-time, AMZN is up +189,133.33%.

Learn more about Amazon: Website | Investor Deck | AMZN Chart

Source: CNBC Television YouTube

Fiscal Year 2023 Fourth Quarter Financial Results

Q4 Key Numbers:

- Revenue: $86.3 billion, up 13% year-over-year

- Beat the street’s expectation of $85.24 billion

- Net Income: $20.69 billion, up 52% year-over-year

- Beat the street’s expectation of $20.28 billion

- Earnings Per Share (EPS): $1.64, up 56% year-over-year

- Beat the street’s expectation of $1.61

- Ad Revenue: $65.52 billion

- Missed the street’s expectation of $65.94 billion

Comments from Alphabet CEO Sundar Pichai:

- Earnings Conference Call: Webcast | Transcript

- GOOG Official Press Release

Shares of Alphabet last traded at $143.68, up +0.91% on the day. YTD, GOOGL stock is up +3.99%. All-time, GOOGL is up +5,201.85%.

Learn more about Alphabet: Website | Investor Deck | GOOGL Chart

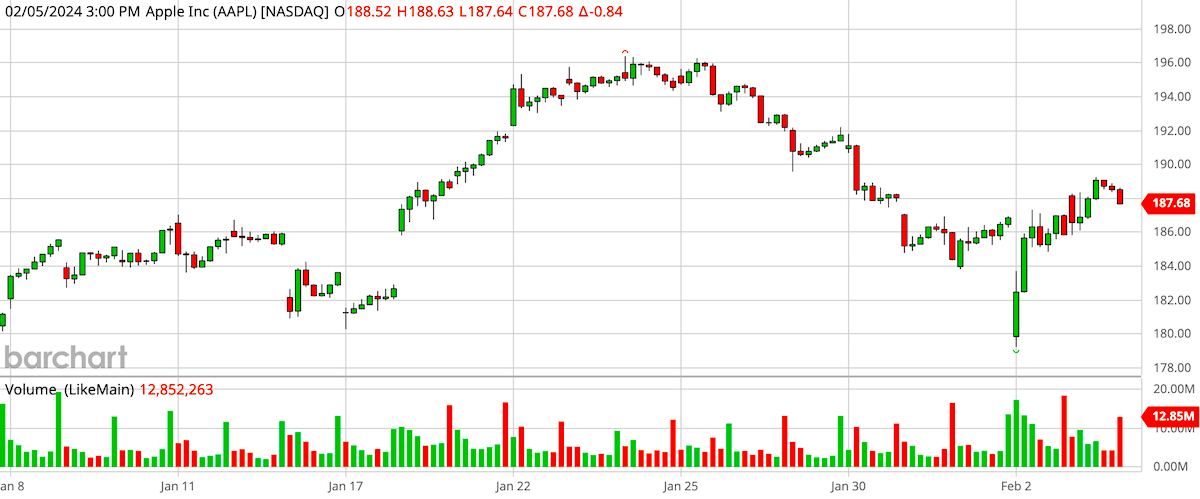

Fiscal Year 2024 First Quarter Financial Results

Q1 Key Numbers:

- Revenue: $119.6 billion, up 2% year-over-year

- Beat the street’s expectation of $117.97 billion

- Net Income: $33.92 billion, up 13% year-over-year

- Beat the street’s expectation of $32.56 billion

- Earnings Per Share (EPS): $2.18, up 16% year-over-year

- Beat the street’s expectation of $2.09

- China Revenue: $20.82 billion, down 13% year-over-year

Comments from Apple CEO Tim Cook:

- Earnings Conference Call: Webcast | PowerPoint

- AAPL Official Press Release

Shares of Apple last traded at $187.68, up +0.98% on the day. YTD, AAPL stock is up +1.1%. All-time, AAPL is up +170,518.18%.

Learn more about Apple: Website | Investor Deck | AAPL Chart

Fiscal Year 2024 Second Quarter Financial Results

Q2 Key Numbers:

- Revenue: $62.02 billion, 18% year-over-year

- Beat the street’s expectation of $61.12 billion

- Net Income: $21.87 billion, 33% year-over-year

- Beat the street’s expectation of $20.6 billion

- Earnings Per Share (EPS): $2.93, 33% year-over-year

- Beat the street’s expectation of $2.78

- Intelligent Cloud Revenue: $25.88 billion, up 20% year-over-year

- Beat the street’s expectation of $25.29 billion

Comments from Microsoft Chairman & CEO Satya Nadella:

- Earnings Conference Call: Webcast | PowerPoint

- MSFT Official Press Release

Shares of Microsoft last traded at $405.65, down -1.35% on the day. YTD, MSFT stock is up +9.38%. All-time, MSFT is up +405,550%.

Learn more about Microsoft: Website | Investor Deck | MSFT Chart

Read More:

Fed Leaves Interest Rates Unchanged, Signals When Rate Cuts Could Begin (VIDEO)

Follow Wealthy VC on Socials: Threads | Facebook | Instagram | Twitter | LinkedIn | GETTR | Tumblr

Join the Discussion in the Wealthy VC Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

Disclaimer: Wealthy VC does not hold a long or short position in any of the stocks mentioned in this article.