Top 5 Most Searched Stocks This Week According to Google Trends

From meme stocks to AI and e-commerce giants, here are the stock tickers that captured investor attention online this week.

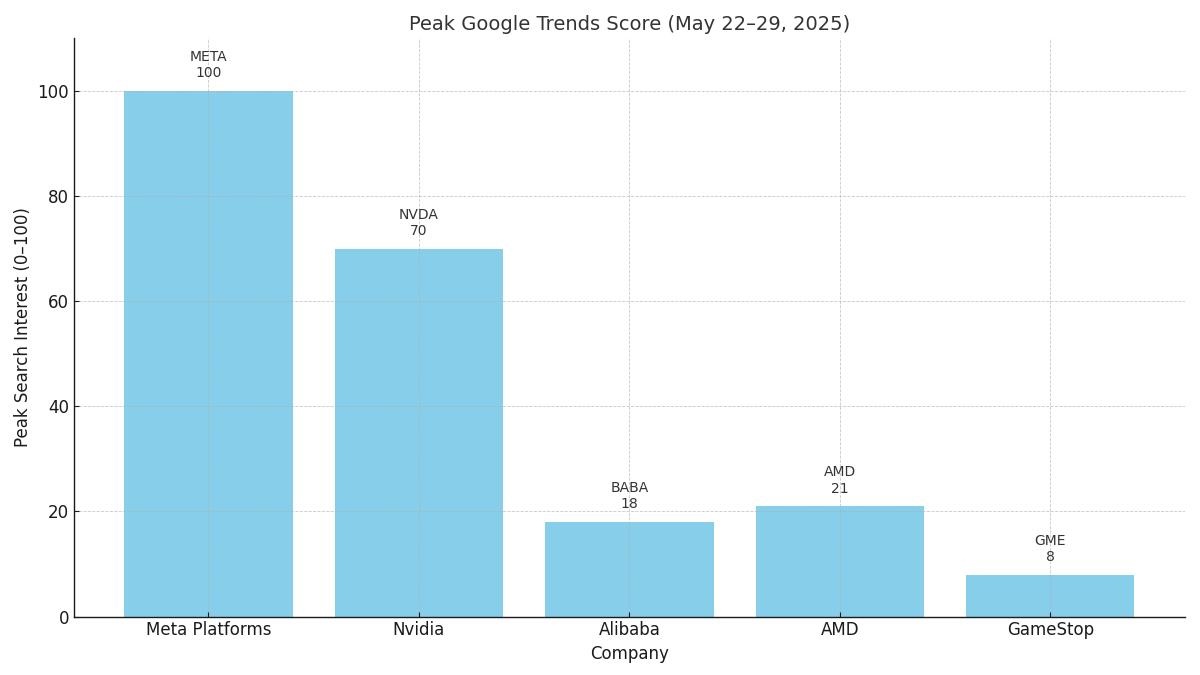

Meta Platforms (NASDAQ: META) surged ahead of its peers this week—not just in market sentiment, but in public curiosity. According to Google Trends data from May 22 to May 29, 2025, Meta ranked as the most searched stock globally, eclipsing a diverse group that includes chipmakers, e-commerce titans, and even the infamous GameStop (NYSE: GME).

Google Trends, which tracks relative search interest on a 0–100 scale, showed Meta spiking sharply midweek, a reflection of the company’s fresh developments in virtual reality and AI integration.

META Tops the Charts

If Google Trends were a popularity contest, META would take the crown this week. The social media conglomerate consistently outpaced every other stock in the top five, frequently hitting scores in the high 70s, while reaching a peak score of 100.

While Meta’s stock price remained relatively stable, search activity suggested widespread curiosity—likely driven by its newly announced AI assistant for enterprise use and fresh rumors surrounding its next-generation VR hardware.

With a growing presence in AI and continued dominance in digital ad spend, Meta’s place atop the search leaderboard reflects both investor interest and broader tech fascination.

AI Buzz Keeps NVDA Relevant

Hot on Meta’s heels, Nvidia (NASDAQ: NVDA) continues to ride the artificial intelligence wave. Search interest in NVDA spiked sharply on May 28, coinciding with the company’s Q1 earnings and news about an expanded partnership with OpenAI.

Nvidia’s Google Trends score reached a weekly peak of 70, signaling a strong midweek burst in public attention.

While it didn’t maintain the same consistent highs as Meta, Nvidia recorded the second-highest average score over the week. The semiconductor leader’s dominance in the GPU and AI acceleration markets ensures it remains a focal point for both retail and institutional investors alike.

AMD: Quiet Climb, Consistent Curiosity

Advanced Micro Devices (NASDAQ: AMD) may not have had a singular headline-driving moment this week, but its name remained in steady rotation among searchers. AMD maintained a relatively flat yet consistent trend line in the Google data, suggesting ongoing interest—likely tied to its upcoming chip launches and competitive positioning against Nvidia.

Its peak Google Trends score came in at 21, reflecting moderate but stable investor attention throughout the week.

With increasing speculation around AMD’s next-gen AI chips, investors are keeping a close eye on how the company plans to catch up in this fast-evolving space.

Read Next: This Biotech Stock Took The Center Stage at the Planet MicroCap Showcase: VEGAS 2025

International Headlines Drive BABA Spike

Alibaba’s (NYSE: BABA) appearance in the top five search list might surprise some, but geopolitical and earnings-related headlines gave the Chinese e-commerce juggernaut a noticeable lift.

BABA reached a Google Trends high of 18 during the week, reflecting short bursts of interest driven by broader China-related news.

Though not as consistent in search volume as Nvidia or Meta, Alibaba saw brief periods of increased activity—particularly in relation to China’s evolving economic policy and its effect on major tech stocks. Investor interest seems to be balancing between caution and curiosity as the company works to regain momentum in global markets.

GME: The Meme That Won’t Die

Rounding out the top five is none other than GameStop—yes, that GameStop. Though GME’s search volume never reached the peaks of its meme-stock heyday, it remains a consistent presence in retail investor circles.

GameStop’s peak Google Trends score landed at 8, making it the lowest-ranked by volume among the top five—but enough to earn it a spot due to its volatile cult status.

A mini-resurgence in attention occurred midweek as forums like Reddit’s WallStreetBets reignited chatter over potential short squeezes. While this didn’t translate into significant stock movement, the company’s presence on the Google Trends chart shows that meme stock nostalgia still burns bright for some traders.

What Google Trends Data Tells Us

While market caps, earnings, and analyst reports provide financial insight, Google Trends offers a unique window into public sentiment and attention. This week, that attention focused most intensely on Meta and Nvidia—fueled by the tech sector’s relentless march toward AI and immersive digital experiences.

Meanwhile, AMD, Alibaba, and GameStop proved that a mix of steady fundamentals, geopolitical news, and good old-fashioned hype can still drive public interest in surprising ways.

In a world saturated with data, knowing what people search for can often be as revealing as knowing what they buy. This week’s top five—META, NVDA, AMD, BABA, and GME—are a testament to the shifting landscape of investor curiosity, where technology, speculation, and momentum collide in real time.

Read Next: 4 Stocks Poised for Big Gains Amid Major Transformations

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at Invest@WealthyVC.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.