Why Nvidia’s Blockbuster Q3 Earnings Just Popped the ‘AI Bubble’ Narrative

Record revenues and soaring guidance calm Wall Street's nerves, proving the AI infrastructure buildout is far from over.

Wall Street loves a narrative, and for the past few weeks, the prevailing story involved a looming disaster. Critics shouted that the artificial intelligence trade had overheated. They claimed the spending was unsustainable and the returns non-existent. But on Wednesday, Nvidia (NASDAQ: NVDA) flipped the script. The chip giant didn’t just beat expectations; it crushed them, delivering a quarterly report that acts as a firm rebuttal to the “AI bubble” theory.

Nvidia reported a staggering $57 billion in revenue for the third quarter, destroying the $35.1 billion figure from the same time last year. Data center revenue alone hit $51.2 billion, exceeding analyst predictions by over $2 billion. Yet, the numbers only tell half the story. The real news lies in the company’s outlook and the voracious, unceasing demand for its hardware.

Investors viewed this earnings report as a “financial Super Bowl.” The stakes felt incredibly high because confidence had started to crack. A Bank of America (NYSE: BAC) survey recently noted that 45% of global fund managers viewed an AI stock-market bubble as a top market risk. High-profile skeptics made bold moves, too. Masayoshi Son’s SoftBank (OTC: SFTBY) sold its massive $5.8 billion stake in Nvidia, and Peter Thiel’s hedge fund dumped its entire position. Even Michael Burry, the famously bearish predictor of the 2008 housing crash, bet against Nvidia, citing concerns over the depreciation of data center assets.

Jensen Huang, Nvidia’s CEO, wasted no time addressing the market’s anxiety. “We’ve entered the virtuous cycle of AI,” Huang said. “AI is going everywhere, doing everything, all at once.”

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Dismantling the Bear Case

The earnings call served as a masterclass in objection handling. Nvidia management systematically addressed the fears causing volatility in the tech sector. Analysts had worried about circular funding, the idea that Nvidia merely boosts revenue by investing in startups that turn around and buy its chips. Others worried about the lifespan of these expensive GPUs.

CFO Colette Kress tackled the depreciation argument head-on. She explained that Nvidia’s CUDA software updates allow older chips, like the six-year-old A100, to remain viable and productive long after purchase. This implies that the billions that big tech companies spend today won’t evaporate in value next year.

Ben Barringer, global head of technology research at Quilter Cheviot, noted the thoroughness of Nvidia’s defense, stating:

“They really went through and sort of tried to disprove pretty much all of the bear cases out there. They talked about scaling laws, they talked about all the different elements of demand, not just hyperscaler capex, but the model demand that they’re seeing from companies like OpenAI and Anthropic, software demand, enterprise demand, sovereign AI.”

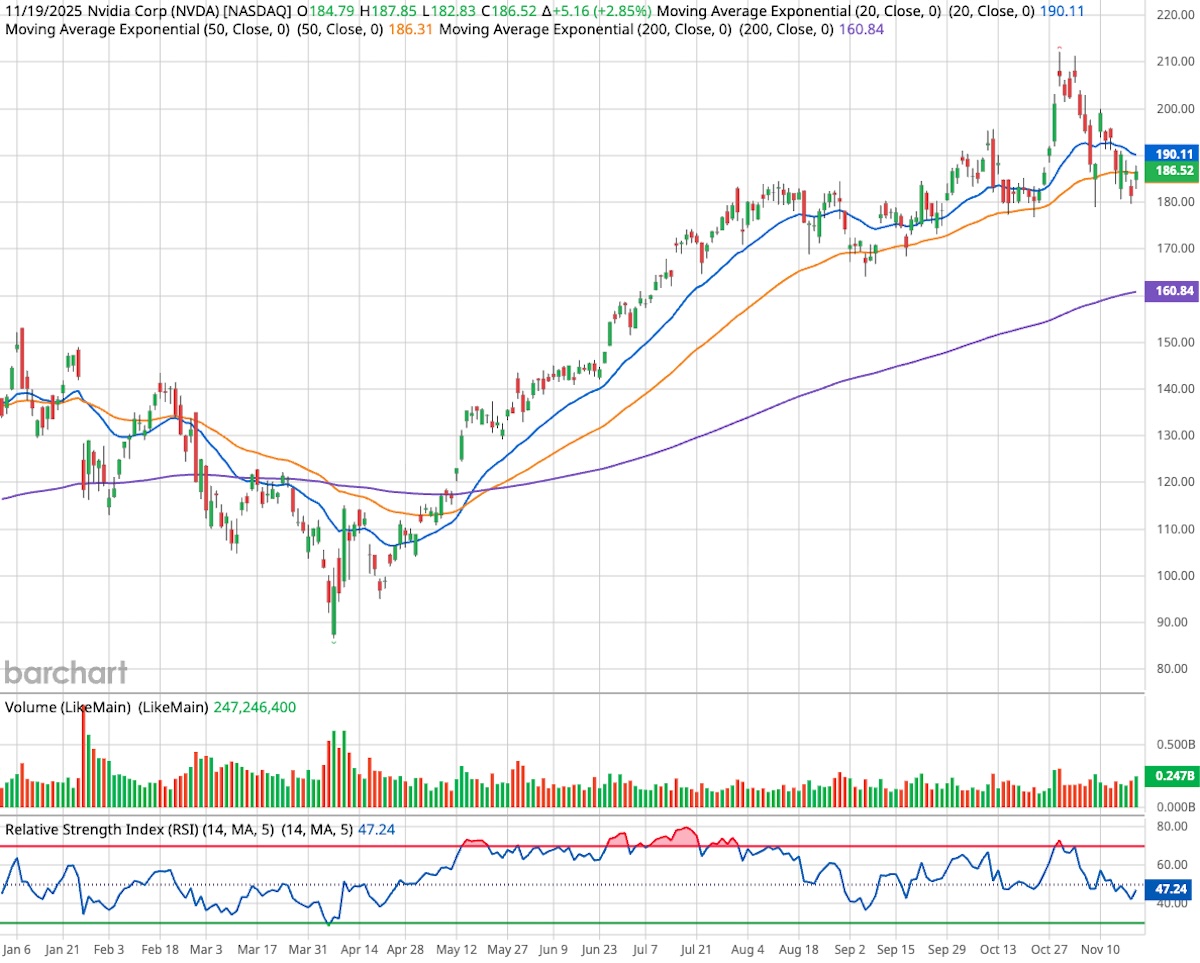

The market responded instantly. Nvidia’s stock climbed 2.85% on Wednesday and is currently up 4.79% in premarket trading this morning, dragging the broader tech sector up with it. The sheer volume of the beat forces analysts to recalculate their models. Ben Reitzes of Melius Research summed up the sentiment perfectly in a note to clients.

“What else did you want?” Reitzes asked. “Revenue acceleration to 65%+ with this kind of margin at scale, benefiting from the greatest paradigm shift of my lifetime, is worth more than ~25x next year’s EPS.”

The Infrastructure “Rising Tide”

Nvidia sits at the center of the AI universe, but it pulls an entire constellation of infrastructure stocks along with it. The logic holds that if companies buy billions of dollars’ worth of Blackwell chips, they need somewhere to put them, cables to connect them, and electricity to run them.

Evercore ISI analyst Amit Daryanani highlighted this ripple effect, noting that “a rising tide lifts all boats.”

We see this clearly in the hardware and networking sector. Arista Networks (NYSE: ANET) and Ciena (NYSE: CIEN) both saw gains as the need for high-speed data transfer grows alongside GPU clusters. Amphenol (NYSE: APH), a major player in the complex cabling required for these systems, also benefited. Perhaps most notably, Vertiv Holdings (NYSE: VRT), which specializes in power and cooling infrastructure for data centers, surged over 6% in extended trading.

The energy sector also joined the rally. AI data centers consume voracious amounts of electricity, and Nvidia’s guidance implies that power consumption will only skyrocket. Bloom Energy (NYSE: BE) jumped more than 7%, while Vistra (NYSE: VST) advanced 3%. The market realizes that without massive power upgrades, the chips usually sit idle.

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

The Hyperscaler Ecosystem

The earnings report also provided a health check on Nvidia’s biggest customers: the hyperscalers. Investors have fretted that companies like Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOGL) are spending too much without showing returns.

Nvidia countered this by highlighting success stories. Management specifically pointed to Meta Platforms (NASDAQ: META) and its Generative Ads Model (GEM). Huang cited this as proof that AI investment leads directly to better monetization and revenue gains.

This validation spread optimism across the “Magnificent 7” and beyond. Oracle (NYSE: ORCL) and Palantir (NASDAQ: PLTR) stand to gain as enterprises move from simply buying chips to deploying software that runs on them. Even competitors like Advanced Micro Devices (NASDAQ: AMD) and memory supplier Micron (NASDAQ: MU) saw their stocks rise, riding the wave of renewed confidence in the sector’s longevity.

Wedbush analyst Dan Ives, a long-time tech bull, viewed the report as a vindication for those who held through the recent volatility, writing:

“With tensions growing across the Street over the last few weeks as AI bubble fears have grown and put pressure on tech stocks, the markets and tech stocks got a pop-the-champagne moment with Nvidia’s robust earnings and guidance.”

Blackwell and the Road Ahead

Looking forward, Nvidia shows no signs of slowing down. The company issued guidance for $65 billion in revenue for the current quarter, well above the $62 billion that Wall Street expected. The primary driver for this next leg of growth is Blackwell, Nvidia’s next-generation chip architecture.

Demand for these new chips appears insatiable. “Blackwell sales are off the charts, and cloud GPUs are sold out,” Huang stated.

The company also scored significant geopolitical wins. The U.S. Commerce Department recently approved the sale of 70,000 advanced chips to state-backed firms in the United Arab Emirates and Saudi Arabia. This opens up a massive sovereign AI market that had previously faced regulatory hurdles. While restrictions on sales to China remain a headwind, the explosive demand from the Middle East and domestic customers more than compensates for the loss.

Nvidia’s Q3 report did exactly what the bulls needed: it replaced speculation with cold, hard numbers. The critics will undoubtedly remain, and the debate over the long-term ROI of artificial intelligence will continue. But for now, the bubble talk has quieted. As long as Nvidia keeps selling every chip it manufactures, the AI party continues.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.