GSI Technology Stock Triples After Cornell Study Confirms Its APU Matches Nvidia GPU Performance

Cornell research shows GSI’s Gemini-I APU delivers GPU-class performance with 98% lower energy use and up to 80% faster processing than CPUs.

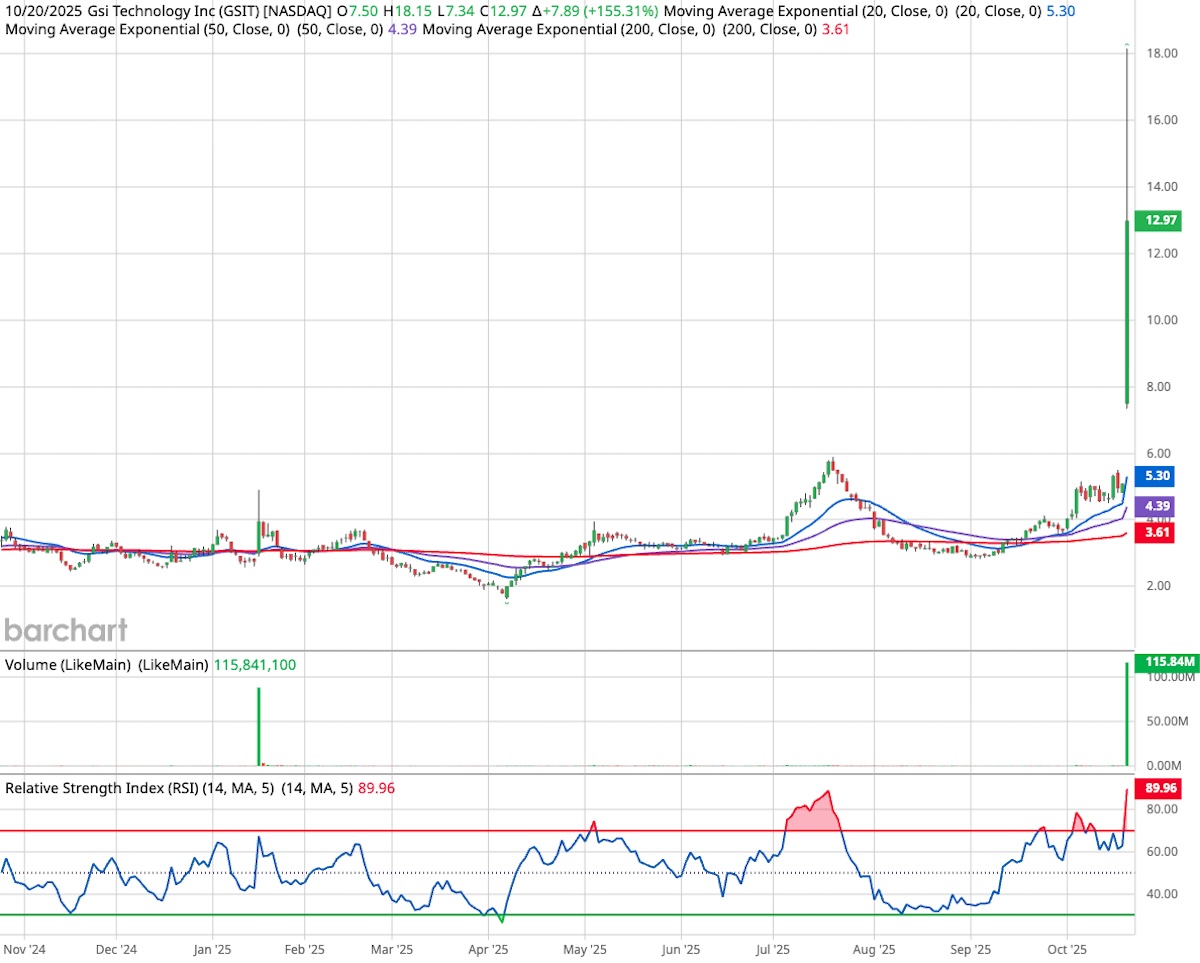

Shares of GSI Technology (NASDAQ: GSIT) skyrocketed on Monday after Cornell University researchers validated that the company’s Gemini-I Associative Processing Unit (APU) delivers GPU-class performance at a fraction of the energy cost. The stock, which soared as much as 257% en route to an intraday high of $18.15, closed Monday’s trading session up 155% at $12.97, extending a year-to-date gain of nearly 300%.

The study, published by the Association for Computing Machinery and presented at the Micro ’25 Conference, found that GSI’s compute-in-memory (CIM) design achieved comparable throughput to Nvidia’s (NASDAQ: NVDA) A6000 GPU during retrieval-augmented generation (RAG) tasks, a benchmark increasingly used for large language model optimization. More impressively, the APU consumed over 98% less energy across datasets ranging from 10GB to 200GB.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Lee-Lean Shu, GSI Technology’s Chairman and CEO, stated:

“Cornell’s independent validation confirms what we’ve long believed—compute-in-memory has the potential to disrupt the $100 billion AI inference market. The APU delivers GPU-class performance at a fraction of the energy cost, thanks to its highly efficient memory-centric architecture.”

APU Architecture Redefines Efficiency

The Gemini-I’s architecture stands apart from conventional CPU and GPU designs by processing data directly within the memory array, eliminating the need to shuttle data between processor and memory. This “compute-in-memory” structure dramatically reduces latency and power loss while maintaining high processing density.

Cornell’s benchmarking showed that the APU not only matched GPU-class speed but also performed retrieval operations several times faster than CPUs, shortening overall processing times by up to 80%. The results highlight the APU’s potential to serve as a sustainable, high-performance engine for AI workloads where both power and cooling efficiency are critical.

Researchers also introduced an analytical framework for optimizing compute-in-memory devices, providing system integrators with tools to adapt GSI’s architecture across AI-driven industries. The validation establishes the APU as a scalable platform suited for defense, aerospace, robotics, and edge computing, where efficiency and reliability outweigh raw processing power.

Competition and Market Implications

While Nvidia remains the dominant force in AI hardware, the Cornell study underscores that new architectures like GSI’s could challenge traditional GPU dominance. Competitors such as Advanced Micro Devices (NASDAQ: AMD) and Intel (NASDAQ: INTC) are also developing energy-optimized processors. Still, GSI’s results represent one of the first third-party confirmations of GPU-class performance from a compute-in-memory chip.

The breakthrough arrives as data centers and AI developers grapple with surging power costs. Major hyperscalers have signaled growing interest in performance-per-watt efficiency, a metric GSI’s APU now leads by a wide margin. Analysts suggest the validation could accelerate the company’s pathway to commercialization and potential partnerships across sectors pursuing greener AI infrastructure.

With AI workloads expanding exponentially, from retrieval-augmented generation to edge inference in smart devices, energy efficiency has become a defining competitive edge. GSI’s 98% energy savings mark a critical differentiator in a market increasingly constrained by power supply and cooling capacity.

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

Next Steps: Gemini-II and Beyond

Looking ahead, GSI Technology has already unveiled its Gemini-II APU, which it says delivers nearly tenfold higher throughput and reduced latency compared to Gemini-I. The company’s upcoming “Plato” platform aims to extend these gains to embedded and edge AI environments, particularly in robotics and defense systems where thermal and energy constraints are severe.

“This tremendous work by Cornell highlights CIM advantages using the Gemini-I silicon. Our recently released second-generation APU silicon, Gemini-II, can deliver roughly 10x faster throughput and even lower latency for memory-intensive AI workloads, while further improving energy efficiency,” Shu added.

As GSI prepares to announce fiscal Q2 2026 results on October 30, investors will be watching for updates on commercialization plans and potential customer engagements. With momentum building around sustainable AI computing, the company’s validation from Cornell represents not just a technological milestone, but a strategic one.

The Bigger Picture

GSI Technology’s surge embodies a broader trend reshaping the semiconductor landscape: the pursuit of AI acceleration with extreme efficiency. The firm’s compute-in-memory approach, once a niche concept, now stands validated against industry giants. For a company with a market cap still under $1 billion, the implications are enormous.

In an industry where every watt and millisecond count, GSI’s Gemini architecture offers a glimpse of a new direction, one where performance, sustainability, and scalability align. With competition intensifying and demand for efficient AI processing rising, GSI’s breakthrough has placed it firmly on the radar of investors and rivals alike.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.