Stop Loss Hunting Unmasked: Why Big Money Targets Your Trades and How to Defend Your Portfolio

It’s not just bad luck, it’s a strategy. Discover how hedge funds and institutions hunt your stops and learn to protect your trades like a pro.

It’s one of the market’s most frustrating events. You do your research, you find a great setup, and you enter a trade. You responsibly place a stop-loss order to protect your capital. Then, almost to the penny, the price drops, triggers your stop, and kicks you out of the trade, only to immediately reverse and soar in the direction you originally predicted.

This isn’t just bad luck. You may have just been a victim of a “stop hunt.” This is a deliberate strategy, employed by some of the largest players on Wall Street, and it’s designed to do exactly what you just experienced: use your protective stop as fuel for their own massive trades.

It feels predatory, and it’s certainly frustrating. But it’s a fundamental part of the market’s structure. The good news is that once you understand how it works, why it happens, and who is doing it, you can take concrete steps to protect your portfolio.

We are going to pull back the curtain on this shadowy practice. We will explore the mechanics of the stop hunt, look at how hedge funds and institutions use it to their advantage, and, most importantly, provide you with an actionable playbook to defend your trades.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

The Market’s Thirst for Liquidity

To understand stop hunting, you must first stop thinking like a retail investor and start thinking like a multi-billion-dollar hedge fund. When you or I want to buy 100 shares of Apple (NASDAQ: AAPL) or Nvidia (NASDAQ: NVDA), we just click a button. Our order is tiny and fills instantly. Now, imagine a hedge fund needs to buy five million shares of that same stock.

If they simply place a single, massive buy order, they create a gigantic problem for themselves. The market’s algorithms will see this huge demand, and the price will instantly skyrocket. They’ll end up buying shares at increasingly worse prices, a costly problem known as slippage.

These large institutions need liquidity. In simple terms, to buy five million shares, they need five million shares to be for sale at a price they like. The stop hunt is a strategy to create that liquidity.

How does it work? They know that millions of retail traders have placed their protective stop-loss orders in predictable locations. For a stock in an uptrend, these stops are clustered just below key support levels or big, round numbers.

These stop-loss orders are a giant, invisible pool of sell orders just waiting to be triggered. For the hedge fund wanting to buy, this pool is a goldmine. They can initiate the hunt by utilizing their substantial capital to place large sell orders, aggressively pushing the price down just far enough to breach the support level.

The moment the price falls below that level, it triggers a devastating chain reaction.

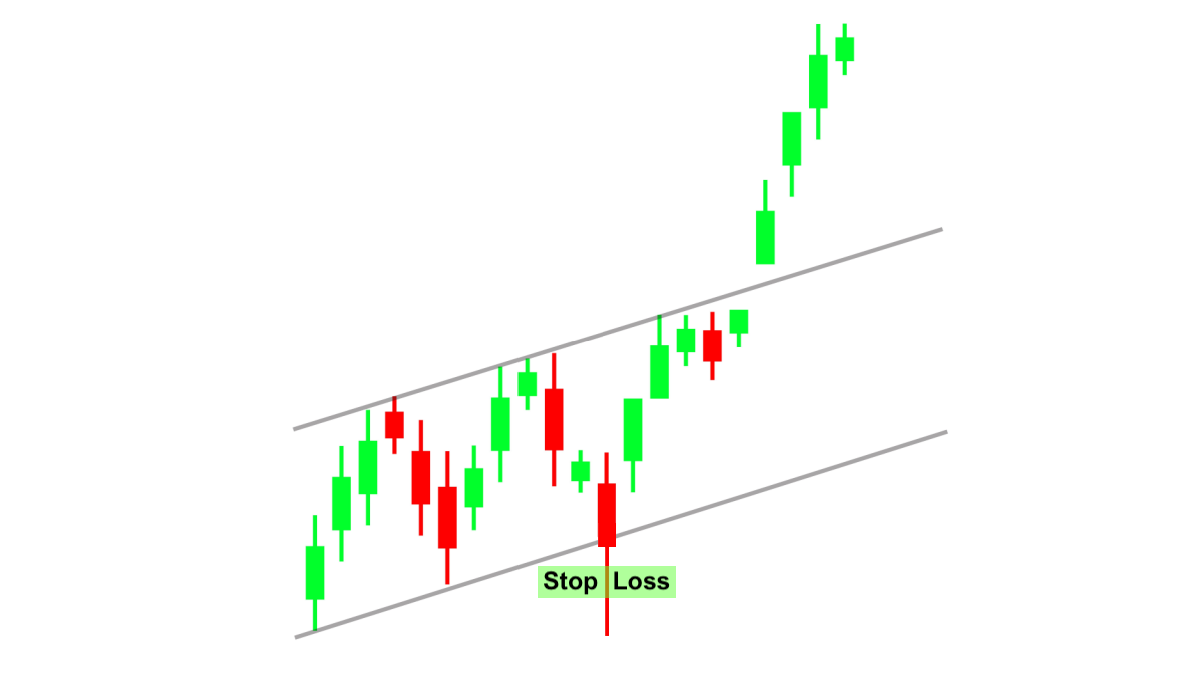

The Anatomy of a Stop Hunt Cascade

The strategy unfolds in a few calculated steps, all designed to exploit predictable human behavior.

- Clustering: Retail traders, often taught from the same “Trading 101” textbooks, predictably place their stops in the same obvious places. This includes just below recent swing lows, underneath major support lines, or right below psychologically significant round numbers (like $50.00 or $100.00).

- Targeting: Institutional algorithms and traders identify these dense clusters of stop orders. They see this fuel sitting on the order book, ripe for the taking.

- The Sweep: The institution (the hunter) unleashes a large volume of aggressive sell orders to deliberately push the price past that clustered level.

- The Cascade: The first few stop-loss orders are triggered. A stop-loss order, when hit, becomes an immediate market order. In this case, they all become market sell orders. This sudden flood of new sell orders overwhelms demand, pushing the price down even faster, which in turn triggers the next cluster of stops further down. This is the cascade or liquidity sweep.

- The Reversal: This is the hunter’s true goal. While retail traders are in a panic, getting stopped out at the worst possible price, the institution quietly steps in and buys all of those panicked sell orders. They absorb the entire flood of shares, filling their massive five-million-share position at a fantastic average price.

Once they have filled their orders, they stop selling. The artificial pressure vanishes, and the price, now free from the manipulative push, snaps back and rockets higher, precisely as the retail traders originally thought it would. The institution got its shares, and the retail traders were left holding the bag.

Real-World Example: The Round Number Trap

Let’s look at a scenario using a real, popular company like Advanced Micro Devices (NASDAQ: AMD).

For this example, we’ll use hypothetical prices to illustrate the point. Imagine AMD stock has been trading strongly and is currently at $233.50. The $230.00 level is a major, widely recognized psychological support level.

- Retail Action: Thousands of retail traders who are long the stock (expecting it to go up) place their stop-loss orders just below this level, creating a massive cluster of sell orders between $228.90 and $228.30.

- The Hunt: A large institution wants to accumulate a huge long position but doesn’t want to chase the price higher. They see the cluster of stops below $230.00 as the perfect entry opportunity.

- The Execution: They begin selling large blocks of shares, pushing the price from $233.50 down to $230.00. The price hesitates, but the institution unloads another heavy batch of sell orders, forcing the price to break $230.00.

- The Cascade: The first stops at $228.90 are triggered, becoming market sell orders. This pushes the price to $228.60, triggering the next wave. In seconds, the price tumbles to $228.30 as the cascade clears out all the retail stops.

- The Reversal: During this panic, the institution, which was hunting for liquidity, flips its strategy. It now activates its massive buy orders and absorbs every single share that the triggered stop-losses are selling. Within minutes, the liquidity sweep is complete. The selling pressure evaporates, and the stock reverses sharply, closing the day at $235.90.

The retail traders are out with a loss, convinced their analysis was wrong. The institution is in with a massive position, acquired at an average price of $228.55.

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

How Retail Investors Can Defend Themselves

You cannot stop the hunt. It’s a structural feature of a market driven by large players. But you can absolutely stop being the prey. The key is to avoid being predictable.

Here are five strategies to protect your trades.

1. Stop Placing Obvious Stops

This is the most important rule. If you can look at a chart and point to the obvious place for a stop, that is precisely where the hunters will aim.

- The Trap: Placing your stop just cents below a major support level or a round number (like $49.90 on a $50 support).

- The Solution: Give your trade padding or breathing room. Instead of placing your stop based on a line, place it based on the stock’s actual behavior.

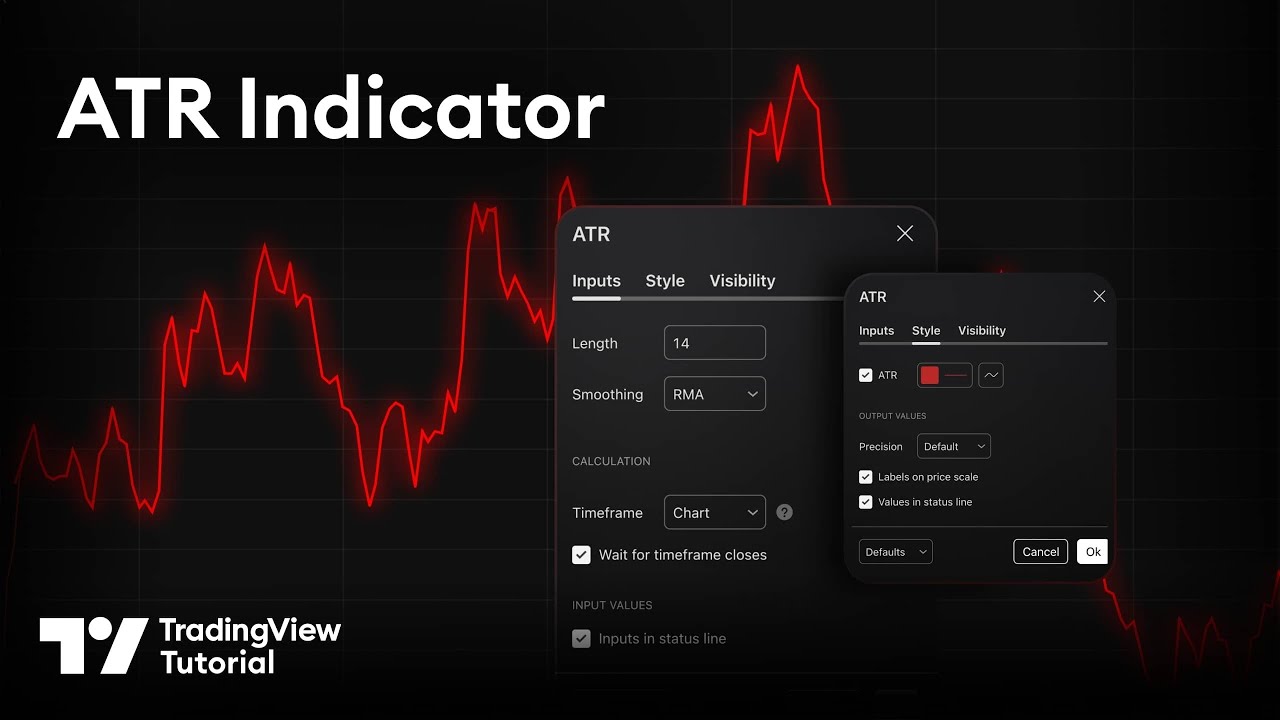

2. Use Volatility-Based Stops (The ATR Method)

A far superior method is to base your stop on the stock’s current volatility. The Average True Range (ATR) is an indicator that measures the average market noise or price movement over a set period.

- How it Works: Let’s say a stock’s 14-day ATR is $1.50. This means the stock, on average, has a trading range of $1.50 per day.

- The Solution: Instead of placing a tight, arbitrary stop, you might place your stop two times the ATR below your entry or below the key support level. For example, if support is at $100 and the ATR is $1.50, a 2x ATR stop would be at $97 ($100 – (2 * $1.50)).

- The Benefit: This places your stop well outside the noise and far away from the clustered, obvious stops. The hunters’ quick sweep to $99.75 will not touch your $97 stop.

3. Manage Your Position Size

Using a wider, ATR-based stop requires you to adjust your position size. If your wider stop means you have $3 of risk per share instead of $0.50, you must buy fewer shares.

This is the professional’s trade-off: A smaller position size with a wider, smarter stop is infinitely better than a large position size with a tight, dumb stop.

4. Wait for Confirmation (Or Trade the Reversal)

Stop hunts are fast and violent. Patience is your best defense.

- Wait for a Close: Instead of buying a stock the moment it breaks above a resistance level, wait. Let the 1-hour or 4-hour candlestick close above that level. A hunt will often spike above resistance, trigger all the buy stops from short-sellers, and then fail immediately. A strong close suggests a legitimate breakout.

- Trade the Reversal: This is a more advanced, contrarian strategy. Actively watch for a stop hunt. If you see the price spike below a key support level (like our $230.00 AMD example) and then aggressively reverse and close back above it on the same candlestick, this is a powerful buy signal. You are essentially following the smart money after they have finished their hunt.

5. Use Mental Stops or Price Alerts (With Extreme Caution)

An institutional algorithm can only hunt a physical order that exists on the broker’s server. A mental stop, a price level you decide on in advance to manually exit, is invisible to them.

- Benefit: You cannot be hunted.

- Risk: This requires iron discipline. In a fast-moving market, you might suffer terrible slippage, or worse, you might freeze and fail to exit at all. This is not recommended for beginners.

- A Safer Hybrid: Place a price alert (not an order) with your broker at your intended stop level. When the alert triggers, you can manually assess the price action. Is it a violent, fast-moving hunt, or a genuine breakdown? This gives you a moment to think before executing.

Average True Range (ATR) Indicator Tutorial

Source: TradingView YouTube

Is Stop Hunting Legal?

This is a gray area. Overt market manipulation, such as spoofing (placing fake orders to trick others) or using fraudulent information, is highly illegal.

However, the activity we’ve described is generally not considered illegal. It is seen as large players skillfully navigating the market. They are not breaking any rules by anticipating where liquidity (the clustered stops) will appear and executing large trades at those levels. They are simply operating at a level that exploits the predictable, herd-like behavior of the retail crowd.

Think Like a Hunter, Not the Hunted

Stop loss hunting is a fact of life in the financial markets. You cannot change the game, but you can change how you play it.

The key takeaway is to stop being predictable. Stop placing your stops where everyone else does. Start using tools like the ATR to place your stops in zones of lower probability. Prioritize a smart, wide stop over a large position size. And finally, cultivate the patience to wait for confirmation, or even use the hunt itself as your entry signal.

When you shift your perspective from “where should I put my stop?” to “where is the crowd putting their stops?” you have taken the first and most important step in protecting your capital.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.