Here’s How Much Gold the Earth Holds, and What’s Left to Be Mined

As gold hovers near record levels, investors weigh the finite supply above ground, the reserves still in the crust, and the vast trove locked in Earth’s core.

The ancient quest for Gold (XAUUSD) has entered a new and fascinating phase. Surging over 50% through the first ten months of 2025, the precious metal has captured the investment world’s attention, recently surpassing the $4,000 mark for the first time en route to an all-time high of $4,381.21. Following a brief 10% pullback last week, gold again rallied past $4,000, last trading at $4,017.07.

Persistent global inflation, debt expansion, and mounting geopolitical risk have fueled a powerful rally, underscoring gold’s enduring appeal as a trusted, finite asset. Yet, the price action raises a critical, fundamental question: how much gold have we already claimed, and what quantity still lies hidden beneath our feet?

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Humanity has already extracted a staggering volume of gold. According to the World Gold Council (WGC), all the gold ever mined amounts to approximately 216,265 tonnes. Visualize this immense stock as a single, imposing cube: it would stand roughly 22 meters (73 feet) tall, commanding a breathtaking valuation of nearly $30 trillion at current spot prices. The world adds to this cache incrementally, extracting between 3,000 and 3,500 tonnes annually, a growth rate of around 1.5–2%. Understanding the physical bounds of this resource illuminates its scarcity and its relevance in a financial landscape rattled by currency volatility and diminished faith in paper assets.

The Above-Ground Supply: From Jewelry to the Central Vaults

Because gold ranks as a noble metal, it resists corrosion and decay; nearly every ounce ever mined remains in circulation. This makes the above-ground supply a critical factor in market dynamics. The largest allocation, almost 45% (97,149 tonnes), exists as jewelry, with traditional and cultural demand in powerhouse nations like India and China fueling steady, if tempered, growth.

The second-largest segment, representing 22% (48,634 tonnes), sits in the hands of private investors via bars, coins, and ETFs, such as the popular SPDR Gold Shares ETF (NYSE Arca: GLD). Escalating investor interest, driven by the desire for portfolio diversification and long-term protection of real wealth, has steadily boosted this category.

Central banks comprise the third major allocation, holding 17% (37,755 tonnes) of the total stock. These national reserves reflect gold’s neutrality, resilience, and liquidity, qualities that make it an ideal strategic hedge during periods of global instability. Recent significant purchases by countries like China, Turkey, and Poland indicate a wider, ongoing trend toward de-dollarization, a move reflecting volatility in the U.S. Dollar Index (DXY) and the global financial order it underpins. Furthermore, the “Urban Mine” contributes substantially to supply security; recycling old jewelry and electronic waste meets about 25% of annual global demand, approximately 1,370 tonnes in 2024, offering a sustainable alternative to primary mining.

Wall Street analysts at firms like Goldman Sachs (NYSE: GS) and JPMorgan (NYSE: JPM) frequently cite gold’s finite nature and this shifting central bank dynamic as core drivers for their bullish outlooks, emphasizing the metal’s status as the ultimate store of value. Currently, JPMorgan projects gold prices to reach $5,055 in 2026, while Goldman Sachs maintains a $4,900 target.

The Finite Reserves: What the Industry Can Still Extract

While the world uses over 3,000 tonnes of new gold each year, the economically viable reserves remaining in the Earth’s crust are surprisingly modest. Experts distinguish between reserves, which are deposits that are both verified and economically feasible to extract using current technology, and resources, which are verified but cannot yet be profitably accessed.

The consensus from the U.S. Geological Survey (USGS) and the WGC suggests that between 54,770 and 70,550 tonnes of gold deposits qualify as extractable reserves. These known reserves are concentrated primarily in a handful of nations: Australia (12,000 tonnes), Russia (12,000 tonnes), South Africa (5,000 tonnes), and Canada (3,200 tonnes). At current production rates, which saw a record 3,661 tonnes extracted in 2024, these proven, accessible reserves may last only 17 to 20 years. Beyond this immediate horizon, an additional 132,110 tonnes are classified as resources, verified deposits that wait for either higher gold prices or breakthrough technological advancements to become commercially viable. This finite timeline creates an inherent pressure that supports the value of gold.

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

The Rising Cost of the Final Ounce

The modern era of gold production is dramatically different from the gold rush days. Two-thirds of all gold ever mined has been extracted since 1950, thanks to technological leaps. However, finding and processing high-grade ore deposits has become increasingly difficult. As miners dig deeper and grapple with lower ore grades, every new ounce requires greater energy and financial commitment.

Major producers are adjusting to this difficult reality. Mining giants like Newmont Corporation (NYSE: NEM) (TSX: NGT), Barrick Gold (NYSE: B) (TSX: ABX), and Agnico Eagle Mines (NYSE: AEM) (TSX: AEM) now place substantial focus on profitability, operational safety, and stringent environmental, social, and governance (ESG) compliance. Gold mining is inherently energy-intensive and environmentally impactful, with a single wedding ring generating an estimated three tons of waste. This heightened scrutiny drives a powerful push for sustainability, obligating producers to adhere to standards like the Responsible Gold Mining Principles (RGMPs). The inevitable consequence of this shift is clear: every new ounce extracted will carry a higher cost.

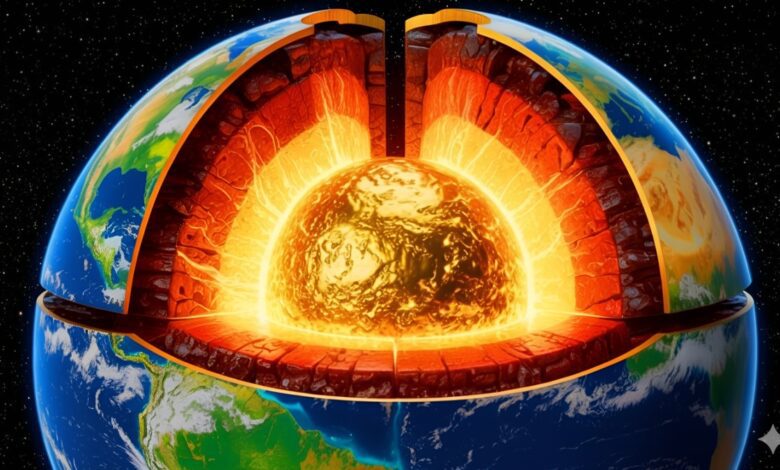

The Unreachable Core: The Earth’s True Gold Wealth

Despite the millions of tonnes already mined and the tens of thousands remaining in reserves, the staggering truth is that nearly all of the planet’s gold remains entirely inaccessible. Geologists estimate that 99% of the world’s gold resides deep within the Earth’s core, enough, theoretically, to coat the entire surface of the planet in a half-meter-thick layer. This radical distribution traces back to the planet’s violent formation. As Earth coalesced and remained molten, gold, due to its high density, sank toward the center.

Chris Voisey, an ore deposit geologist at Monash University, explained the phenomenon, stating:

“Consider that 99.5% of the Earth’s mass formed when things were molten and could differentiate based on density (so, gold would sink to the core).”

The tiny fraction of gold accessible in the crust arrived later, delivered during the “Late Heavy Bombardment,” a period when meteorites pummeled a more solid Earth. Voisey confirmed this origin for accessible reserves, noting:

“A lot of Earth’s precious metals that form ore deposits is believed to be sourced from this event, since it isn’t locked in the iron-nickel core.”

Given that geological processes only shuffle this limited fraction around, and with the core’s immense wealth sealed off, the quest for gold remains defined by extreme scarcity.

The narrative of gold pivots on a single, powerful fact: it is finite. As global economies contend with geopolitical risk, currency volatility, and debt expansion, the appeal of owning a finite, trusted asset only amplifies. Dwindling crustal supplies and the rising costs faced by companies like Barrick Gold and Newmont naturally increase gold’s intrinsic value, cementing its role as a premier hedge. Whether it serves as the foundation for a central bank’s reserve strategy, a private investor’s diversification tool, or a shimmering element in consumer technology, every gram of gold represents not just chemical matter, but millennia of profound, unwavering trust.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.