Why Armata Pharmaceuticals Skyrocketed 370% Today

Biotech stock surges after landmark Phase 2a data validates first-of-its-kind phage therapy against deadly infections.

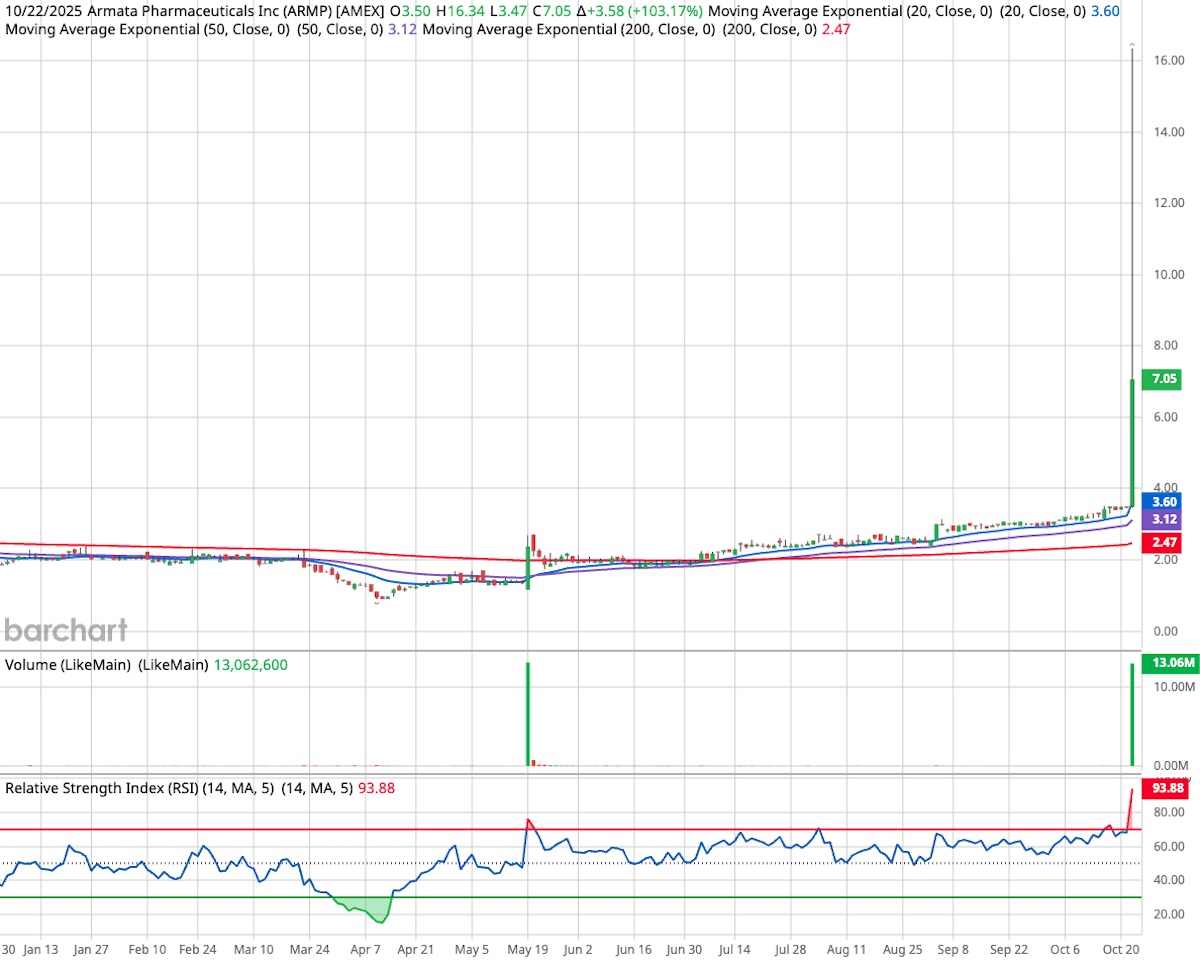

Armata Pharmaceuticals (NYSE American: ARMP) surprised Wall Street on Wednesday after its stock rocketed as much as 370% intraday on the back of groundbreaking mid-stage clinical results for its bacteriophage-based therapy, AP-SA02. The company’s announcement marked the first randomized trial to demonstrate meaningful clinical efficacy for intravenous phage therapy, a novel approach to fighting antibiotic-resistant infections.

Shares of the Los Angeles-based biotech touched an intraday high of $16.34 before closing the day at $7.05, still up 103%. Year-to-date, Armata shares have now surged 261%, pushing its market capitalization to roughly $255 million.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

A Major Milestone in Phage Therapy

The massive rally followed the release of positive Phase 2a trial data for AP-SA02, Armata’s antibacterial cocktail designed to treat complicated Staphylococcus aureus bacteremia, including methicillin-resistant strains (MRSA).

The 42-patient, randomized, double-blind study, funded in part by a $26.2 million grant from the U.S. Department of Defense, compared AP-SA02 in combination with best available antibiotic therapy against antibiotics alone. Results presented at IDWeek 2025™ in Atlanta showed a clinical response in 88% of treated patients, compared with 58% in the placebo group by Day 12. Importantly, no serious adverse events were linked to AP-SA02.

Dr. Loren G. Miller, who presented the findings, stated:

“The results of the diSArm study confirm, for the first time in a randomized clinical trial, the efficacy of intravenous phage therapy for S. aureus bacteremia, and we are very pleased to highlight these compelling data in an oral presentation at IDWeek. The results of this rigorously designed study provide strong rationale for advancement into a Phase 3 superiority study that, if successful, would support its use in clinical practice for Staphylococcus aureus bacteremia.”

He added that high-purity phage therapeutics like AP-SA02 “have the potential to become the new standard of care for this common, extremely severe, and often deadly infection.”

CEO Calls Results “Another Significant Achievement”

Armata’s Chief Executive Officer, Dr. Deborah Birx, called the breakthrough a pivotal moment for the company and the field of infectious disease treatment.

“The positive results from the diSArm study represent another significant achievement for Armata as we aim to advance AP-SA02 into a pivotal trial,” Birx said.

The company now plans to initiate a Phase 3 superiority trial in 2026, pending U.S. Food and Drug Administration (FDA) feedback. If successful, it could position Armata as a leader in a new class of therapies designed to combat antibiotic-resistant “superbugs.”

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

Analyst Reaction and Market Outlook

The dramatic clinical results quickly drew praise from Wall Street. H.C. Wainwright analyst Joseph Pantginis reiterated a Buy rating on Armata with a $9 price target, citing the strong data and the therapy’s unique design, which uses multiple genetically stable phage variants to tailor treatment to each patient’s infection profile.

Pantginis noted the trial’s high responder rate and absence of relapse as key indicators supporting advancement to Phase 3. His rating implies another 29% upside from current levels.

While enthusiasm surged among retail investors, analysts also warned of lingering risks. Armata remains a pre-revenue biotech with a fragile balance sheet; its most recent filings show a current ratio of just 0.06 and an EPS of -1.03. Still, Wednesday’s results may shift the company’s trajectory if it can secure additional funding and regulatory approval.

Broader Market Sees Biotech Strength

Armata’s explosion capped a bullish session for small-cap healthcare names. Several other biotech and life sciences stocks moved sharply higher in sympathy:

- Applied DNA Sciences (NASDAQ: BNBX) jumped 40% to $4.80.

- iBio (NASDAQ: IBIO) rose 25% to $1.39.

- Estrella Immunopharma (NASDAQ: ESLA) gained 24% to $2.33.

- Simulations Plus (NASDAQ: SLP) advanced 13% to $17.62.

The collective momentum reflected renewed investor interest in experimental biotech names following Armata’s clinical success, an event some analysts view as a proof point for the viability of phage-based medicine.

The Road Ahead

With its stock now back on traders’ radar, Armata enters its next chapter with both opportunity and risk in equal measure. The Phase 3 trial expected in 2026 will be crucial for validating AP-SA02’s safety and efficacy in a larger patient population.

If those results mirror Wednesday’s data, Armata could not only cement its place as a pioneer in phage therapy but also redefine how the medical community treats one of the deadliest forms of bacterial infection.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.