Profusa Expands European Reach and Doubles Down on Bitcoin Treasury Strategy

Digital health innovator Profusa deepens European footprint while doubling down on Bitcoin as part of its treasury diversification.

Profusa (NASDAQ: PFSA) is advancing on two fronts this month, expanding its European commercialization footprint for its Lumee™ Oxygen platform and reinforcing its treasury with an additional $1 million investment in Bitcoin (BTCUSD). The moves mark another strategic step for the Berkeley-based digital health company as it accelerates both global distribution and long-term capital management.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Strengthening the Balance Sheet with Bitcoin

On October 7, Profusa announced its second $1 million investment in digital treasury assets, reaffirming its conviction that Bitcoin is a foundational store of value. The decision aligns with the company’s broader treasury management strategy, designed to hedge against macroeconomic uncertainty and support ongoing product commercialization.

Chairman and CEO Ben Hwang, Ph.D., said:

“We believe the continued execution of our digital asset strategy helps ensure that we are prudently managing our resources to continue to support both our commercial and development plans for our Lumee platform technology. Our digital treasury strategy is designed to facilitate that we maintain sufficient capital to provide the best-in-class, AI-driven digital health platform for the benefit of chronic disease and health and wellness management.”

Hwang explained that Profusa’s digital treasury approach aims to maintain sufficient liquidity while enhancing capital efficiency. “We continue to collaborate with Ascent Partners Fund, which funded our second tranche of $2 million in additional investments, to establish a low cost, capital efficient, best of breed Bitcoin treasury strategy which reflects our strong conviction that Bitcoin is the digital store of value for the future. We believe it will provide firm foundation as we progress our commercial and clinical programs,” Hwang said.

By integrating Bitcoin into its balance sheet, Profusa joins a growing list of forward-looking public companies exploring blockchain-based hedges against inflation and currency risk. The investment also underscores confidence in Bitcoin’s long-term role in corporate treasury diversification amid persistent economic volatility.

Expanding the Lumee Platform Across Europe

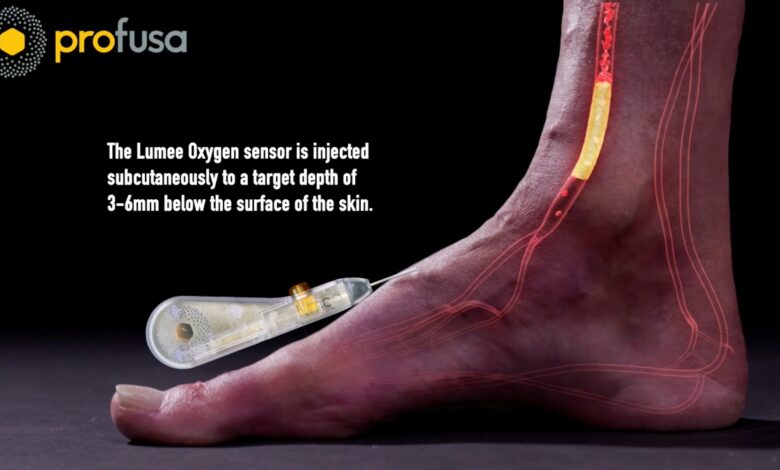

Just over a week later, on October 15, Profusa revealed a major expansion of its commercial presence in Europe through a new distribution partnership with Angiopro GmbH. The collaboration extends coverage of its Lumee™ Oxygen platform, a tissue-integrated sensor system that continuously monitors oxygen levels in real-time, into key regional markets, including Germany, the Benelux countries, Austria, the United Kingdom, and Scandinavia.

The partnership broadens Profusa’s European distribution network to approximately 35% of the European Union population, encompassing an estimated 300,000 annual endovascular procedures. This follows a previously reported agreement with a distributor in Spain, as well as recently announced collaborations with leading vascular specialists in Belgium, Austria, and France, further strengthening Profusa’s footprint across the continent.

Angiopro’s CEO and General Manager Benjamin J. Rieck said:

“As industry specialists on clinical needs in vascular and peripheral diseases, we recognize the innovation and need for Profusa’s Lumee platform technology. We are also enthusiastic about collaborating with Profusa on additional pipeline clinical indications, such as diabetes and other chronic conditions where continuous tissue monitoring could provide significant patient benefits. Leveraging our marketing and sales infrastructure, established networks, regulatory expertise, and strong presence in European regions, we are excited to build a strong foundation for long term partnership and growth with Profusa.”

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

Targeting a $10 Billion Market Opportunity

Profusa’s Lumee™ Oxygen platform addresses a vast and growing global market for continuous biochemical monitoring technologies. According to the company, the total addressable market for its tissue oxygen applications across peripheral artery disease, chronic wounds, and critical limb ischemia exceeds $10.5 billion globally, with Europe representing a major early growth region.

Hwang said the company’s European strategy is central to its global expansion plans. “With growth capital in hand, we are focused on building our robust distribution infrastructure in Europe and are excited to partner with Angiopro as we execute on our strategy to bring our pioneering real-time personal healthcare technologies to the clinical community, driving growth in our business,” he said.

A Dual Focus on Growth and Resilience

Between its expanding sales reach and strengthened Bitcoin holdings, Profusa continues to position itself as both a technological and financial innovator. Its dual strategy, advancing AI-driven, tissue-integrated health solutions while maintaining a forward-thinking digital treasury, reflects a company intent on balancing innovation with fiscal discipline.

As Profusa deepens its European footprint and reinforces its Bitcoin-backed financial foundation, the company’s long-term trajectory appears aligned with both healthcare innovation and the digital asset evolution shaping modern corporate finance.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Wealthy VC and its employees are not Registered Investment Advisors, Broker-Dealers or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Wealthy VC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled through their website, news releases, and corporate filings, or is available from public sources and Wealthy VC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Our website and newsletter are for entertainment purposes only. This website is NOT a source of unbiased information. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment.

Release of Liability: Through the use of this email and/or website advertisement, by viewing or using it, you agree to hold Wealthy VC, its operators, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Wealthy VC-sponsored advertisements do not purport to provide an analysis of any company’s financial position, operations or prospects and this is not to be construed as a recommendation by Wealthy VC or an offer or solicitation to buy or sell any security.

None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Wealthy VC strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below. Profusa, Inc. (NASDAQ: PFSA) has compensated wealthyvc.com’s parent company, 1000358139 Ontario Limited, USD $568,000 by wire transfer. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D and all reports published on SEDAR if the company featured is Canadian. Wealthy VC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors with a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results. Past Performance is based on the security’s previous day’s closing price and the high of-day price during our promotional coverage.

In preparing this publication, Wealthy VC has relied upon information supplied by various public sources and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this email and website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this email and website are believed to be reliable, however, Wealthy VC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Wealthy VC is not responsible for any claims made by the companies advertised herein, nor is Wealthy VC responsible for any other promotional firm, its program or its structure.