Congress Passes Bill to Release Epstein Files, But Will Trump Sign It?

Overwhelming congressional support sends Epstein Files Transparency Act to President's desk.

In a rare and powerful show of bipartisan force, Congress overwhelmingly approved legislation this week demanding the public release of a trove of government files related to the late convicted sex offender, Jeffrey Epstein. The vote, a monumental victory for Epstein’s victims and their congressional allies, now pushes the political drama directly to President Donald Trump’s desk, forcing a decision that tests his declared support against his history of aggressive opposition.

The House of Representatives passed the Epstein Files Transparency Act with a stunning 427-1 vote on Tuesday, after a monthslong, politically charged fight. Hours later, the Senate swiftly followed suit, adopting the measure by unanimous consent, accelerating its path to the White House. This near-total legislative consensus marks the culmination of a fierce battle, driven by a discharge petition that forced the hand of GOP leadership and even divided elements of the President’s own base.

Also Read: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Shifting Tides of Congressional Support

For months, the effort faced stiff resistance, which bill proponents directly attributed to the President and his allies. Rep. Marjorie Taylor Greene (R., Ga.), one of the main champions of the bill, reflected on the intense struggle. Greene stated the survivors and their backers fought “so hard against the most powerful people in the world, even the president of the United States, in order to make this vote happen today.” Greene herself was one of the Republican renegades who pressed the issue, noting Trump had tagged her as a traitor over her initial push.

The political calculus changed dramatically over the weekend when President Trump reversed his stance, urging Republicans to support the bill while continuing to label the entire focus a “hoax.”

Trump posted on Truth Social:

“As I said on Friday night aboard Air Force One to the Fake News Media, House Republicans should vote to release the Epstein files, because we have nothing to hide, and it’s time to move on from this Democrat Hoax perpetrated by Radical Left Lunatics in order to deflect from the Great Success of the Republican Party, including our recent Victory on the Democrat Shutdown.”

This sudden shift cleared the way for almost every Republican, including House Speaker Mike Johnson (R., La.), to vote in favor of the measure.

The legislation compels the Department of Justice (DOJ) to release all unclassified records, documents, and investigative materials tied to Epstein no later than 30 days after enactment. The bill also prohibits the DOJ from withholding records for “reputational and political reasons,” though it does allow for the necessary withholding of information that would identify victims or jeopardize an ongoing federal investigation.

Source: Forbes Breaking News YouTube

Victims’ Plea and the Political Stage

Epstein survivors, who filled the public galleries above the House floor to witness the vote, greeted the outcome with cheers and hugs, underscoring the deeply personal nature of this legislative battle. Their frustration with past administrations, both Republican and Democratic, came into sharp focus before the vote. Victim Jena Lisa Jones publicly pleaded, saying: “I’m begging you, President Trump, stop making this political.”

The President, meanwhile, insisted he had long ago severed ties with Epstein, saying:

“[I have] nothing to do with Jeffrey Epstein. I threw him out of my club many years ago because I thought he was a sick pervert, and I guess I turned out to be right.”

He has repeatedly characterized the Epstein narrative as a politically motivated distraction. House Minority Leader Hakeem Jeffries (D., N.Y.) saw the President’s last-minute change of heart as a concession, flatly calling it out, stating: “He’s caved. It’s a complete and total surrender.”

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

Financial Fallout and Corporate Scrutiny

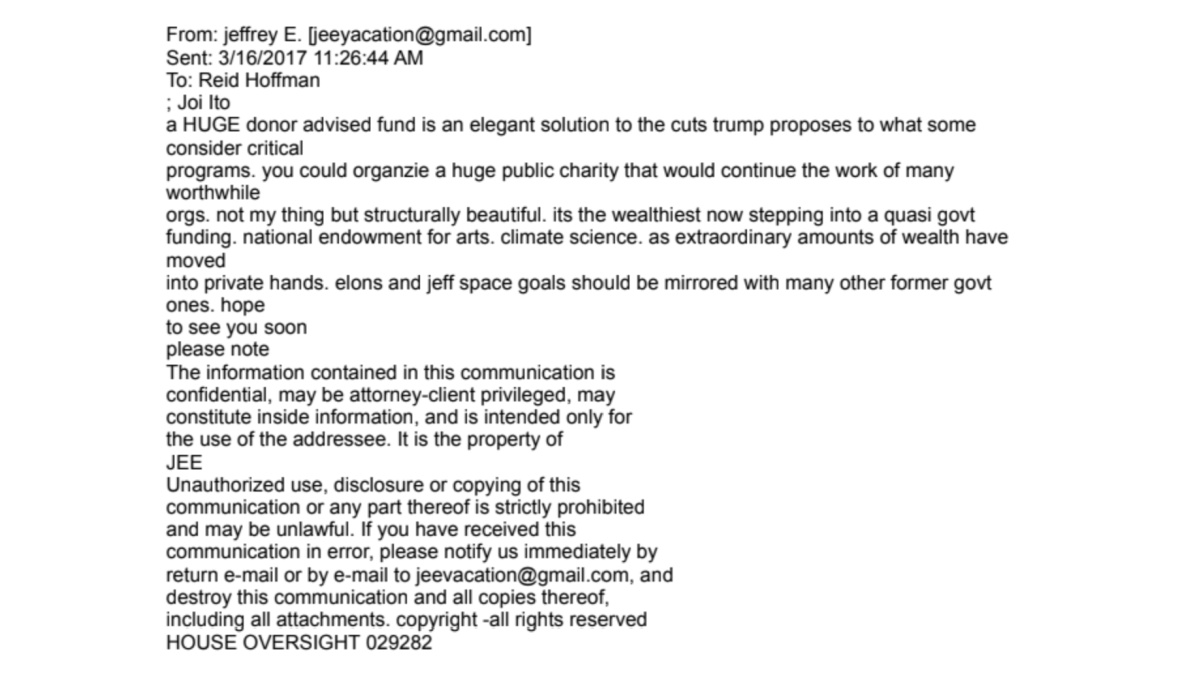

The financial implications of a full document release continue to loom large, particularly for institutions and powerful individuals who associated with the disgraced financier. Earlier this month, President Trump ordered the DOJ to investigate the relationships between Epstein and a list of high-profile figures and entities, including former President Bill Clinton, ex-Treasury Secretary Larry Summers, LinkedIn co-founder Reid Hoffman, and the banking titan JPMorgan Chase (NYSE: JPM).

JPMorgan has already faced significant fallout from its relationship with longtime client Jeffrey Epstein, paying a total of $365 million to settle separate lawsuits with Epstein’s victims and the government of the U.S. Virgin Islands in 2023, without admitting to wrongdoing. The bank quickly fired back against Trump’s recent directive to the DOJ. A spokeswoman for JPMorgan, Patricia Wexler, stated: “The government had damning information about [Epstein’s] crimes and failed to share it with us or other banks.” She added, “We regret any association we had with the man, but did not help him commit his heinous acts. We ended our relationship with him years before his arrest on sex trafficking charges.”

The documents also place a direct spotlight on some of the world’s most powerful technology leaders, raising questions about the extent of their interactions with Epstein. Unsealed records and reporting indicate the financier attended a 2015 dinner hosted by Reid Hoffman, which was also attended by prominent Silicon Valley figures, including Tesla (NASDAQ: TSLA) CEO Elon Musk and Meta Platforms (NASDAQ: META) co-founder and CEO Mark Zuckerberg, alongside Palantir (NASDAQ: PLTR) co-founder and chairman Peter Thiel. Furthermore, documents from 2014 show Hoffman planned an overnight stay at Epstein’s Manhattan townhouse for a “breakfast party” the following morning, which was expected to include Microsoft (NASDAQ: MSFT) co-founder Bill Gates, though it remains unclear if that visit occurred. Hoffman has repeatedly apologized for his association, claiming he only engaged with Epstein for fundraising efforts and that the political probe against him is “nothing more than political persecution and slander,” a charge he made on X as he demanded the full release of all files.

Final Hurdle: The President’s Signature

With the bill now heading to the White House, the final hurdle involves President Trump putting his pen to the paper. Senate Majority Leader John Thune (R., S.D.) reflected the overwhelming momentum of the bill, dismissing the idea of Senate amendments before the unanimous consent motion. “I think when a bill comes out of the House 427-1, and the president said he’s going to sign it, I’m not sure that is in the cards,” Thune observed.

A senior White House official reportedly confirmed the President will sign the bill “whenever it gets to the White House,” yet bill supporters remain concerned about the potential for future non-compliance. The DOJ could cite a continuing investigation, such as the review Trump recently ordered into Clinton’s connection to Epstein, or use the allowed redactions to keep information secret.

If Trump does sign, the law will immediately set a 30-day clock for one of the most anticipated document dumps in recent memory, promising to shine a brutal spotlight on the powerful men and institutions that facilitated Epstein’s dark world. The lone dissent in the House, Rep. Clay Higgins (R., La.), articulated the lingering concern of those who voted no, fearing that a “broad reveal of criminal investigative files, released to a rabid media, will absolutely result in innocent people being hurt.” Nevertheless, for the victims, this vote means a potential step toward justice and full transparency.

Small Cap News Movers & Winner Deep Dive – By WealthyVC.com

We scan over 10,000 publicly listed stocks across all seven North American exchanges to uncover the market-moving news that actually matters—focusing on high-quality, liquid, growth-oriented companies in sectors attracting serious capital, like AI, blockchain, biotech, and consumer tech.

Each week, we publish Small Cap News Movers, a curated roundup of small and micro-cap stocks surging on meaningful catalysts. We break down what’s driving the move, tap into rumors swirling on social media, and surface sharp insights from both industry experts and retail sleuths.

From this list, we select one standout stock for our Small Cap Winner Deep Dive, released the next day, where we take a closer look at the fundamentals, narrative, and technicals that suggest this winner could keep running.

Powered by our proprietary 4-element, AI-driven analysis system, our goal is simple: cut through the noise, remove the emotion, and help investors dominate the small-cap market with momentum-driven strategies—completely free.

Sign up for email alerts to get the moves before our social media followers.

Read Next: Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Disclaimer: Wealthy VC does not hold a position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.