Yoshitsu Co. Ltd is a Japanese Sleeper Stock That is Quietly Kicking Off a Global Expansion Strategy

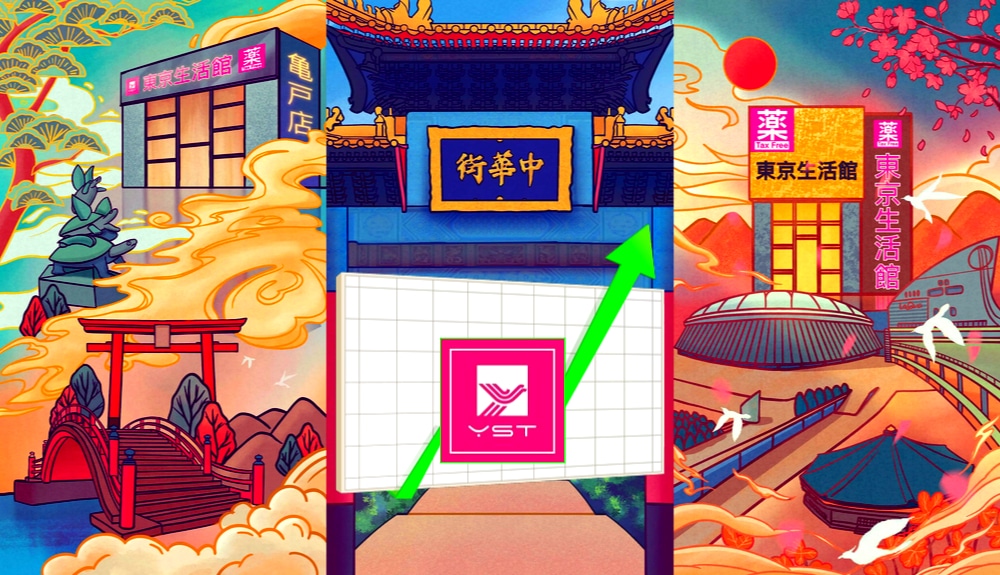

Yoshitsu is a retailer and wholesaler of en-vogue Japanese health and beauty products.

The company is currently leveraged to China but has recently embarked on a global expansion on several continents (NASDAQ: TKLF)

Founded in Tokyo, Japan, in 2006, Yoshitsu (NASDAQ: TKLF) was started with the goal of becoming the preeminent supplier of health and beauty products in Japan. Yoshitsu wanted to offer its customers the widest selection of quality goods that could be found in their local area. After launching the company with a focus on health and beauty, management decided to add home goods, food and even alcohol to its offerings.

This goal of not focusing on one particular brand or type of product meant it drew a wide variety of customers, kickstarting its revenue growth. Today, the company offers over 120,000 unique SKUs, allowing them to provide a product (or multiple products) for just about any customer need.

In addition to operating its own Tokyo Lifestyle-branded retail outlets in major Japanese cities, the company has many international franchisees in major cities worldwide, including the U.S., Canada, and the U.K.

While its retail outlets were its base, its wholesale operations and online stores grew Yoshitsu into what they are now. The company currently boasts many different wholesale customers, putting its products in hundreds of stores worldwide and in many other online stores across Japan, China and Korea.

These online stores, franchised stores and wholesale operations make up the bulk (95%) of the company’s revenues. No surprise, given the company’s focus on international expansion. It is this global growth that makes Yoshitsu an attractive investment option.

Yoshitsu’s Future Growth

Yoshitsu stands to continue its growth over the coming years, as there are several catalysts and plans in its pipeline. The Japanese health and beauty industry is expected to boast a CAGR of 3.9% through 2025, while the online component of the industry is expected to grow at a 6% clip. Meanwhile, the outlook is even better in North America, with expected total growth for beauty and health products of 4.9% and growth for Korean and Japanese beauty and health products sold in North America of 6.7%. The Chinese beauty industry, however, is expected to grow the most, with an anticipated CAGR of 7%.

Much of the expected growth in China can be attributed to the country having some of the fastest-growing disposable income in the world. Yoshitsu rapidly expanding economy is lifting millions out of poverty and allowing them to purchase things like high-quality health and beauty products for the first time. Yoshitsu intends to capitalize on this growth opportunity by offering tailor-made items for Chinese customers.

To advance its expansion plans, Yoshitsu opened its warehouses in the U.S., Canada, the U.K. and China (Hong Kong) to support order fulfillment across Southeast Asia, which includes many densely populated coastal cities, as the region returns to normal.

Also Read: Yoshitsu to Accelerate its Global Expansion in Europe With New London Warehouse

Yoshitsu’s Organic Growth

In addition to the industry-wide growth, Yoshitsu will grow sales by focusing on a few key organic growth initiatives. First, the company plans on opening a total of 50 new stores over the next five years; 10 of these stores would be in the Tokyo area, while the other ten would be franchised locations in preeminent cities in the United States, Canada, Australia, China (Hong Kong) and the U.K.

A crucial part of Yoshitsu’s strategy to grow its bottom line is developing its private label line of products. Typically, private label products sell at a higher margin for a retailer since they don’t have to buy the products (and pay a markup) from the manufacturer. By introducing its private-label products and growing the share of revenues from those products, the company stands to increase their net profits.

Finally, the company will focus on customer satisfaction by improving the online shopping experience and increasing fulfillment speed. To increase customer engagement, the company will integrate its online stores with their social media platforms. This will allow customers to purchase items directly from photos/videos of them on social media. Meanwhile, the company plans to open a new distribution center in the U.S., replenishing North American stores and ensuring high-demand products remain in stock year-round.

Yoshitsu Management

Mei Kanayama – Representative Director and Principal Executive Officer: Mr. Kanayama has a long history of executive positions in consumer packaged goods companies. Mr. Kanayama has served as the representative director of Yoshitsu Co., Ltd. since 2009. Between 2008 and 2012, he was the president of Hakumei Co. Ltd, a telecommunications company. Mr. Kanayama’s extensive experience should serve the company well as it seeks.

Youichiro Haga – Director and Principal Accounting and Financial Officer: Mr. Haga has over 30 years of experience as a finance executive at major Japanese firms, including MUFG Bank, Ltd, where he worked most of his career. During his time with the bank, he held several positions, including senior investigator and deputy branch manager. Mr. Haga’s significant experience should help the company greatly as it seeks to raise funds needed to continue its expansion efforts.

The rest of the Board of Directors of Yoshitsu boast long careers in fields like finance, human resources, corporate law and academia. Yoshitsu’s strong board will serve the company well as it continues to enter new markets, develop new products and improve customer satisfaction.

Yoshitsu Valuation

The valuation becomes even more attractive if Yoshitsu can pull off its ambitious plans to expand both margins and revenues. The company’s price-to-earnings of under 13 stands in stark contrast to the P/E of other online retailers like Amazon (NASDAQ: AMZN) and Alibaba (NYSE: BABA), which boast PE ratios (PE) of 101 and 37, respectively. Meanwhile, leading health and beauty supplies like Ulta Beauty (NASDAQ: ULTA) and L’Oreal (OTC: LRLCY) sport PEs of 18.5 and 28.5, respectively.

Conclusion

The global health and beauty industry stands to grow significantly over the coming years. Yoshitsu is a rapidly growing provider of a wide variety of beauty products. The company’s ambitious expansion plans should see them create a significant presence in North America while also increasing its business in its primary market of China. The company’s plan to introduce private-label products should allow them to increase margins and net income. The company’s low valuation makes Yoshitsu Co., Ltd an attractive option as a growth stock in the coming years.

Shares of Yoshitsu are currently trading at $1.28 per share, down -0.78% on the day.

Learn more about Yoshitsu: Website | Investor Deck | TKLF Chart

Join the Discussion in the Wealthy V.C. Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

Yoshitsu Co. Ltd. is a paid client of Wealthy V.C.

Wealthy VC’s parent company has been compensated $75,000 per month for four months for investor relations and market awareness services by Yoshitsu Co. Ltd. (NASDAQ: TKLF).

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.