Why Nvidia’s Tech Investments Could Transform the Entire AI Innovation Ecosystem

As Nvidia backs AI, cloud and computing power, emerging health-tech firms may benefit from the ripple effects.

Nvidia (NASDAQ: NVDA) hasn’t just ridden the AI wave; it’s helped shape it, on the chip side and, increasingly, through targeted equity bets in fast-scaling, small-cap partners. Two names stand out: Nebius (NASDAQ: NBIS) and CoreWeave (NASDAQ: CRWV). Both tapped Nvidia’s ecosystem, both secured major hyperscaler demand, and both delivered outsized stock moves after Nvidia got involved. With Profusa (NASDAQ: PFSA) announcing today that it is adopting Nvidia-powered technology to build an AI-driven insight portal for continuous biomarker monitoring, investors have a fresh “early-stage, AI-enabled” setup to watch.

Also Read: Why This Tiny Wearable Tech Stock Looks Poised for a Massive Breakout

Nvidia’s Small-Cap Formula

Call it the flywheel. Nvidia invests in smaller, compute-hungry companies; those companies raise their buildout budgets, secure a supply of Nvidia GPUs, and win big, long-dated contracts that require even more Nvidia hardware. The result is a revenue loop that can reward both sides. Nvidia has disclosed equity positions across CoreWeave, Nebius, Arm Holdings (NASDAQ: ARM), Applied Digital (NASDAQ: APLD), WeRide (NASDAQ: WRD), and Recursion Pharmaceuticals (NASDAQ: RXRX), names that either expand access to Nvidia GPUs, push frontier AI workloads, or commercialize novel AI use cases at scale. That network effect strengthens the CUDA/NVIDIA AI Enterprise moat, broadens distribution beyond hyperscalers like Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT), and Alphabet (NASDAQ: GOOGL), and seeds upside in smaller, faster-moving partners.

How Nebius and CoreWeave Rewrote Expectations

Nebius has been a standout. Shares have surged roughly 231% year-to-date and about 553% since its IPO, fueled most recently by a five-year AI infrastructure contract with Microsoft, reportedly valued at $17.4 billion, with potential to reach $19.4 billion if additional capacity layers in. That kind of “committed compute” is the lifeblood of the neocloud model, and it presupposes reliable access to Nvidia GPUs. Momentum there is more than narrative; it’s backlog.

CoreWeave tells a similar story from a different angle. Since going public in March, shares climbed as much as 379% at the peak and remain up about 200% from the IPO price, with renewed strength as the company launched a venture arm to pull more AI startups into its orbit. SEC filings revealed Nvidia owned about 24.2 million CoreWeave shares shortly after the IPO, a stake initially valued near $900 million that swelled alongside CoreWeave’s rally. Operationally, CoreWeave has raced to make Nvidia’s newest architectures generally available, scaled revenue triple-digits, and positioned itself as a purpose-built AI cloud, not a generalist. The market has rewarded that focus.

The common thread is simple: when compute scarcity collides with soaring AI demand, capital and supply-chain credibility become decisive. Nvidia helps provide both.

Why This Matters for Profusa Right Now

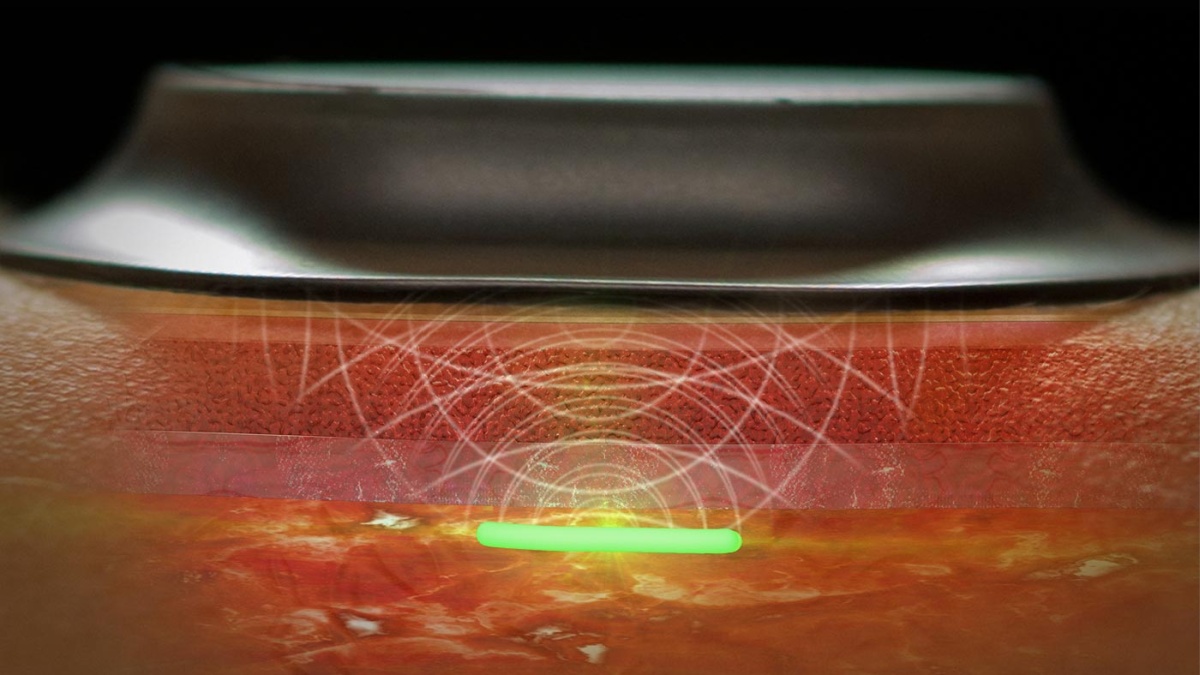

Profusa sits in digital health, not cloud infrastructure. But its data story screams “AI-native.” The company’s AI foundation is already central to its growth strategy. Profusa’s biosensors continuously feed data into an AI-powered analytics platform designed to deliver personalized insights for patients and healthcare providers. That integration opens the door to coaching, predictive alerts, and optimization of treatment strategies, moving wearables beyond simple data tracking to active health management tools. By embedding AI into the platform from the start, Profusa has positioned itself to ride the next wave of digital health, where devices don’t just measure but also interpret and guide.

On September 11, 2025, Profusa confirmed it will adopt Nvidia-powered technology to build an AI-driven physician portal that combines its Lumee™ Oxygen monitoring platform with Nvidia NeMo hardware and software. The company expects an early 2026 rollout in the European Economic Area (EEA).

According to Chairman and CEO Ben Hwang, Ph.D.:

By combining our Lumee platform with the industry-leading NVIDIA NeMo hardware and software stack, we plan to build an AI-fueled, scalable technology backbone for better personalized sensor data accuracy and real-time sensor data connections with electronic medical records (EMR), facilitating treatment and outcome predictions, in addition to establishing a robust data base for clinical literature for disease management.

The new physician portal is designed to deliver agentic clinical workflows with LLM-powered assistants, integrate with EMRs and wearables, and provide capabilities such as remote physiologic and therapeutic monitoring, triage support, and predictive insights. It will also feature guardrails for privacy and safety, model training options, and a time-aligned health data graph that fuses Profusa biomarkers with EMR and other health data to support coaching and clinical predictions. Profusa emphasized that physicians need actionable insights rather than more dashboards, and the goal of the portal is to translate raw sensor data into reliable, context-rich biometrics for patient care.

This chip adoption move firmly establishes Nvidia as the backbone of Profusa’s AI platform. It signals that Profusa’s growth strategy now depends on Nvidia hardware and software, raising its visibility within Nvidia’s investment ecosystem.

Also Read: How to Capitalize on the Five Pillars of Growth in the Red-Hot Wearables Market

The Win-Win Potential

Nvidia has a pattern: when it invests in small-cap, AI-critical businesses, the cash typically accelerates infrastructure buildouts and catalyzes customer wins, which in turn drive more demand for Nvidia GPUs. Nebius and CoreWeave are case studies. If, and only if, Nvidia were to invest in Profusa down the road, the funding could:

- Speed commercial deployment of Profusa’s AI pipelines across oxygen and glucose programs,

- Expand data-science teams and validation studies, and

- Lock in long-term compute roadmaps that keep Profusa current with Nvidia’s chip cycles.

That’s the same “capital-enables-compute-enables-revenue” loop investors saw elsewhere. But again, there is no guarantee Nvidia will invest in PFSA. Today’s news is about buying and deploying Nvidia-powered chips, not raising equity. The appropriate investor takeaway is probability, not inevitability: the Nvidia relationship raises the odds that PFSA’s AI strategy scales efficiently, and it increases the chance Nvidia evaluates Profusa more closely if product-market fit strengthens.

Upcoming Milestones

From here, the catalyst path looks straightforward:

- Portal rollout: early 2026 launch in the EEA, where CE Mark clearance allows deployment.

- Execution signals: EU commercialization steps for oxygen monitoring; study progress and peer-reviewed data; any partnerships with hospitals, device makers, or payors that translate AI insights into clinical decisions.

- Scaling indicators: expanding data volumes, model performance improvements, and any disclosures pointing to recurring analytics revenue.

- Ecosystem ties: Whether Profusa surfaces in Nvidia developer programs, reference architectures, or healthcare-focused showcases—early signs the relationship is deepening.

For portfolio context, investors already tracking Nvidia’s public holdings will recognize the broader ecosystem: Arm for CPU/GPU/IP alignment; Applied Digital for data-center buildouts; WeRide and Recursion as vertical AI exemplars; and the hyperscalers, Amazon, Microsoft, Alphabet, as both demand drivers and competitive foils. Profusa, while much smaller, fits the pattern of AI-centric operators whose products get markedly better with more compute and more data.

The Bottom Line

Nebius and CoreWeave show what happens when Nvidia’s capital and compute collide with urgent AI demand: growth accelerates, confidence compounds, and stocks can rerate sharply. Profusa is not a neocloud; it’s a digital-health platform aiming to convert continuous biochemical signals into clinical-grade intelligence. But the strategic rhyme is real. By standardizing on Nvidia chips for its AI backbone, Profusa positions itself to scale faster if its commercial and clinical milestones are hit. That, in turn, places PFSA squarely on the kind of radar Nvidia has used before.

Investors should treat today’s setup as potential energy, not a promised outcome. The chip purchase is step one. If the forthcoming release confirms a robust roadmap, and subsequent quarters show traction, then Profusa’s new Nvidia relationship could prove to be the first step toward deeper strategic alignment and, possibly, a stock trajectory that echoes what Nebius and CoreWeave already delivered.

Read Next: Why Big Investors Who Can’t Buy Crypto Are Gobbling Up These Stocks Instead

Join the Discussion in the WVC Facebook Investor Group

Do you have a stock tip or news story suggestion? Please email us at: invest@wealthyvc.com.

Wealthy VC and its employees are not Registered Investment Advisors, Broker-Dealers or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Wealthy VC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled through their website, news releases, and corporate filings, or is available from public sources and Wealthy VC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Our website and newsletter are for entertainment purposes only. This website is NOT a source of unbiased information. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment.

Release of Liability: Through the use of this email and/or website advertisement, by viewing or using it, you agree to hold Wealthy VC, its operators, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Wealthy VC-sponsored advertisements do not purport to provide an analysis of any company’s financial position, operations or prospects and this is not to be construed as a recommendation by Wealthy VC or an offer or solicitation to buy or sell any security.

None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Wealthy VC strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below. Profusa, Inc. (NASDAQ: PFSA) has compensated wealthyvc.com’s parent company, 1000358139 Ontario Limited, USD $568,000 by wire transfer. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D and all reports published on SEDAR if the company featured is Canadian. Wealthy VC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors with a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results. Past Performance is based on the security’s previous day’s closing price and the high of-day price during our promotional coverage.

In preparing this publication, Wealthy VC has relied upon information supplied by various public sources and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this email and website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this email and website are believed to be reliable, however, Wealthy VC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Wealthy VC is not responsible for any claims made by the companies advertised herein, nor is Wealthy VC responsible for any other promotional firm, its program or its structure.