Plant-Based Food Leader Eat Well Group to Expand Investor Base With Listing on National U.S. Stock Exchange

While big-name plant-based brands like Beyond Meat (NASDAQ: BYND) and Tattooed Chef (NASDAQ: TTCF) are well-known and get plenty of attention, there are other, smaller companies that present investors with even more growth opportunities.

Eat Well Group (CSE: EWG) (OTC: EWGFF) (FRA: 6BC0) is one such company. Eat Well is building a vertically integrated plant-based powerhouse with a leading plant-based CPG brand. Since the industry is still relatively new and growing exponentially, it’s ripe for consolidation, as well as huge investor gains.

Eat Well began its plan of becoming vertically integrated by acquiring Belle Pulses, one of the world’s leading processors of protein-rich pulses. Belle Pulses currently supplies the industry with ingredients such as pulse flour. They count Beyond Meat, General Mills (NYSE: GIS) and Nestle (SWX: NESN) (OTC: NSRGY) among their current customers. Eat Well plans to expand Belle Pulses operations to continue supplying the broader industry while also supplying their future CPG products.

Next up, management wanted to get their CPG line off the ground. Eat Well did so by acquiring Sapientia Technology, a food technology company specializing in creating form factors for plant-based CPG products. Sapientia Technologies is led by Dr. Eugenio Bortone, who previously worked at FritoLay and was instrumental in developing the Twisted Cheeto. Dr. Bortone plans to use his extensive skills and experience to develop Eat Well’s in-house CPG products, the first of which is their take on a “Vegan Cheeto.”

Eat Well invested in its first external brand when it acquired a 51% majority stake in Amara Organic Foods. Amara is a young company that is quickly becoming one of the hottest names in baby food. As part of the agreement, Eat Well also has the option to acquire an additional 29% of Amara, which if exercised, would boost its stake in the leading baby food maker to 80%. The health-first approach of Amara has made its products very popular among new parents, especially younger ones. Should the partnership prove fruitful, it’s likely that Eat Well will exercise its option to increase its majority stake to 80% and perhaps even consider a complete takeover of Amara.

The most recent addition to Eat Well’s portfolio was not a food company but rather a media company. The company participated in the recent financing round from Plant Based News, one of the leading voices in the plant-based industries. As the company’s name implies, with its millions of social media followers, Plant Based News is shining one of the brightest lights on the industry. Eat Well likely realizes that increased attention for the industry benefits all participants, so they are more than willing to support a company that might not directly advance their operations.

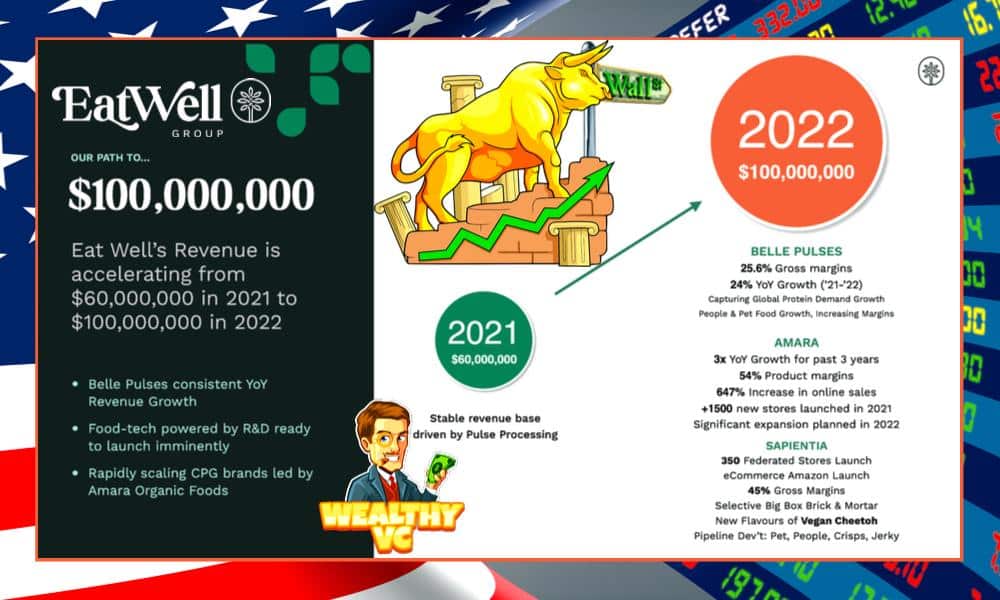

Source: Eat Well Investor Presentation

Eat Well Plans Move to Wall Street

Eat Well Group currently trades on the Canadian Securities Exchange (CSE), U.S. OTC Markets and the German Frankfurt Stock Exchange. The CSE is typically reserved for smaller, speculative Canadian companies. One wouldn’t find any global powerhouses on the exchange; the combined market cap of the companies listed on the CSE is less than the market of many single companies trading on the New York Stock Exchange (NYSE) and NASDAQ. Meanwhile, the daily trading volume on the CSE is much lower compared to larger national exchanges.

On November 15th, Eat Well Group’s Board of Directors announced that it is working with leading investment bank Roth Capital Partners to explore options for uplisting to either the NYSE or the NASDAQ.

Commenting on the U.S. uplisting news, Eat Well President Marc Aneed stated:

By being listed on both the CSE and a major U.S. stock exchange, Eat Well Group will have access to a pool of North American investors, orders of magnitude larger than the company currently has access to. It is this larger investor base that, in all likelihood, will push Eat Well Group’s share price and valuation to levels that are on par with many of its industry peers.

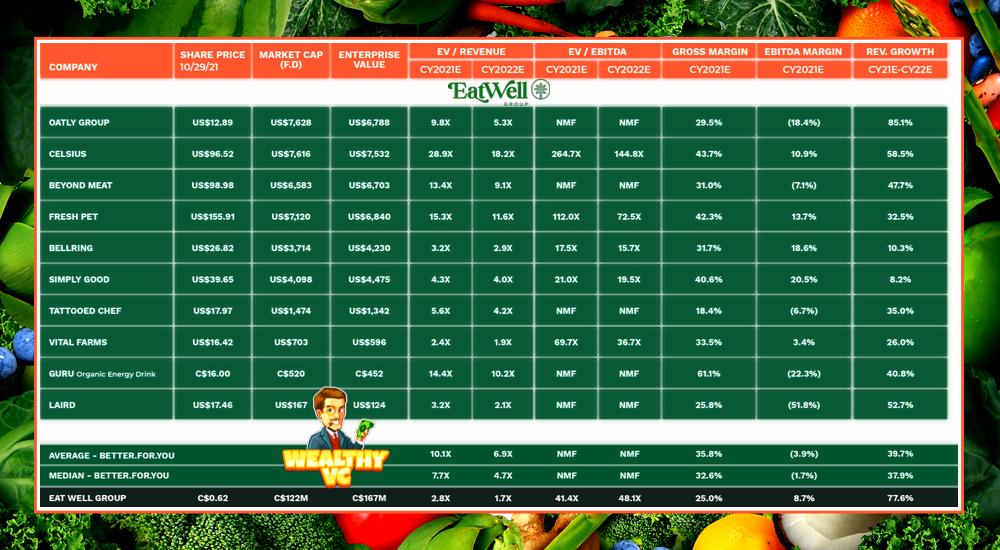

Source: Eat Well Investor Presentation

Listing on Major U.S. Exchange Could Boost Valuation

A publicly-traded company cannot reach its full potential if it does not trade on the most senior exchanges. By seeking an uplisting to either the NYSE or the NASDAQ, Eat Well Group is maximizing its opportunity to build a leading vertically integrated company from the ground up.

Learn more about Eat Well: Website | Investor Deck | EWG Chart

Follow Wealthy V.C. on Social Media: Facebook | Instagram | Twitter | LinkedIn | GETTR

????Join the Discussion in the Wealthy V.C. Investor Group

????Have a Stock Tip or News Story Suggestion? Email us at Invest@WealthyVC.com

Eat Well Investment Group is a paid client of Wealthy V.C.

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.