Eat Well: The Future of Plant Based Proteins

The plant-based vegan foods industry is thriving but still in its infancy, with an enormous amount of untapped upside

- Despite being in its early days, the flourishing new sector has already pumped out several huge winners, such as Beyond Meat (NASDAQ: BYND)

- As a result of BYND’s rapid rise, investors are currently on the lookout for the “Next Beyond Meat Multibagger”

- The Wealthy VC research team has uncovered a new plant-based foods stock with all the right ingredients to be the burgeoning sector’s next big winner

- We present to you, Eat Well Investment Group (CSE: EWG) (OTC: EWGFF) (FRA: 6BC0)

The most popular trend in the culinary world right now is plant-based proteins. As the damage to both our bodies and our environment caused by diets high in meat becomes more apparent, an increasing number of people are seeking ways to eliminate meat from their diets, either partly or entirely. Eliminating meat consumption in favour of vegetables is not new, of course, as there have been vegetarians for as long as there have been humans.

For most of human history, vegetarians simply went without animal products. They did not consume animal milk or any animal by-products. Now, they have plant-based versions of these products. Cow’s milk is being replaced by soy milk, oat milk and other plant-based milk substitutes. Jackfruit makes a delicious substitute for BBQ pulled pork or chipotle chicken tacos—Coconut milk subs in nicely for cream in a smoothie. The list goes on.

No plant-based food group has received more attention recently than meat analogues. These heavily processed products are not only meant to replace meat (usually beef) in a recipe but also to mimic the taste and mouthfeel. Companies like Impossible Foods and Beyond Meat (NASDAQ: BYND) have brought meat analogues to the masses, with the products being available in grocery stores and restaurants all over the U.S.

Of course, all of these different plant-based products require raw materials and technological advancements to create. There is now a booming so-called “picks and shovels” industry dedicated to meeting the needs of the plant-based protein industry. One company is attempting to roll up a group of these ancillary players into the next big name in plant-based protein.

Eat Well: A New Plant-Based Contender

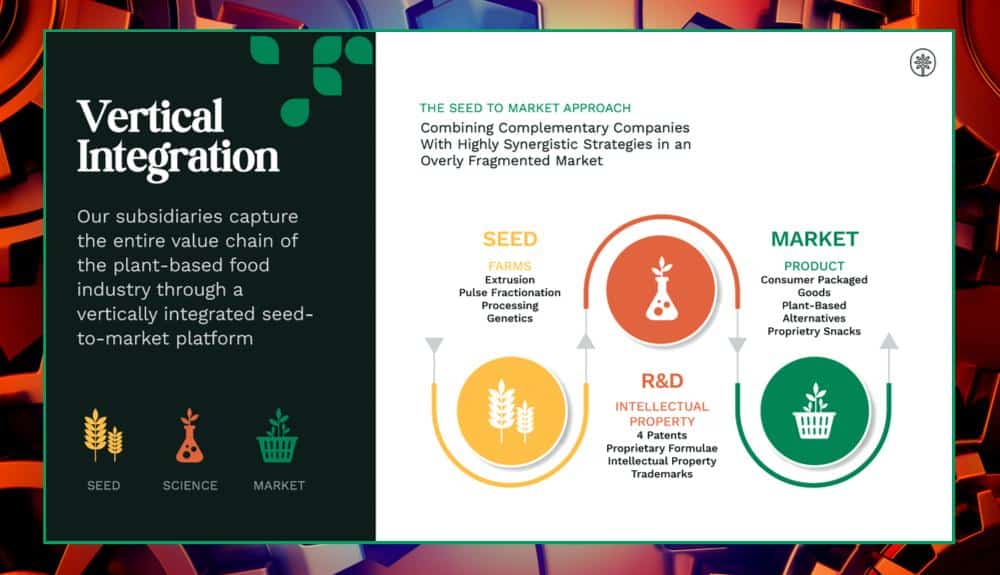

Plant-based protein upstart Eat Well Investment Group (CSE: EWG) (OTC: EWGFF) (FRA: 6BC0) believes they have the team and the business plan to successfully implement a vertical integration strategy to become a dominant player in the plant-based protein supply and CPG industries.

The company describes itself as:

“A fully integrated plant-based seed-to-market company, with a goal of ensuring that you Eat Well.”

As a holding company, Eat Well will invest in and acquire other companies; they plan on acquiring leading companies up and down the supply chain to build a global plant-based protein supply and CPG powerhouse.

Eat Well has made it its mission to feed the populace in a responsible and healthy manner, with the company’s website stating:

“Our mission is to create a company that feeds families globally while honouring time-valued health and wellness traditions, to maximize shareholder value through cornerstone partnerships & strategic investments, and bring transformational change at scale to the plant-based food ecosystem.”

The plant-based protein industry is expected to undergo significant growth in the coming years. This means that investors who choose the right companies should be richly rewarded. We’ll explore why Eat Well is one of the better bets in the industry, thanks largely to a number of attributes that set them apart from competitors, none more so than the way they prioritizes their business decisions.

Eat Well breaks down its three top priorities as:

The Planet: Management has looked at the science that commercial meat production has challenging environmental consequences and dedicated their efforts to become good stewards of the earth. They believe their products can help cut down on methane and other greenhouse gas emissions, helping to stave off climate change.

Source: Eat Well Investor Presentation

The People: Eat Well believes that opting for plant-based protein over animal proteins can be just as supportive for the body as it is for the planet. The company believes that going plant-based can help with a variety of health issues, including high cholesterol, obesity, cardiovascular disease and cancer. The company even draws a direct link with overall life expectancy, with vegetarians living an average of 8 years longer than their meat-eating peers.

Source: Eat Well Investor Presentation

The Profits: While the health of our bodies and the planet is of utmost importance, Eat Well is a for-profit company, and therefore, money must be made. Management believes that the plant-based protein industry is going to experience outsized growth relative to the meat market. With plant-based protein still a tiny part of the overall protein industry, this growth should continue for years to come.

Source: Eat Well Investor Presentation

Eat Well Management Team

Mark Coles – Founder & Chief Investment Officer: As a holding company, Eat Well will achieve growth primarily through acquisitions. Mark Coles has over 25 years of experience in CPG business mergers and acquisitions. Mr. Coles has spent the last decade in the plant-based protein industry, culminating in his previous company getting bought out by a global food supply conglomerate. Mr. Coles is an experienced industry expert and provides Eat Well with invaluable leadership and industry experience. Mr. Coles’ business acumen will help make sure Eat Well pursues the best M&A and business opportunities to grow the CPG company.

Marc Aneed – Co-Founder, President & Director: Mr. Aneed has worked in the CPG industry for over 20 years. He previously worked at multi-national nutrition company Glanbia PLC (LON: GLB) (OTC: GLAPY), where he led and/or acquired multiple brands, totalling over $1 billion in retail sales in nearly two dozen product categories. Earlier in his career, Mr. Aneed cut his teeth at The Quaker Oats Company/PepsiCo, where he worked on the hugely popular Gatorade brand. Mr. Aneed’s brand expertise, executive management, and M&A experience should prove invaluable as EatWell builds out its house of plant-based protein CPG brands.

Video Source: Wealthy VC YouTube

Barry Didato – Co-Founder & VP of Strategy: Mr. Didato is focused on developing strategic revenue channels, sales partnerships, and international distribution. Mr. Didato brings extensive strategic sales capabilities and an extensive network of contacts in the industry. He served for 18+ years as a senior advisor for several ultra-high net-worth family offices and numerous innovative wellness, nutrition, medical, and food businesses.

Patrick Dunn – Co-Founder, VP of Finance: Patrick Dunn, CPA, is a founding partner of Dunn, Pariser & Peyrot. He has a track record of building highly successful agribusinesses throughout North America and other international jurisdictions. As a partner of one of the top business management firms in Los Angeles, Mr. Dunn believes the business of plant-based nutrition will drive profitability through its unique properties in various business channels in food, cosmetics, and healthcare worldwide. As a testimony to his business portfolio work, Mr. Dunn and his firm have won multiple industry awards for accounting, finance, and business management.

Plant-Based Vertical Integration

One of the oldest and most popular business models is vertical integration, where a company controls multiple parts of the supply chain. For instance, a potato chip company owns the potato farm, the production facility and the brand itself. Such an arrangement, when done successfully, can boost profitability. When done wrong, though, vertical integration can be inefficient and become a drag on earnings.

Source: Eat Well Investor Presentation

Eat Well came into being due to the company’s successful acquisition of Belle Pulses, a leading pulse crop processor and food technology company Sapientia Technology.

Belle Pulses

A pulse is a legume that is processed and treated like a grain. There are a variety of pulses that companies use as ingredients in their plant-based foods, including peas, fava beans, lentils and chickpeas. Belle Pulses sources raw pulses from local farmers and processes them into commercial food ingredients at their industry-leading facilities in Canada’s breadbasket, Saskatchewan. These ingredients are sold to plant-based protein companies worldwide, including Nestle (SWX: NESN) (OTC: NSRGY), Beyond Meat (NASDAQ: BYND), and many other companies across 50 countries. In fact, you’re likely already a consumer of an Eat Well-owned company too.

Eat Well owns 100% of Belle Pulses and plans to use the company to supply their internally-developed CPG products. To meet this need while supplying the broader industry, management intends to continue to expand the business and increase processing capacity. So great is the need for pea protein products that Beyond Meat felt the need to warn its investors that their business may be negatively impacted by the limited supply of the popular protein substitute. Clearly, the runway for growth in Belle Pulses’ business is extensive.

Sapientia Technology

We might not think about it, but there are extremely complex processes and technology involved with creating our favorite food products. Sapientia Technology specializes in developing technologies that process and form pulse proteins into plant-based snacks and meat analogues. The company is headed by Dr. Eugenio Bortone, who has a Ph.D. in Food Engineering. He has been in the CPG foods industry for over two decades, has over 25 issued patents and even invented the Twisted Cheeto during his time at FritoLay. The Frito-Lay brand is owned by PepsiCo (NASDAQ: PEP).

Dr. Bortone will lead Eat Well’s development of their forthcoming line of plant-based protein snack foods. Dr. Bortone’s unparalleled experience with creating fun and attractive snack food products will be one of the things that set Eat Well apart from its competitors.

Source: Eat Well Investor Presentation

The Future of Snack Foods

Analysts believe that snack foods are among the most profitable food products on the market today. They are also among the most unhealthy foods that we eat. These two attributes make developing their own snack food CPG products an easy decision for Eat Well’s management team. According to Future Market Insights, “vegan salty snacks” is expected to be a $70 billion+ market over the next 10 years.

The Sapientia Technologies team has many plant-based protein snack foods under development, including salted snacks (chips, crackers, puffs, etc.), meat analogue snacks, and high-protein plant-based pasta. The first of these products – a “vegan cheetoh” will begin to hit store shelves at the Federated Coop in Western Canada, in Q4 2021, with discussions for expansion already begun.

Eat Well Valuation

Eat Well’s management believes their company is undervalued relative to competitors, largely thanks to it being a new company that not many investors are familiar with. The numbers appear to bear that out, as Eat Well trades at a significant discount to peers on several metrics, including price to sales and EBITDA.

Source: Eat Well Investor Presentation

Based on the above metrics, compared to the valuations of its competitors, Eat Well has a ton of upside growth potential. As a result, Eat Well currently presents prospective investors with an excellent value investment opportunity.

Insider Buying

Per Investopedia: “Insider buying is the purchase of shares in a corporation by a director, officer, or executive within the company. Insider buying is not the same as insider trading, which refers to corporate insiders making illegal stock purchases based on non-public information.”

If an insider increases stake in a company, the act may be taken as a sign of confidence in the company’s growth and earnings. The insider may believe that the strategies put into action by the executive leadership will result in greater market presence, increased profit, and other opportunities for the business. The size of the buying is also significant because large purchases signal greater confidence compared with small insider buys. For instance, it is more significant if an insider buys one million shares than if the insider purchases 100,000 shares.

As you can see via the image below, there has been significant insider buying by Eat Well executives over the past month. This is a very bullish signal being sent to the market by Eat Well executives, indicating they feel so strongly about the future growth potential of the company, that they’re willing to put additional skin in the game.

Source: Eat Well Group SEDI Data Here

Conclusion

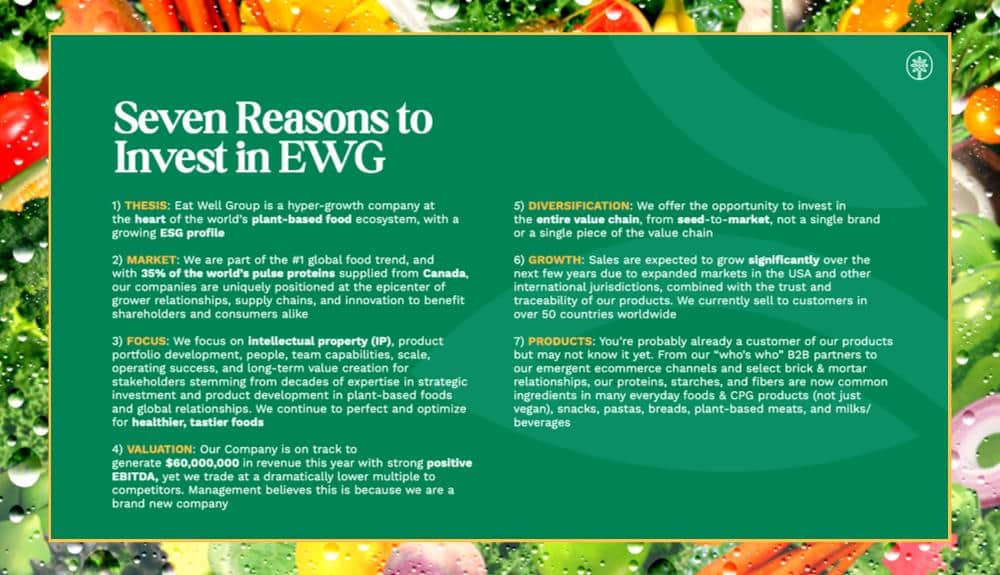

Eat Well Investment Group (CSE: EWG) (OTC: EWGFF) (FRA: 6BC0) is a new player in the plant-based protein industry, but they’ve quickly established a foundation on which they can build a global leader in plant-based protein. In their investment deck, management laid out seven key reasons why investors should invest in their company:

- The company operates in the fast-growing plant-based protein industry; the sector is expected to experience growth that vastly exceeds the overall market.

- With 35% of the global protein supply coming from Canada, Eat Well’s companies are uniquely positioned at the epicentre of the global plant-based foods market.

- The company’s products are already being used by other companies as ingredients in a wide variety of foods, including pasta, bread, milk and plant-based meat analogues. Once they roll out their own CPG products, Eat Well will be heavily represented on store shelves.

- Eat Well’s vertical integration approach gives investors exposure to a variety of technologies and processes, up and down the plant-based protein supply chain, any one of which could grow to a global powerhouse on its own.

- Technological advancement and intellectual property are central to management’s business plan. The company has invested in leading agricultural technology companies that provide the products and services that make plant-based proteins possible.

- The company just debuted on the public markets and carries a valuation that is rather low compared to competitors, given their revenues and profitability.

- The company is currently selling to customers in 50 countries and is expanding rapidly. In addition to adding new international markets, management is drilling down into high-priority markets, namely, the U.S. Eat Well plans to roll out its new CPG products to major health food and grocery stores across North America.

Source: Eat Well Investor Presentation

Eat Well has an ambitious business strategy, with the company already having early success executing its game plan. The plant-based foods industry is thriving but still in its infancy, with an enormous amount of untapped upside. Despite being in its early days, the burgeoning new sector has already pumped out several huge winners, such as Beyond Meat (NASDAQ: BYND). As a result of BYND’s rapid rise, investors are currently on the lookout for the “Next Beyond Meat Multibagger.”

The Wealthy VC research team believes EWG has all the right ingredients to be the plant-based foods sector’s next big winning stock. With that said, investors would be wise to start their due diligence on Eat Well Investment Group (CSE: EWG) (OTC: EWGFF) (FRA: 6BC) immediately. For your convenience, we’ve provided a number of due diligence links below to help you get started with your research on the company.

Have a Stock Tip or News Story Suggestion? Email us at Invest@WealthyVC.com

Eat Well Investment Group is a paid client of Wealthy VC.

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.