Mortgages In The USA Hit Highest Levels Since 2000

Last Updated: 20.3.2024 21:16

What You Need to Know Navigating the Surge in Mortgage Rates: An Investor’s Guide to Seizing Opportunity in a Volatile Market.

The Surge in Mortgage Rates

The U.S. mortgage landscape is undergoing a seismic shift. Recent data reveals that the average 30-year fixed mortgage rate has soared to 7.31%, a level not seen since the year 2000. This surge has led to a decline in mortgage applications, with the Mortgage Bankers Association index plummeting to its lowest point since 1995.

What’s Driving the Spike? Navigating Surge in Mortgage Rates:

Several factors are contributing to this dramatic rise in mortgage rates. Primarily, the rates are benchmarked to U.S. Treasuries, whose yields have been climbing due to a resilient economy. Additionally, the Federal Reserve has indicated a willingness to keep interest rates elevated to combat persistent inflation. This cocktail of factors has led to borrowing costs that are nearly triple what they were just a couple of years ago.

The Ripple Effect on the Housing Market

The surge in mortgage rates has had a domino effect on the housing market. Homeowners are increasingly reluctant to move and take on higher mortgage rates, leading to a stagnation in the residential real estate sector. New home sales, however, have seen a spike as prospective buyers look for alternatives. Despite this, the overall affordability of homes has reached its lowest point in nearly four decades.

Investment Strategies in a High-Rate Environment

For investors, this volatile environment presents both challenges and opportunities. Here are some strategies you should consider:

- Diversify into REITs: Real Estate Investment Trusts can offer a hedge against the direct impact of rising mortgage rates. In addition, finding the right REIT can return hefty dividends making them a great addition to your portfolio. One little known REIT gaining popularity is VICI Properties. With a current dividend payment of 5.10% based in the United States on the NYSE if you’re looking to build a dividend portfolio this may be a strong addition:

- New Constructions: With existing homeowners reluctant to sell, new constructions offer a lucrative investment avenue.

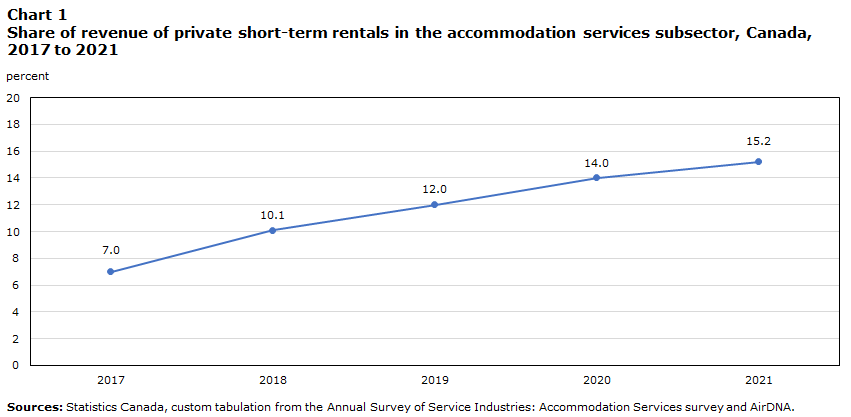

- Rentals: As homeownership becomes less affordable, the demand for rentals may increase, making short-term rentals a viable investment. This can range from short term vacation Airbnb rentals which are growing in popularity among investors to longer term tenants. The proportion of revenue of private short term rentals has more than doubled since 2017 as per Statscan:

Is Now the Time to Invest?

While the surge in mortgage rates has introduced uncertainty into the housing market, it has also opened doors for savvy investors. By understanding the underlying factors and adjusting strategies accordingly, investors can navigate this high-rate environment to their advantage.

Read More:

Follow Wealthy VC on Socials:

Threads | Facebook | Instagram |

Twitter | LinkedIn | GETTR | Tumblr

????Join the Discussion in the Wealthy VC Investor Group

????Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

WealthyVC does not hold any positions in the stocks listed in this article.