Sezzle (SEZL) Stock Plunges 8% Amid Insider Sale and Market Dynamics

Recent insider activity appears non-consequential as stock maintains positive outlook for the year.

Sezzle (NASDAQ: SEZL) experienced an 8% decline in its stock price this morning, triggered by news of an insider sale. Despite this drop, the company has shown strong performance over the year, reflecting its significant growth and solid position within the Buy Now, Pay Later (BNPL) industry.

Background on Sezzle

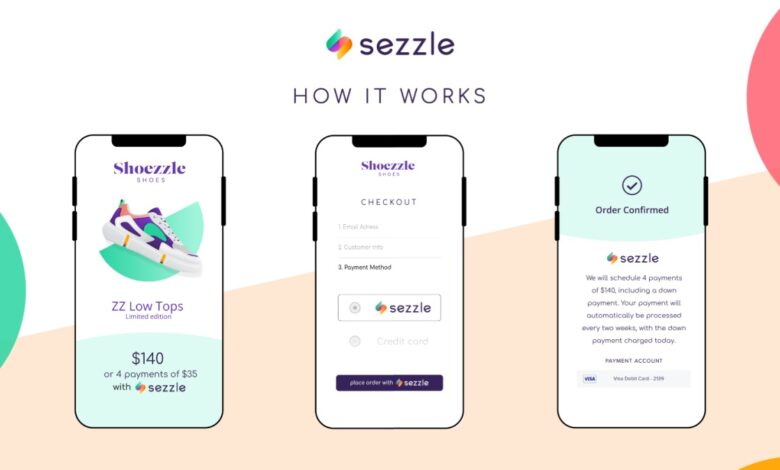

Sezzle Inc. is a prominent player in the rapidly growing BNPL sector, offering consumers a flexible and convenient way to pay for purchases over time. The BNPL market has surged in popularity, driven by consumer demand for alternative credit options and the digital transformation of financial services. Sezzle’s platform allows customers to split their payments into interest-free installments, a model that has proven attractive to both consumers and merchants.

Insider Sale: A Non-Issue?

The recent drop in SEZL stock price is largely attributed to the sale of 1,645 shares by Sezzle’s Executive Director and President, Paul Paradis. The sale, disclosed in a regulatory filing, amounted to approximately $143,904 based on the transaction date’s closing price. While insider sales often trigger market concerns about the company’s future prospects, this particular transaction represents a minor fraction of Paradis’ overall holdings (0.8%). Investors should recognize that insiders sell shares for various personal reasons unrelated to their views on the company’s performance.

The adage “many reasons to sell, only one reason to buy” holds true here, suggesting that the insider sale should not be interpreted as a negative signal about Sezzle’s business health or future potential.

Recent Developments and Financial Health

In contrast to the temporary market reaction to the insider sale, Sezzle has been making strategic moves to bolster its market position and shareholder value. Notably, Sezzle recently authorized a $15 million stock repurchase program, a move indicating management’s confidence in the company’s long-term prospects and commitment to enhancing shareholder value. Stock repurchases often signal that a company believes its shares are undervalued and can serve as a catalyst for price appreciation.

Additionally, Sezzle has been expanding its footprint in the BNPL space, evidenced by its partnership announcements and new product offerings. The company continues to innovate, aiming to capture a larger share of the growing market by providing enhanced services and improved user experiences.

Technical Analysis and Stock Performance

Despite today’s decline, SEZL stock has shown impressive performance year-to-date. The stock has surged over 430% in 2024, reflecting investor confidence and the company’s robust growth trajectory.

A technical analysis of the SEZL stock chart indicates several key levels of support and resistance. The stock recently encountered resistance at around $85.50, a level it has struggled to break through consistently. However, support remains strong at the $70.00 level, providing a safety net for investors.

Industry Context and Outlook

The BNPL industry is poised for continued growth, driven by increasing consumer adoption and merchant partnerships. According to Grandview Research, the global BNPL market is expected to expand at a compound annual growth rate (CAGR) of 28% over the next five years, presenting substantial opportunities for established players like Sezzle.

Sezzle’s strategic initiatives, including its stock repurchase program and continuous innovation in service offerings, position the company to capitalize on this growth. The company’s focus on enhancing user experience and expanding its merchant base underscores its commitment to maintaining a competitive edge in the market.

Conclusion: Buy, Hold, or Sell?

While the insider sale by Sezzle’s president has caused a short-term dip in the stock price, the overall outlook for SEZL stock remains positive. The company’s strong performance year-to-date, strategic initiatives, and bullish technical indicators suggest that the recent decline may present a buying opportunity for investors confident in the long-term growth prospects of the BNPL sector.

Shares of Sezzle stock last traded at $88.89, down 0.7% today. YTD, SEZL stock is up 315.37%. All time, SEZL stock is up 9.63%.

View Sezzle Stock Chart on Barchart

Read Next:

- Top 4 Reduced-Risk Nicotine Stocks to Watch in 2024

- Nvidia Stock Split Leads to New NVDA Price Targets

- Fed Holds Interest Rates Steady Amid Mixed Inflation Signals, Forecasts One Cut in 2024

- 2024’s Top 10 Cryptocurrencies

Join the Discussion in the WVC Facebook Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com.

Disclaimer: Wealthy VC does not hold a long or short position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.