XTM Plans Acquisition of World-Class Earned Wage Access Company QRails

QRails is a Fully Certified and Live In-Market Provider of Earned Wage Access (EWA) With Operations in the United States and the U.K.

XTM Inc. (CSE: PAID) (OTCQB: XTMIF) (FSE: 7XT), a Miami and Toronto-based Fintech creator of disruptive payment innovations and mobile solutions specifically geared towards service industries including hospitality, personal care and other service providers, announced its intent to acquire QRails Inc., a prepaid payments issuer-processor and one of the first vertically integrated provider of earned wage access (EWA) with operations currently in the United States and the UK, offices in Denver, Kansas City and London and which is incorporated under the laws of Delaware.

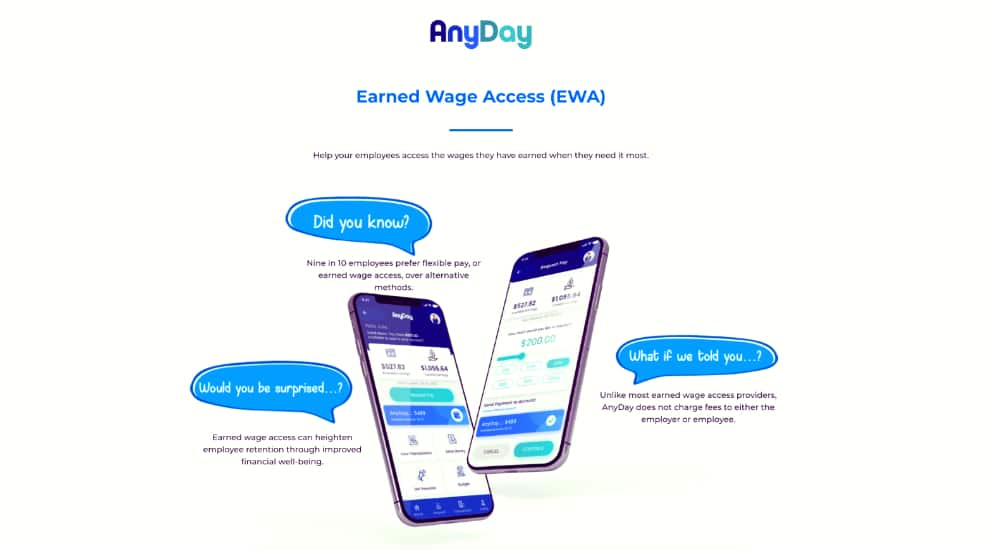

Built on its own world-class issuer-processor platform, QRails’ flagship product AnyDay™ is currently white-labelled for some of the largest HR & Payroll Solution Providers in the world and is fully integrated into multiple payroll and time & attendance systems providing workers with real-time access to available wages.

Some of the product features included in AnyDay are:

- Full suite of payment options, including virtual and physical cards, mobile wallets, and card-to-card transfers.

- White-label opportunities for integration into existing apps using APIs and SDKs.

- Perfect for Workforce Management (WFM), Time and Attendance, and Payroll partners to include as part of the overall solution.

Information on QRails’ traction in the EWA space can be reviewed by clicking here.

As part of the acquisition, Cary Strange, XTM’s Chief Revenue Officer, will be appointed President of QRails. Strange is an early investor in QRails and its former Chief Revenue Officer. QRails will run as a wholly owned subsidiary of XTM, with staff and operational integrations phased in over time as revenue potential has achieved momentum. With a deep and experienced background in payments and with first-hand knowledge of QRails’ clients, Strange has been assisting XTM with its evaluation and integration planning to be able to quickly scale QRails and XTM into the US and international markets.

Comments From Management

Commenting on the announcement, XTM CEO Marilyn Schaffer stated:

“This is fortuitous for XTM. QRails brings XTM into the US market with live, fully compliant EWA clients, new opportunities and increase to XTM’s already growing revenue, something our investors have been eagerly anticipating. And, it gives us a first mover advantage with EWA in Canada and the US, which is already fully certified and compliant.”

XTM CRO Cary Strange added:

“This is a big step in realizing the full potential of QRails and AnyDay. QRails’ vertically integrated earned wage access solution, along with the state-of-the-art processing and issuing platform, will be accelerated into the market with the strength of XTM’s team and successful track record. I look forward to leveraging XTM’s experience and resources to fully realize the cross-border potential of both companies.”

Deal Terms

XTM and the QRails Board aim to close the Share Purchase Agreement by May 31, 2023. XTM will provide further details regarding the Proposed Transaction in due course via a press release. XTM will make available all information as required by applicable regulatory authorities and will provide, in a press release to be disseminated at a later date, the required disclosure.

In connection with the Potential Acquisition, XTM and QRails have entered into a non-binding letter of intent (LOI) dated April 2, 2023. The Letter of Intent provides that XTM and QRails will negotiate and enter into a definitive agreement regarding the Proposed Transaction (Definitive Agreement) on or before May 31, 2023, or such a later date as may be mutually agreed upon. The Proposed Transaction contemplates that the purchase price of US$3.5 million paid to shareholders of QRails be satisfied by the payment of $100,000 in cash and US$3.4 million in common shares of XTM, and a price reservation for common shares issued as consideration has been filed with the Canadian Securities Exchange at a price of $0.16 per common share. As part of the Proposed Transaction, XTM will also assume all of the debt of QRails. The Proposed Transaction is subject to, among other things, the negotiation and execution of the Definitive Agreement, XTM fulfilling all of the applicable regulatory and listing requirements, and each of the parties obtaining all necessary board, shareholder and regulatory approvals, and other standard closing conditions.

To allow XTM and QRails the necessary time to enter into the Definitive Agreement and to allow XTM to evaluate and investigate the Proposed Transaction, QRails has agreed that from the LOI Date until June 30, 2023, QRails and its shareholders will immediately suspend and cease any negotiations or other discussions or communications of any nature with any other party concerning the sale of QRails, or its shares or assets, in any manner.

The foregoing description and summary of the Proposed Transaction does not purport to be complete. XTM will provide further details in respect of the Proposed Transaction in due course by way of a press release. XTM will make available all information as required by applicable regulatory authorities and will provide, in a press release to be disseminated at a later date, the required disclosure.

XTM’s Q1 2023 Quarterly Financials and Y/E 2022 Financials are expected to be filed on or before June 30, 2023, in accordance with the OSC regulatory requirements.

XTM/QRails Investor Call

Management will host an Investor Conference Call upon closing the Share Purchase Agreement to further discuss the transaction and answer questions.

A press release will be issued with the coordinates to access the conference call. Also, an archived recording of the conference call will be available following the conference upon request.

Shares of XTM last traded at $0.16 per share. YTD, PAID stock is up +40.91%.

Learn more about XTM: Website | Investor Deck | PAID Chart

Follow XTM on Social Media: Facebook | Instagram | Twitter | LinkedIn

Join the Discussion in the Wealthy VC Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

XTM Inc. (CSE: PAID) is a paid client of Wealthy VC.

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.