PowerTap Hydrogen Signs T2M as Engineering and Design Validation Partner For its Gen3 MHPDU, Closes Private Placement

PowerTap Announced it Engaged T2M Global as Its New Engineering and Design Partner to Conduct Validation of its Gen3 Modular Hydrogen Production and Dispensing Unit (MHPDU)

The company also reported closing the first tranche of a non-brokered private placement for gross proceeds of $1 million.

PowerTap Hydrogen (NEO: MOVE) (OTC: MOTNF) (FRA: 2K6B) announced Monday that it engaged T2M Global as its engineering and design partner to conduct validation of its Gen3 Modular Hydrogen Production and Dispensing Unit (MHPDU) and to provide final engineering for lower-cost manufacturing with enhanced robustness.

The demand for hydrogen refueling stations is growing rapidly worldwide, promising a multi-billion dollar market. PowerTap has engaged T2M Global to fast-track initial station delivery to capitalize on this demand. The T2M team, led by Mr. Pinakin Patel, has extensive experience producing green hydrogen for multiple applications in the USA and Canada. Mr. Patel led the world’s first, award-winning Tri-Generation project at Fountain Valley, California, a joint demonstration project between Air Products and FuelCell Energy that refueled over 5,000 fuel cell vehicles while powering the host site with green electricity.

Speaking on the newly minted partnership with T2M, PowerTap CEO Raghu Kilambi stated:

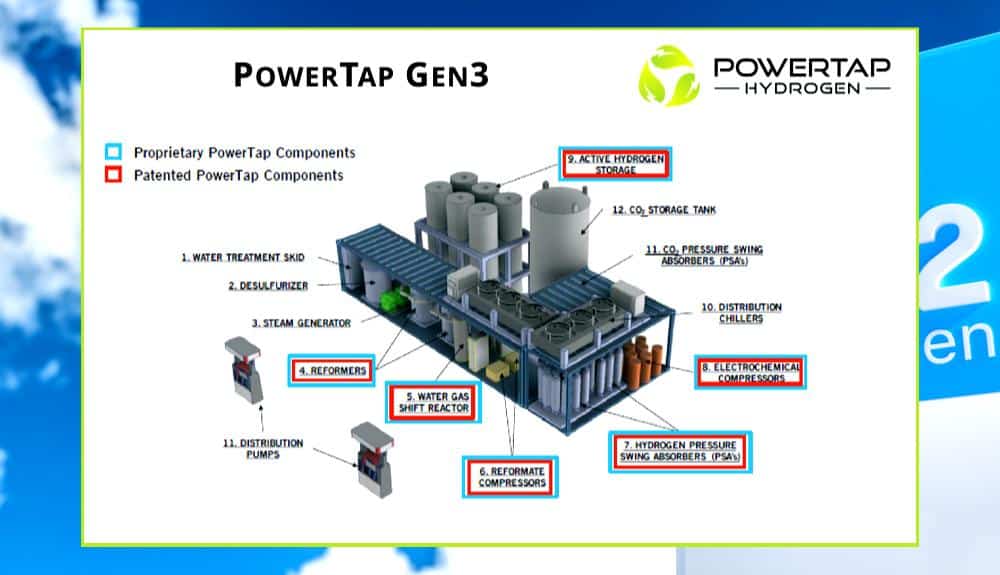

“We are excited to engage with T2M for rapid deployment of our Gen3 MHPDU leveraging their extensive hydrogen experience. T2 M’s experience will enable PowerTap to take full advantage of the excellent market conditions for blue hydrogen over the next few years, especially benefitting from an already existing infrastructure of natural gas and renewable natural gas. In today’s market, a reliable supply chain for modular hydrogen plants is a critical aspect required for the Gen3 MHPDU stations. T2M brings valuable experience in strategic alliances for major green or blue hydrogen components, such as high-pressure steam methane reformers, hydrogen purification for fuel cell use, hydrogen compression for efficient storage and dispensing to heavy-duty vehicles, as well as long-range light-duty vehicles.”

Source: PowerTap Investor Presentation

Pinakin Patel, President & CEO of T2M Global, also commented on the announcement:

“We are delighted by the PowerTap decision to benefit from T2M Global’s extensive network in the hydrogen and fuel cell arena. Our vast experience in fuel cell commercialization, hydrogen production, technology collaborations and supply chain development in the US, Canada, Japan, South Korea, Germany, and Denmark will help PowerTap to accelerate its deployment of hydrogen stations. Our team’s prior collaborative experience includes multi-national corporations, such as Haldor Topsoe. BASF, Sempra, Enbridge, Siemens-Westinghouse, Fluor Engineers, NRG, Mitsubishi, Sanyo, Marubeni, POSCO Energy, Daimler-MTU, and ExxonMobil.”

PowerTap Closes Private Placement

PowerTap Hydrogen also reported closing the first tranche of its non-brokered private placement for gross proceeds of $1 million. PowerTap issued 6,666,667 units of the company at $0.15 per unit. Each unit consists of one common share and one transferable Share purchase warrant. Each warrant entitles the holder to purchase one additional share of PowerTap stock at $0.30 for twenty-four (24) months from the date of issuance.

PowerTap says it will use the proceeds from the private placement for general working capital purposes. The company did not pay a finder’s fee for the private placement. As is typically customary, all securities issued under the private placement are subject to a statutory four-month and one-day hold period that expires on December 27, 2022.

None of the securities issued in connection with the private placement will be registered under the United States Securities Act of 1933, as amended, and none of them will be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act. This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of the securities in any state where such offer, solicitation, or sale would be unlawful.

Shares of PowerTap closed Tuesday at $0.08 per share, up +6.67% on the day.

Join the Discussion in the Wealthy V.C. Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

PowerTap Hydrogen Capital Corp. is a paid client of Wealthy V.C.

This report/release/profile is a commercial advertisement and is for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated below.